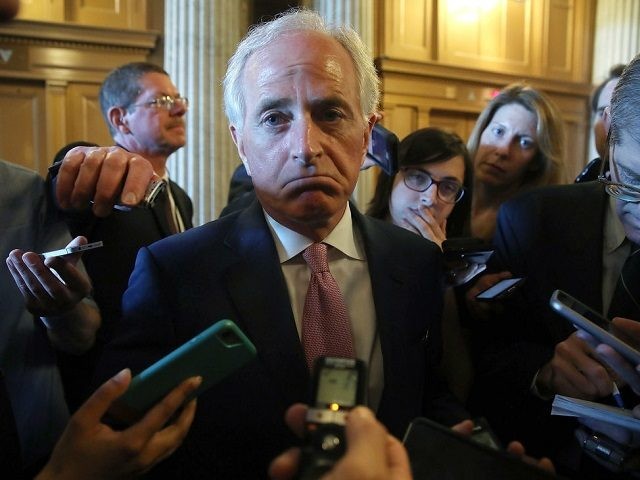

The director of communications for the City of Mobile, Alabama, tells Breitbart News that the city cannot produce a key legal document from 2013 that forms the basis for the McGowin Park retail center “swamp deal” in which Senator Bob Corker (R-TN) is set to receive millions of dollars over 20 years from Alabama taxpayers because, “this event occurred under the previous administration.”

The curious response from City of Mobile director of communications George Talbot raises questions about the entire legal basis for the tens of millions of dollars in tax subsidies (at least $75 million and as much as $260 million) provided to McGowin Park LLC, the company in which Corker has a 13 percent interest according to his 2016 personal financial statement filed with the U.S. Senate, and the subsequent $21.8 million revenue bond offering issued in 2016 by the related McGowin Park Improvement District.

Payments to the purchasers of the 2016 $21.8 million revenue bond offering over its 20 year life total $66 million. Total sales tax incentive payments made to the entity the City of Mobile says is legally authorized to receive those payments, however, are likely to be significantly greater–at least $75 million and possibly as much as $260 million.

The difference in those payments–which could be as little as $9 million or as much as $194 million–is scheduled to be paid directly to McGowin Park Incentive, LLC, an entity in which Senator Bob Corker also holds a 13 percent interest, and the same entity to which McGowin Park, LLC assigned its stream of payments to in August 2014, with the approval of the Mobile City Council, and September 2014, with the approval of the Mobile County Commission.

According to a Breitbart investigation, that August 2014 assignment may have violated an October 3, 2013 court order that “validated” an earlier project development agreement which has no specific provision authorizing such an assignment prior to the completion of the project. The City of Mobile, however, refuses to produce the documentation of that court order, and the Mobile County Circuit Court that originated the court order has not yet responded to a Breitbart News request to produce it.

Stunningly, the diversion of some sales tax incentive rebates from the McGowin Park retail center to the owners of McGowin Park Incentive, LLC may also violate the enabling statute–the Alabama Improvement District Act–which prohibits the use of such sales tax incentives for any purpose other than the rebatement of the debt incurred in revenue bond offerings when those rebates are specified as the source of repayment to bond purchasers in the offering.

In other words the payments are specifically intended to flow to the bondholders, not back into the pockets of the developer.

And the failure of the City of Mobile, Mobile County, and McGowin Park Incentives to disclose in the 2016 $21.8 million revenue bond offering by the McGowin Park Improvement District that the sales tax incentive rebates had been assigned to McGowin Park Incentives–and not the McGowin Park Improvement District–and that further a significant portion of those sales tax incentive rebates would flow to McGowin Park Incentives, rather than the purchasers of the bond, could create serious problems for all parties involved in the transaction.

Those problems could be so great they could cause the entire transaction to unravel.

Though the public benefits of the transaction have come under intense debate, it has proved immensely profitable for the development company in which Senator Corker holds a 13 percent interest.

