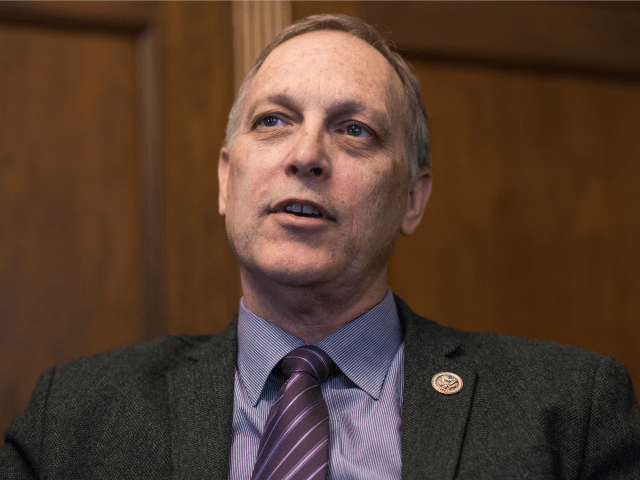

Rep. Andy Biggs (R-AZ), a member of the House Freedom Caucus, wrote a letter to Speaker Paul Ryan and House Ways and Means Committee Chairman Kevin Brady (R-TX) that Republicans should retroactively cut taxes starting on January 1, 2017.

Congressman Biggs wrote, “We should implement all tax rate reductions and other provisions of the Tax Cuts and Jobs Act (H.R. 1) retroactive to January 1, 2017. While I appreciate that filers will see immediate benefits arising from decreased withholding in their paychecks already by January 2018, these same taxpayers will also fail to notice that their respective tax burdens have not decreased. Needless to say, the political fallout for Republicans could be dire.”

Biggs explained, “Delaying the tax cuts may also slow our nation’s economy. Since President Trump took office in January, our nation has seen three consecutive quarters of economic growth in excess of 3 percent. By applying full retroactivity to this tax reform package and returning more hard-earned money back to individuals and small businesses to spend or invest as they see fit, we will be in the best position possible to capitalize on the enormous economic growth of the past few months. And the budget hawks need not even be concerned: history has shown again and again that the stimulus brought by tax relief pays for itself, especially when the overall economy is robust.”

Congressman Biggs suggested that by retroactively cutting taxes effective January 2017, Americans can continue to benefit from the growing economy. Furthermore, Biggs contends that if Republicans fail to retroactively cut taxes, then the average American may fail to realize that their taxes have actually decreased and that could spell disaster for Republicans during the 2018 midterm elections.

The Republican tax, which was unveiled last week, will collapse the seven income tax brackets into four rates starting at 12 percent for incomes below $45,000, 25 percent for $45,000 or higher, 35 percent at $200,000, and keeping the 39.6 percent rates at $500,000. The tax plan will also double the standard deduction for individual and married couples. The plan, also known as the Tax Cuts and Jobs Act, will cut the corporate tax rate for small businesses to 20 percent.

Republican lawmakers remain desperate for a victory ahead of the 2018 midterm elections after Republicans failed on Obamacare repeal.

House Freedom Caucus Chairman Mark Meadows (R-NC) cheered the Republican tax plan. On November 2, Meadows tweeted, “Today is a good day for the American people–#TaxRefom is headed in the right direction. Time to finish the job and get our economy going.”

COMMENTS

Please let us know if you're having issues with commenting.