Democrats remain divided over whether to work with Republicans to revamp the controversial Consumer Financial Protection Bureau (CFPB).

The CFPB is a consumer watchdog organization created in the wake of the financial crisis. Republicans have criticized the CFPB since its inception, believing the bureau redundant, unaccountable to Congress and the president, and a drain on the economy.

The CFPB is an independent agency with a single director, who can only be fired by the president for gross misconduct or abuse of power. The Federal Reserve, not Congress, funds it, which insulates the organization from congressional oversight.

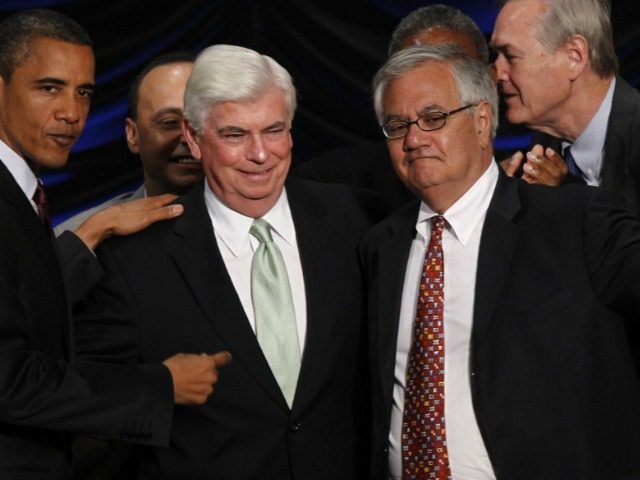

President Trump has promised to “dismantle” the Dodd-Frank financial overhaul, which set up the CFPB. The bureau finds itself in court after the D.C. Court of Appeals ruled the agency’s structure unconstitutional. The Trump White House previously weighed options to fire CFPB Director Richard Cordray.

Republicans on the House Financial Services Committee hope to markup legislation to reform Dodd-Frank in April. Democrats will have a month to agree upon a strategy to defend the CFPB and to decide to what to degree they wish to work with Republicans to keep the CFPB alive.

Democrats believe they can strike a deal with Republicans to transform the CFPB into a bipartisan commission from a single directorship. Congressman Brad Sherman (D-CA) explained that the alternative would give President Trump sole control over the CFPB when current director Richard Cordray’s term expires next year.

Congressman Sherman said:

I’ve been warning my party for a long time that at some point you’re going to have a Republican president. I prefer a bipartisan commission. For some Democrats, the choice is do we stick with the holy scripture, which is what we passed in Dodd-Frank. For others, it’s the practical question, which is, next year, do you want a Trump appointee or a board? Nothing that Trump has done makes me think that I want a Trump appointee.

Congressman John Delaney (D-MD) said he discussed turning the CFPB into a bipartisan bureau last year with Republicans—only if Richard Cordray remains involved—and that the Senate would have to approve the commissioners involved.

Rep. Michael Capuano (D-MA) explained he is not opposed to a commission in theory, but that “It’s awfully hard to be open-minded when the people who are pushing it the hardest are the ones who’ve been against the CFPB from day one.”

Senator Elizabeth Warren (D-MA) remains opposed to changing the bureau’s structure. She wrote in an October 2016 piece, “The quickest way to undermine an agency’s effectiveness is to make it a commission — which is why I want a single director and the banking industry doesn’t.”

Republicans remain secretive regarding their plans to reform the CFPB. Congressman Jeb Hensarling (R-TX), chairman of the House Financial Services Committee, wrote in a memo to committee Republicans that they could retain the CFPB’s single directorship with reduced autonomy and more White House oversight.

The Trump administration backed a lawsuit in the D.C. Court of Appeals, arguing that the CFPB’s single directorship is unconstitutional.

The Trump administration’s brief stated, “Because a single agency head is unchecked by the constraints of group decision-making among members appointed by different Presidents, there is a greater risk that an `independent’ agency headed by a single person will engage in extreme departures from the President’s executive policy.”

COMMENTS

Please let us know if you're having issues with commenting.