“Through an agreement with developers of the McGowin Park shopping center, the city has refunded more than $3.9 million in sales tax revenue since 2015,” Lagniappe Weekly reported last week.

More than three percent of those sales tax incentive payments – or $149,031 – have ended up in the pocket of Senator Corker, according to his personal financial statements for 2015 and 2016 filed with the U.S. Senate. Another $1 million –or about 24 percent of those sales tax incentives–went to the other owners of McGowin Park Incentive, LLC. Only 73 percent of those sales tax incentive rebates paid by Alabama taxpayers shopping at the McGowin Park shopping center–or $2.75 million of of the $3.9 million collected–went to repay the bondholders who purchased the $21.8 million revenue bond issued by the McGowin Park Improvement District in 2016.

According to his 2015 personal financial statement, Senator Corker received $40,349 in 2015 from sales taxes paid by Alabama consumers at retail stores located within the McGowin Park retail center (located within the McGowin Park Improvement District) in the form of payments related to City of Mobile Limited Obligation Project Revenue Warrants, Series 2013 and Mobile County Limited Obligation Project Revenue Warrants, Series 2013. In 2016, those payments jumped to $108,682, according to his 2016 personal financial statement.

A spokesperson for Senator Corker has confirmed to Breitbart News his personal financial statements report the receipt of these payments, as well as the underlying assets.

Unanswered among all these questions is why a sitting U.S. senator would find it appropriate to participate in such a controversial investment that involved pocketing millions of taxpayer dollars.

A brief timeline that outlines the unusual aspects of this project is included below:

July 23, 2013–The Mobile City Council and the Mobile County Commission approve a sales tax incentive rebate incentive program to benefit McGowin Park, LLC, a development company organized by Chattanooga based developer with close ties to Senator Bob Corker, The Hutton Company. Sam Jones is the mayor of Mobile at this time.

Under that sales tax rebate incentive program, 28 percent of all city sales taxes collected at the 600,000 square foot McGowin Park retail center in Mobile (anchored by Dick’s Sporting Goods and Costco), or 1.4 cents of each 5 cents of city sales tax collected on each dollar sold at a store in the center, and 30 percent of all county sales tax collected, or 0.3 cents for each 1 cent of county sales tax collected on each dollar sold at a store in the center is given directly to the developer, McGowin Park, LLC.

McGowin Park, LLC is represented before the Mobile City Council and the Mobile County Commission by Alvin Hope, a partner with the Alabama based law firm of Maynard, Cooper, and Gale. In 2017, partners in this firm and the firm’s political action committee contribute $28,000 to the Senate election campaign of Senator Luther Strange (R-AL), who was defeated in the Republican Senate primary runoff on September 26 by conservative grassroots candidate Judge Roy Moore.

At separate meetings on the same day, both the Mobile City Council and the Mobile County Commission approved project development agreements with McGowin Park, LLC.

That same day, Mobile Mayor Sam Jones and Hutton Company CEO/McGowin Park, LLC CEO Karen Hutton sign the July 23, 2013 Project Development Agreement between the City of Mobile and McGowin Park, LLC. As part of the agreement, the financial payments stemming from these sales tax incentives from the City of Mobile to McGowin Park, LLC are memorialized in a financial document describing the City of Mobile Limited Obligation Project Revenue Warrants, Series 2013.

Section 7.6. (c) of that agreement, “Delegation and Assignment of this Agreement,” (see page 11) will play a critical role in the determination of the legal basis for subsequent assignments and the 2016 revenue bond offering:

The Developer’s rights under this Agreement or the Warrant may be assigned without the City’s consent to any person, including any lender providing financing for the Project or a part thereof; provided however, the Developer’s rights under this Agreement or the Warrant may be assigned without the City’s consent to a person other than a lender providing financing for the Project or a part thereof only after the Developer delivers the Project Completion Certificate to the City.

