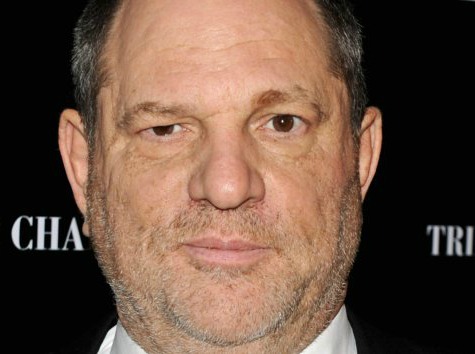

Some in Hollywood continue to lobby the Golden State for what is commonly derided as a corporate bailout. The amount of film production taking place outside of California is approaching crisis levels as union groups and now high profile studio boss Harvey Weinstein have joined the chorus for tax relief.

However, in a different economic sector where studios are trying to preserve revenues, another besieged group of entertainment workers may have discovered a new method to save some California entertainment jobs.

This brings a completely different challenge, for just as studios have made strides to preserve royalties overseas that effort has opened the door for certain labor groups desperate to keep jobs in the U.S. The unintended consequence of protecting its money could be higher labor rates.

Recently a petition by a number of industry groups calling for California to provide tax incentives in order to keep production in the state. Now more influence is getting behind the effort. This past weekend, speaking at the UCLA Entertainment Symposium, studio head Harvey Weinstein made the case for the state to expand its tax policies regarding the film industry.

In a discussion with recently appointed LA Film Czar, Ken Ziffren, who has ties to Gov. Jerry Brown, Weinstein rallied on behalf of tax incentives. He pleaded on behalf of the industry, “Please, whatever you can do with the governor…”

Late last month a rally was held by some union organizers also pushing for the state to take action. Speaking at the rally one representative from a teamsters union not only backed the tax incentives, but vowed that his group would be willing to go further. They announced the possibility of repeating a bargaining tactic employed years ago when they sent hundreds of union trucks to the state Capital in Sacramento.

This is how serious the situation has become. When union reps and a noted Presidential supporter throw their collective weight behind a cause they normally would lobby against, something is amiss.

Labor groups are among the first, and the loudest, to rail against “corporate welfare.” Weinstein meanwhile is advocating an economic condition that seems in direct opposition to the tax policies of the President he ardently supports. More than a casual donor Weinstein is a vocal advocate for Obama, staging numerous fundraisers as a campaign bundler on behalf of the President. Yet now he calls for distinctly conservative economic policies to be applied in his industry.

To get a glimpse of how bad this economic reality has become look at a pair of upcoming blockbuster releases — the remake of Godzilla, and the distaer epic San Andreas, starring Dwayne Johnson. Although a significant part of the film has the thunder lizard rampaging in San Francisco, Godzilla only had FOUR days of production in that city. And with San Andreas it is starker, as the film is largely set in that metropolis and yet it only spent around six days filming establishing scenes in town.

These are also films which rely heavily on digital computer imagery, and as for the jobs streaming out of California some of the hardest impacts have been felt in the visual arts field.

While estimates show nearly 90 percent of the top movies rely on digital effects that VFX industry has become devastated in California. The company that produced the copious effects in Titanic went bankrupt and was sold off two years ago. More jarring was the company Rythym & Hues going under just weeks before its work on Life of Pi won the Oscar for visual effects last year. Meanwhile tax and labor subsidies means studios are setting their own digital houses overseas in more favorable markets.

New Line has created all of their effects for The Hobbit films in New Zealand, and Warner Brothers has helped the U.K. become a global player in digital work in recent years.

To combat this tide VFX workers have banded together, staging a March in March protest last week in conjunction with The Oscars, but there may be a more effective gambit on the horizon.

A leader in the VFX lobbying groups, animator and blogger Daniel Lay, had lawyers look into a recent government filing involving the MPAA that could be used against them in the labor field.

In a wholly unrelated case with the International Trade Commission–involving 3-D printers, of all things–the MPAA offered an opinion regarding digital property and copyright protections.

The document, revealed by PandoDaily.com, has the MPAA arguing on behalf of government levies that would help with intellectual property protections (from the document):

The use of electronic means to import into the United States infringing articles threatens important domestic industries such as the motion picture and software industries, as well as U.S. consumers and the government at all levels.

What Lay, and his lawyers, are looking into is using that very declaration by the studios to become applied to their type of digital post-production work, which has been offshored in recent years. The intent might very well negate the cheaper labor overseas and hopefully keep the work in the States.

Here is the simplified way of looking at this. Hollywood has argued that digital property should fall under the same restrictions of imported durable goods. This would shield the entertainment industry in a similar fashion as say, the steel or lumber industries might be protected from overly cheap imports. In an effort to use the argument of the MPAA against itself Lay and his lawyers stipulate the post-production visual effects work should also classified as digital goods, and the cheaper labor should come under tariffs or similar surcharges.

This would make offshoring that work more expensive, and hopefully making domestic production cost-effective. This places the studios in a paradox; if the MPAA wants to combat this rise in digital labor costs it must counter against its own argument to protect its digital property. The decision comes down to, on which side should studios to protect the money?

This also creates a curious decision for the labor groups to make. It would be uncomfortable for labor to argue against a decision to keep work domestically situated, yet at the moment they are on the side of studios in arguing for tax breaks. As another labor representative announced during that rally last month:

“We are going to stand with you to make sure Hollywood does not become Detroit.” The groups are starting to find the solutions produce just as many challenges.

COMMENTS

Please let us know if you're having issues with commenting.