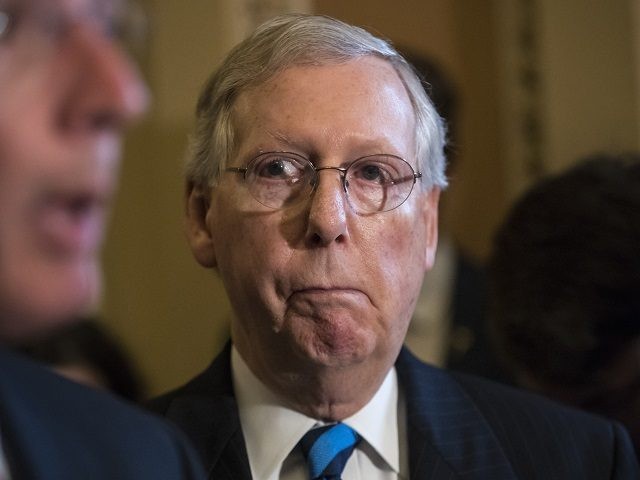

Senate Majority Leader Mitch McConnell is walking back his claim that the middle class would not see tax increases if the GOP-backed tax plan becomes law.

“Nobody in the middle class is going to get a tax increase,” McConnell had said about the plan.

Then on Friday, McConnell told the New York Times that he had “misspoke on that.”

“You can’t guarantee that absolutely no one sees a tax increase, but what we are doing is targeting levels of income and looking at the average in those levels and the average will be tax relief for the average taxpayer in each of those segments,” McConnell told the Times.

Breitbart News reported on Monday that the Senate tax plan delivers the largest tax cuts to middle-class Americans, according to a new report from the nonpartisan Joint Committee on Taxation (JCT).

The average tax rate for a family earning $50,000 to $75,000 would fall from 14.5 percent under current law to 13.6 percent, the Joint Committee on Taxation said in its report on the Senate plan. That is a 6.2 percent tax cut.

The wealthiest Americans get a much smaller tax cut, Breitbart News reported. The average rate for a household earning more than $1 million per year would fall to 31.1 percent from 32.1 percent, only a 2.8 percent reduction.

The JCT report also vindicates President Donald Trump’s claims that truckers would benefit from tax cuts. The average income of all truck drivers is $41,340, according to government statistics. At that income level, the JCT estimates that the average tax rate will fall from around 11 percent to 10.3 percent, a nearly 6.4 percent reduction.

Truckers who work for large fleets, where the average salary is closer to $75,000, would also see big cuts.

Meanwhile, Trump’s Treasury secretary said most middle-income Americans will get a tax break under the Republican plan.

“By simplifying the code, we’re putting everybody on a level playing field,” Steven Mnuchin said on State of the Union on Sunday. “For most people — and, again, it may not be 100 percent, but by far the majority — both the House and Senate version provide middle-income tax relief.”

Mnuchin said that assessment is based on “hundreds if not thousands” of tests the Treasury has run on the bills.

COMMENTS

Please let us know if you're having issues with commenting.