Two Texas Republican lawmakers submitted matching bills in the House and Senate Tuesday to shut down the Consumer Financial Protection Bureau, an agency outside the direct oversight of Congress and the control of the president.

“Don’t let the name fool you, the Consumer Financial Protection Bureau does little to protect consumers,” said Sen. Ted Cruz. “During the Obama administration, the CFPB grew in power and magnitude without any accountability to Congress and the people, and I am encouraged by the actions President Trump has begun to take to roll back the harmful impacts of an out-of-control bureaucracy.”

Cruz’s co-sponsor is Rep. John Ratcliffe. By submitting matching bills in each chamber and going through the procedures at the same time, the men hope to have the legislation on President Donald Trump’s desk sooner than if the bill started in one chamber and then went to the next.

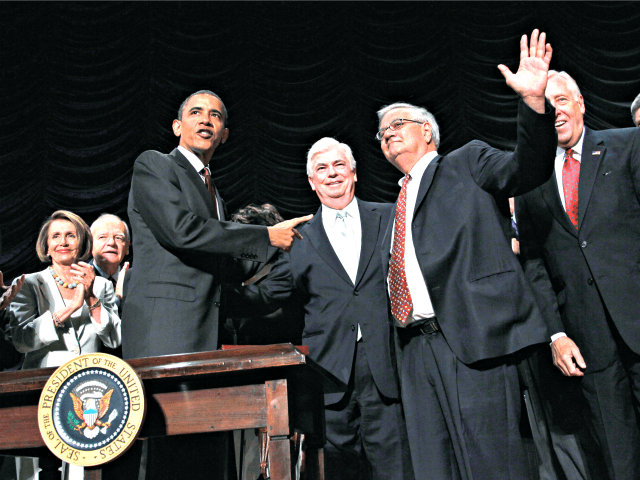

The CFPB was created in the landmark 2010 Wall Street Reform and Consumer Protection Act, also known by the shorthand “Dodd-Frank” after its sponsors Sen. Christopher Dodd (D.-Conn.) and Rep. Barney Frank (D.-Mass.). The Dodd-Frank legislation was the most sweeping financial regulation legislation passed since the deregulatory bills passed in the 1990s under President Bill Clinton.

The Cruz-Ratcliffe bill is targeted on Title X of the Wall Street Reform and Consumer Protection Act, which created the CFPB. The CFPB was specifically designed to be an extra-political entity. Its director, now Richard Cordray, serves a five-year term — which overlaps a president’s own four-year term — and its funding comes from the Federal Reserve Bank, not from Congress. The bureau has a 15-member board of trustees that is empowered to veto a decision by the director, but that veto requires nine votes.

Ratcliffe said that experience should be enough proof that federal regulators are not the solution to the problems of everyday Americans.

“The past several years showed us precisely why massive swaths of federal regulations are never the right solution to help hard-working Americans. President Trump has made it clear he’ll join us in our fight to dismantle Dodd-Frank and finally offer some relief to the small business owners throughout Texas and across the country who’ve been hit hardest by its devastating impact,” the congressman said.

“The CFPB’s lack of accountability to the American people was quickly evidenced when – contrary to its name – it ended up hurting many of the very folks it was intended to help,” he said.

“While Senator Cruz and I have been sounding the alarm on the CFPB’s federal overreach for some time now, I’m optimistic at our renewed chances of advancing this effort with a willing partner in the White House,” Ratcliffe added.

In the last session of Congress, Sen. David Perdue (R.-Ga.) filed legislation to bring the CFPB under the funding aegis of Congress.

“The Consumer Financial Protection Bureau was spawned from the disastrous Dodd-Frank financial regulation law,” said Perdue. “Georgians sent me to Washington to help restore accountability and transparency to the federal government, and the CFPB needs a major dose of both.

“Georgians sent me to Washington to help restore accountability and transparency to the federal government, and the CFPB needs a major dose of both,” he said.

“Right now, the CFPB is a rogue agency that dishes out malicious financial policy and creates new rules and regulations at whim without real Congressional oversight. The American people, through Congress, deserve a closer look at the CFPB and how its actions will impact consumers,” he said.

“Additionally, the agency itself has failed to operate within its own budget and proven it is more concerned with preserving its own power than protecting the public,” he said. “Ultimately, I believe the CFPB should be eliminated, but an important first step is bringing it into the light for the American people.”

There are also concerns on Capitol Hill that because the CFPB collects copies of every financial transaction in the country, the information is a tempting target for hackers or even political opportunists.

Cruz said his legislation with Ratcliffe removes the CFPB and its smothering effect on the economy and then moves on to other parts of Dodd-Frank.

“The legislation that Representative Ratcliffe and I are introducing today gives Congress the opportunity to free consumers and small businesses from the CFPB’s regulatory blockades and financial activism, which stunt economic growth,” he said.

“While there’s much more to do to scale back the harmful regulatory impositions of Dodd-Frank, this legislation takes a critical step in the right direction.”

COMMENTS

Please let us know if you're having issues with commenting.