However, the authorizing statute for such sales tax incentives, the Alabama Improvement District Act, appears to prohibit the disbursement of such sales tax incentives, or “assessments” for any purpose other than the retirement of bond debt when those sales tax incentives are used in the sale of those bonds:

Section 11-99A-17 of that statute (see page 18) deals with pledge of assessments:

If bonds are issued with respect to an assessment, all proceeds of the assessment shall be pledged to secure payment of the bonds and shall be paid directly by the property owners to the board or to a trustee or other holder of funds as may be appointed by the board for the benefit of the holders of the bonds (emphasis added)

This key provision of the enabling statute will figure prominently in concerns over the terms of a subsequent $21.8 million revenue bond offering by the McGowin Park Improvement District in 2016, sources familiar with municipal bond financings tell Breitbart News.

Though neither the City of Mobile nor the Circuit Court of Mobile County have made the July 23, 2013 Project Development Agreement between the City of Mobile and McGowin Park, LLC which is the document that was presumably validated in the yet to be seen October 3, 2013 court order, Breitbart News has been able to obtain a copy of what it believes to be that document, which can be viewed here.

A similar Project Development Agreement, also dated July 23, 2013, between Mobile County and McGowin Park, LLC grants McGowin Park, LLC up to $50 million in sales tax incentive payments over twenty years as part of the same inducement. As part of that agreement, the financial payments stemming from these sales tax incentives from the City of Mobile to McGowin Park, LLC are memorialized in a financial document describing the Mobile County Limited Obligation Project Revenue Warrants, Series 2013.

August 26, 2013–The City of Mobile files “a proceeding pursuant to the Validation Act in the Circuit Court of Mobile County, Alabama (the“Court”) to validate the legality and validity of the City Project Agreement and the warrant issued under the City Project Agreement, the City’s issuance of such warrant and the application of the City Sales Tax in the amount of the Project City Tax Payments to payment of such warrant,” according to page 18 of the 2016 revenue bond prospectus.

August 27, 2013–Sam Jones is defeated in his bid to be re-elected as mayor of Mobile by Sandy Stimpson on August 27, 2013.

October 3, 2013–The Circuit Court of Mobile County validates the July 23, 2013 Project Development Agreement between the City of Mobile and McGowin Park, LLC. (see page 18 of the 2016 revenue bond prospectus):

Following the conclusion of the required Court proceedings set forth in the Validation Act, the Court entered an order on October 3, 2013 (the “Final Judgment”) in which it validated and confirmed the City Project Agreement and such warrant, the City’s issuance of such warrant and the application of the City Sales Tax in the amount of the Project City Tax Payments to payment of such warrant. The period for filing an appeal of the Final Judgment has expired without an appeal having been filed.

The Validation Act provides that the Final Judgment of the Court validating and confirming the issuance of the warrant issued under the City Project Agreement “shall be forever conclusive as to the validity of such obligations against the unit issuing them [the City] and against all taxpayers and citizens of each organizing subdivision, and the validity of such obligations or of the taxes, revenues or other means provided for their payment and of any pledge, covenant or provision for the benefit of said obligations, to the extent that the validity of any such pledge, covenant or provision shall have been presented to the court and validated by its judgment, shall never be called in question in any court in this state.

As a point of interest, the presiding judge of the Mobile County Circuit Court at the time this validation occurred was Judge Charles Graddick, who, upon his retirement as a Circuit Court judge in 2017, was hired by the City of Mobile as a Senior Legal Advisor.

As there are about ten Circuit Court Judges who serve in the Mobile County Circuit Court District, it is unclear if Judge Graddick ruled on the 2013 validation request, though he may have had the ability to assign the case to a specific Circuit Court judge if he did not personally rule on it.

Breitbart News has asked the offices of the current presiding judge of the Mobile County Circuit Court District, Judge John Lockett, as well as the clerk of the Mobile County Circuit Court, to provide us with a copy of the validation document for the City of Mobile-McGowin Park sales tax incentive rebate which the City of Mobile says it is unable to produce. To date, the Mobile County Circuit Court has not yet produced that document

November 4,2013–Sandy Stimpson is sworn in as the new mayor of Mobile, Alabama.

