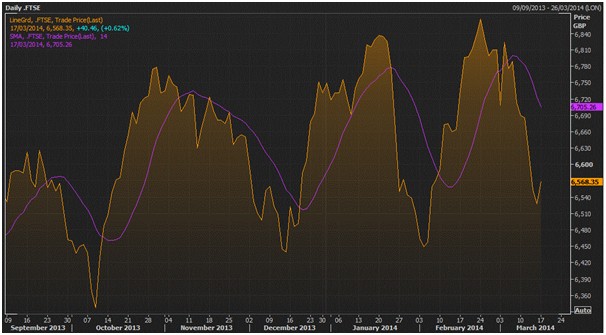

Another week, and another raft of data that will attempt to give some direction to these otherwise directionless markets. Over in the UK, the FTSE 100 has been ‘range bound’ (meaning it struggled to get any real momentum behind it).

The graph below illustrates this point:

For the last six months, the FTSE has traded within a range of about 400 points.

So, what bits of data should we keep an eye on over the coming week?

17th March Euro Zone inflation (10:00 GMT): Forecast rise of 0.4 percent following a previous drop of 1.15 (m/m) and 0.8 percent increase year on year.

The Eurozone inflation data that came out yesterday showed that the Eurozone continues to move ever closer to deflation. This is despite Mario Draghi’s prediction in February that there would be “low level inflation for a protracted period of time, but deflation? No.”

That said, he recently appeared to moderate his position to saying that the risks of deflation were “quite limited” but that inflation expectations “becoming unanchored” would be “countered with additional monetary policy measures”.

Whilst continued repayments from the banks of the ‘Long Term Refinancing Operation’ funds will act to make liquidity (money) scarcer in the short term and thus helping the Euro rise against other currencies, a raft of QE from the ECB is still on the cards. This would have the effect of helping the Euro depreciate against other currencies.

18th March US Housing Starts (12:30 GMT) forecast rise of 910,000 from previous 880,000 rise.

This one is a big test for how much of an impact rising rates following tapering are having, with housing starts down from 1.1 million pre-tapering. Bad weather has been cited up to now following a decline of 16 percent last month to 880,000, but another poor figure will cast some doubt on the validity of such claims.

19th March Japan February Trade Balance (23:50GMT) forecast deficit of 590 billion yen.

Following a huge 5.8 percent decline in exports in January which resulted in a trade deficit of 2.8 trillion Yen, this figure should represent some improvement given the last figure was distorted by seasonal factors and the Lunar New Year.

Nevertheless, the lower value of the Yen combined with the fact Japan’s imports of energy have soared post-Fukushima mean that it’s likely to remain firmly rooted in deficit contrary to conventional wisdom that debunking the currency boosts exports.

It’s also the day of the UK Budget where the Chancellor will announce key measures to boost the economy. Or, given that it’s just over a year until the General Election, a few sweeteners for the electorate.

20th March CBI trends- orders (11:00 GMT) Rise of 5 versus previous of 3.

This survey by the Confederation of British Industry is seen as a key measure of the business community- the people at the coal face of the economy- and the confidence they have. The survey asks “excluding seasonal variations, do you consider that in volume terms your present total order book is above normal, normal or below normal?”. The figure this month is expected represent an improvement of last months, and the chart below illustrates a clear trend of improving confidence.

21st March: February UK Public Sector Borrowing figures (09:30) forecast £8.55 billion deficit versus previous -£6.43 billion surplus from January.

Last month’s January figures produced a surplus, although this was less than usual (with UK taxes due in January). With much of Osborne’s credibility resting on his ability to reduce the size of the UK’s deficit, he’ll be hoping that the reduced takings on income & corporation tax in January don’t represent the start of a slippage in tax receipts.

COMMENTS

Please let us know if you're having issues with commenting.