Tuesday 1st July, US domestic car sales forecast at 5.6 million year on year:

Although this represents a recovery from lows of around 3 million in 2008/9, this still appears to be part of a trend that is some way below the sales seen in the 1990s which typically stood at around 6-7.5 million.

That said, the difference then was that many US domestic automakers weren’t turning consistent profits and were more focused on volume sales. Following the restructuring of the major US automakers, costs have been reduced and there has been less focus on simply ramping up supply at the expense of margins.

Or, you could chalk it down to the price of oil (West Texas Intermediate) consistently being above $100 and declining real wages making car ownership a more costly endeavour…

Wednesday 2nd July, US MBA 30-year mortgage rate previously at 4.17 percent:

Up from 3.5 percent since the onset of tapering, the rate being charged on the average 30 year mortgage has remained largely stable since then. The trajectory for mortgage rates has been on a downward trend though having declined from around 4.5 percent earlier in the year.

This is largely owing to an overreaction by markets following the commencement of the scaling back of the Federal Reserve’s Quantitative Easing programme whereby financial markets thought that interest rate rises would follow shortly after.

The can has been kicked down the road as far as a rate hike is concerned, however, with Janet Yellen describing a recent rise in inflation as “noisy” rather than something the Federal Reserve should be reacting to with a rise in interest rates. This would appear to suggest The Fed does not see a case for raising rates in the near future.

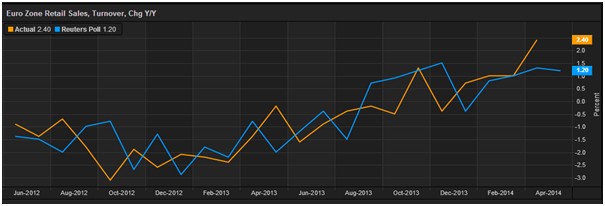

Thursday 3rd July, Eurozone retail sales forecast to improve by 1.2 percent and an ECB rate decision due:

Retail sales in the Eurozone have been gradually picking up since the region found itself engulfed in a full blown existential crisis two years ago, but this has failed to manifest itself in a sturdy recovery with GDP growth forecast at a lowly 0.9 percent.

Meanwhile, the European Central Bank will be making their monthly decision on interest rates. Having cut rates in their last meeting, it is unlikely that they will take further action this time round. Given the banks conservative nature, the ECB is likely to take a “wait and see approach” and will most probably only intervene further if inflation continues to edge any closer to becoming deflation.

Friday 4th July, German industrial orders expected to decline by 1 percent month on month:

The reason Germany has such a strong vested interested in the preservation of the Eurozone was seen in April, when orders for German good rose by 3.1 percent driven by a 9.9 percent rise in orders from the rest of the Eurozone. To this end, Thursday’s Eurozone retail sales figures may give us some clue as to how strong demand for goods from German factories will have been.

COMMENTS

Please let us know if you're having issues with commenting.