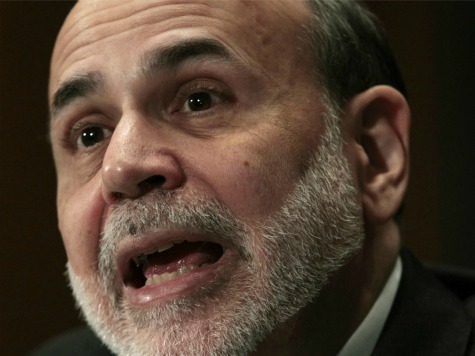

On Wednesday, Federal Reserve Chairman Ben Bernanke conceded there were limits to how much the central bank can stimulate the country’s economy.

Despite this, Bernanke announced the Federal Reserve will purchase $85 billion dollars in bonds every month until the country’s unemployment rate falls to 6.5%. He said the Fed could also find “new ways to provide support for the economy” if the country goes over the so-called fiscal cliff if President Barack Obama and Republicans cannot reach a budget deal in time.

The Fed will make these purchases after its “Operation Twist” program winds down, which in QE3 failed to stimulate the economy.

“We have innovated quite a bit in the last few years, and (it) is always possible we could find new ways to provide support for the economy,” Bernanke said. He acknowledged that “with interest rates near zero and the (Fed’s) balance sheet already large, that the ability to provide additional accommodation is not unlimited.”

Bernanke claimed if the country goes over the fiscal cliff, the Fed could even “perhaps increase a bit” the support that it is able to provide businesses and households.

The Fed already “chopped overnight interest rates to near zero nearly four years ago” and has purchased nearly “$2.4 trillion in securities to drive other borrowing costs lower.”

“If we could wave a magic wand and get unemployment down to 5 percent tomorrow, obviously, we would do that,” Bernanke insisted.

Bernanke said “there are constraints in terms of the dynamics of the economy” and there are “other costs and risks” that “might be associated with a large expansion of our balance sheet.”

“We cannot offset the full impact of the fiscal cliff. It’s just too big,” Bernanke said.

But even after these admissions, Bernanke’s comments indicate the Fed has no plans to stop printing money in attempts to “stimulate” the economy.

COMMENTS

Please let us know if you're having issues with commenting.