July 2014–Senator Bob Corker (R-TN) invests between $1 million and $5 million in McGowin Park, LLC, and receives a 13 percent interest in the company.

July 2014–Wells Fargo Bank, which has been closely tied to Senator Corker in a number of previous transactions, provides an estimated $5 million construction loan to McGowin Park, LLC for the purpose of developing the McGowin Park retail center in Mobile, Alabama. Wells Fargo puts down infrastructure financing and makes project commitments on a non recourse basis.

August 19, 2014—The Mobile City Council assigns sales tax rebate incentives from McGowin Park, LLC – whose assets are used as collateral for Wells Fargo Bank loan, to a newly formed Delaware corporation known as McGowin Park Incentive, LLC, whose assets are not used as collateral for the Wells Fargo Bank loan. According to minutes of the Mobile City Council meeting on August 19, 2014 the resolution (Number 60-377-2014) authorizing the assignment, introduced by Councilmember Richardson and sponsored by Mayor Stimpson and Councilmember Williams, offers this legal basis for the assignment:

WHEREAS, the Developer desires to assign the Warrant in accordance with an assignment (the “Assignment”) to McGowin Park Incentive, LLC, a Delaware limited liability company (the “Assignee”), and, in accordance with Section 7.6(c) of the Agreement, the Developer has requested that the City consent to the Assignment (the “Consent”);

Attorney Alvin Hope, a partner in Maynard, Cooper, and Gale, represents the interests of McGowin Park LLC and McGowin Park Incentive LLC before the Mobile City Council during these discussions.

The Mobile City Council passes the resolution unanimously. There is no reference in the minutes of the meeting that the vote on the resolution was preceded by any discussion of the significant legal questions surrounding this assignment.

The first question relates to whether Section 7.6 (c) of the July 23, 2013 Project Development Agreement between the City of Mobile and McGowin Park, LLC, validated by the yet to be produced October 3, 2013 court order actually allows such an assignment prior to the delivery of a completion certificate by the developer even with the consent of the City Council.

Section 7.6. (c) states that “the Developer’s rights under this Agreement or the Warrant may be assigned without the City’s consent to a person other than a lender providing financing for the Project or a part thereof only after the Developer delivers the Project Completion Certificate to the City.”

The Project Development Agreement is silent about the assignment of those warrants prior to the delivery of the project completion project with the consent of the city.

It is surprising that the minutes of the Mobile City Council meeting on this date do not show that either Mobile City attorney Ricardo Woods, or Alvin Hope of Maynard, Cooper & Gale, counsel for McGowin Park, LLC, specifically advised the Mobile City Council of those significant legal concerns prior to its approval of the assignment.

It also surprising that, given this uncertainty surrounding its legal authority to approve such an assignment, that the Mobile City Council did not submit an amended Project Development Agreement that specified the assignment approval to the Mobile County Circuit Court for validation.

Breitbart News asked City of Mobile spokesperson George Talbot if an Alabama Circuit Court Judge validated the assignment of sales tax rebates from McGowin Park LLC to McGowin Park Incentive LLC that took place during this August 2014 City Council meeting.

“No. The re-assignment or transfer was not re-validated because the authority to assign/transfer the warrant was expressly set out in the development agreements. It was all done in a public forum,” Talbot responded.

Though this important change to the terms of the July 23, 2013 Project Development Agreement between the City of Mobile and McGowin Park, LLC took place one month after Senator Corker’s investment in McGowin Park, LLC, a spokesperson for Senator Corker told Breitbart News “As is custom in development projects, such agreements were in place long in advance of Senator Corker first being approached about being an investor in the project.”

The subsequent failure to disclose this assignment two years later in the $21.8 million revenue bond prospectus of the McGowin Park Improvement District, issued two years later in December 2016 could potentially unravel the entire financing structure of the project.

