An estimated 45.3 percent of Americans are paying no federal income tax for the year 2015.

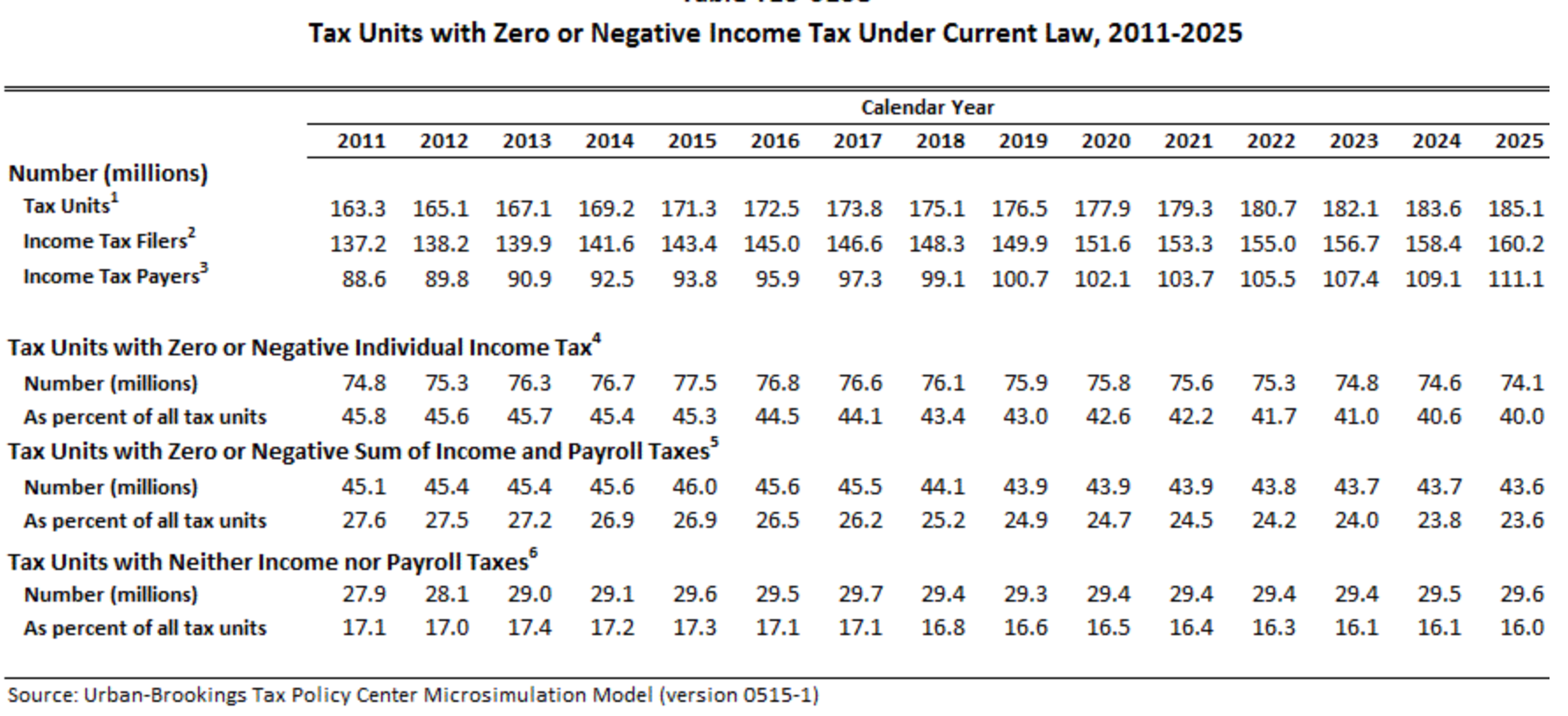

The number of households in the United States that pay no federal income tax, in fact, has been rising steadily. Data from the Tax Policy Center show that, in 2011, 74.8 million Americans paid zero federal income tax or had a negative income tax rate, which means they received benefits from the federal government via programs such as the Earned Income Tax Credit or Child Tax Credit, in addition to having to pay no taxes. In 2015, 77.5 million will do the same.

For 2015, of 171.3 million American households, 143.4 million actually file taxes, and among those only 93.8 million owe federal taxes of at least $5.

“This isn’t actually a shocker,” writes James Quinn at InvestmentWatch. “When 40% of the working age population doesn’t work and another 10% only hold part-time jobs, they aren’t paying any Federal Income taxes.”

Quinn continues that, despite the calls from socialists such as Bernie Sanders and the Occupy Wall Street crowd for the rich to pay more in taxes, wealthy Americans already pay nearly 87 percent of all federal income tax.

