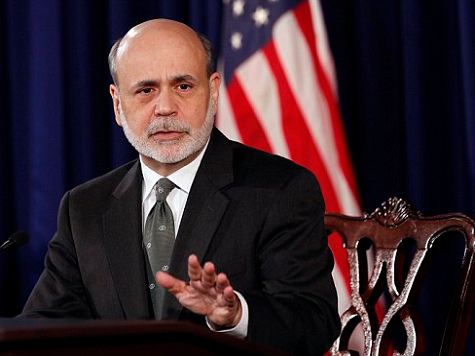

Look out: the Fed’s policy of easy money may be beginning to backfire. Investors who were giddy at the success of the stock market in the first 6 months of 2013 are becoming nervous that the quantitative easing instituted by Fed Chairman Ben Bernanke will be coming to an end. The Fed’s $85-billion-a-month bond-buying program had stimulated closing highs reaching record levels; in May, the Dow Jones Industrial Average was at an all-time high. Meanwhile, yields on 10-year U.S. Treasury notes, were skyrocketing and erasing bond values.

Bob Baur, chief global economist at Principal Global Investors, said, “The U.S. stock market is trying to come to terms with the fading and eventual end of quantitative easing and determine the impact of higher interest rates.” Tellingly, gold prices have plummeted as quantitative easing approaches its end; gold is down 26.9% this year. When the Fed announced that its stimulus program was going to be slackened, stocks had their biggest stock selloff of the year. Interest rates zoomed upward and bond investors took a beating.

COMMENTS

Please let us know if you're having issues with commenting.