Under Rule 15 C2-12 of the Securities and Exchange Commission, the McGowin Park Improvement District has an obligation to make this disclosure, sources familiar with the legal obligations of tax exempt bond revenue offerings tell Breitbart News.

This disclosure requirement is an ongoing obligation. Failure to disclose the assignment of the sales tax rebate incentive from McGowin Park LLC to McGowin Park Incentives, LLC, and an apparent subsequent assignment by McGowin Park Incentives, LLC to McGowin Park Incentives Manager, LLC (this subsequent assignment was apparently not presented to the Mobile City Council or the Mobile County Commission for approval) seriously weakens the bond, since the assignment allows McGowin Park Incentives, LLC and McGowin Park Incentives Manager, LLC to pledge the income from the sales tax incentive rebates as collateral for other projects.

September 23, 2014–The Mobile County Commission authorizes the assignment of the sales tax incentive rebates from McGowin Park, LLC to McGowin Park Incentive, LLC at the request of Maynard Cooper partner Alvin Hope. When Mobile County Attorney Jay Ross is asked by County Commission chairman if he recommends the assignment, he says yes, he does. When asked why, he says “because the City of Mobile did it one month ago.”

September 2014 to late 2015— McGowin Partners accumulates $22 million in project costs, according to the revenue bond prospectus. Construction starts on infrastructure of for the McGowin Park retail center site. McGowin Park LLC signs a deal with Costco and sells them a 13.5 acre site. They do the same with Jared Jewelers and Hilton Garden Hotel. Through these transactions, McGowin Park, LLC recovers the development money they invested up front.

McGowin Park, LLC begins construction on the retained part of project including Dicks Sporting Goods and other stores.

December, 2016–McGowin Park Improvement District issues $21.8 million in revenue bonds in December of 2016.

The proceeds from this $21.8 million revenue bond were used to pay back the entire initial investment in the project by the owners of McGowin Park, LLC, which include Senator Corker, and to replace the loan whose interest was taxable to the lender–Wells Fargo Bank–with a bond whose interest was tax free to the purchaser–also Wells Fargo Bank.

Alabama law requires that sales tax incentive agreements made between private developers and local governments, such as the City of Mobile Project Development Agreement with McGowin Park, LLC and the Mobile County Project Development Agreement with McGowin Park, LLC, must be presented for validation before a Circuit Court in the state. Without a court order validating the agreement, it is not considered legally binding.

Financial experts familiar with the details of the entire McGowin Park retail center transaction now estimate that the sales tax rebate economic incentive package provided to McGowin Park, LLC and related entities–capped in the 2016 revenue bond prospectus (see pages 18 and 19) at $260 million over 20 years–could net Bob Corker over $28 million in profit over the life of the project, not just the minimum $3 million in payments from Alabama taxpayers Breitbart News reported he is set to receive over the twenty years.

June 2017–McGowin Park, LLC sells the developed parts of the project they participated in to an Arizona Real Estate Investment Trust (REIT) in May 2017 for $77.8 million. The company still retains six out parcel sites for sale- free and clear.

Summary–Financial experts familiar with the details of the entire McGowin Park retail center transaction now estimate that McGowin Park LLC $210 million economic incentive package could net Bob Corker over $28 million in profit over the life of the project, not just the minimum $3 million in payments from Alabama taxpayers Breitbart News reported he is set to receive over the twenty years.

In September, Mobile TV station WKRG reported on local reaction to Breitbart’s story on Senator Corker’s investment in McGowin Park retail center “swamp deal” in which he will be paid at least $3 million from Alabama taxpayers.

“Corker is one of the people who benefit from what some criticized as a bad deal for the city of Mobile and Mobile County, that gave major concessions to the Chattanooga-based developers of the shopping center,” WKRG noted.

Local critics of the deal join other critics who say it was not a bad deal for the private investors when they have no risk. The deal, they argue, looks like private gains and public losses, to the benefit of Senator Corker and his fellow investors in McGowin Park, LLC.

COMMENTS

Please let us know if you're having issues with commenting.