He writes:

The top 1% of taxpayers pay a higher effective income-tax rate than any other group (around 23%, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50%.

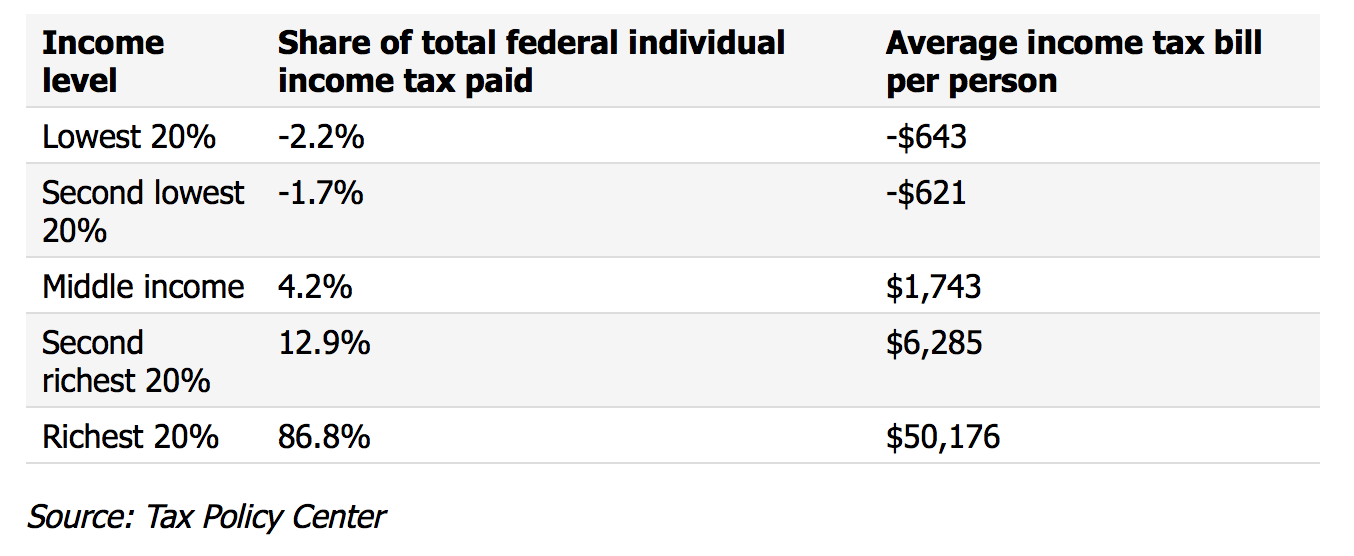

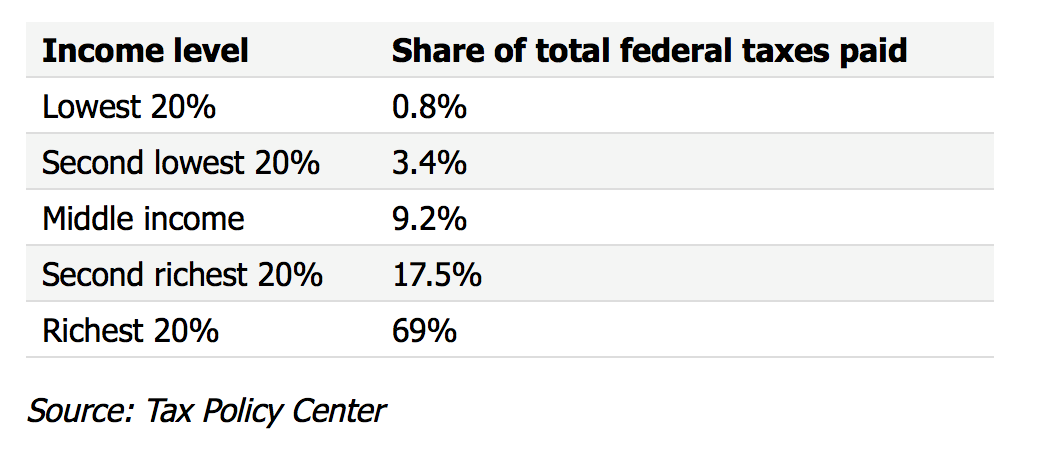

On average, those in the bottom 40% of the income spectrum end up getting money from the government. Meanwhile, the richest 20% of Americans, by far, pay the most in income taxes, forking over nearly 87% of all the income tax collected by Uncle Sam.

“The top 1% of Americans, who have an average income of more than $2.1 million, pay 43.6% of all the federal individual income tax in the U.S.,” he adds. “The top 0.1% — just 115,000 households, whose average income is more than $9.4 million — pay more than 20% of it.”

COMMENTS

Please let us know if you're having issues with commenting.