Despite announcing record quarterly sales through the end of 2015, the market valuation of Apple Inc.’s stock is down $254 billion since this summer. The company has now admitted revenue through March will be down by 10-15 percent as the iPhone sales stall.

The grim forecast comes just 90 days after Apple CEO reported that in the September quarter the company achieved 99 percent year-over-year revenue growth in China. He triumphantly told institutional investors later in the day that he anticipated the “Greater China Region,” currently accounting for 24 percent of sales, will become “Apple’s top market in the world.”

But Breitbart News warned in July that the coming end of Chinese economic miracle represented an existential risk to the iPhone’s future prospects. We cautioned in September that with the iPhone 6 stalling, Apple would needs the iPad and TV to save its stock Price. In early January, we indicated that Apple was slashing parts orders by 30 percent.

Just as we expected for the December quarter, Apple recorded an all-time-revenue high of $75.9 billion, sold 74.8 million iPhones, and earned a record $3.28 per share.

But for the first time since Steve Jobs returned to Apple in 1997, the company missed analysts’ expectation on its major products across the board. Apple iPhone sales came in at 74.78 million vs. 75.46 million estimates; iPad sales were 16.12 million vs. 17.93 million estimates; and Mac was 5.3 million vs. 5.8 million estimates.

More ominously, CEO Tim Cook advised on the company’s earnings call that he expects the company’s revenue for the second quarter ending March to fall from $58 billion for the period last year to between $50 and $53 billion. The comment immediately sent the stock plunging.

The size of the disappointment overwhelmed the little bit of good news for Apple that the “other” category, including Apple Watch and Apple TV, actually did better than we expected with sales of $4.35 billion–up 43 percent since the September quarter. It appears that fourth generation Apple TV is starting to get traction with the public now that it has 3,600 apps available.

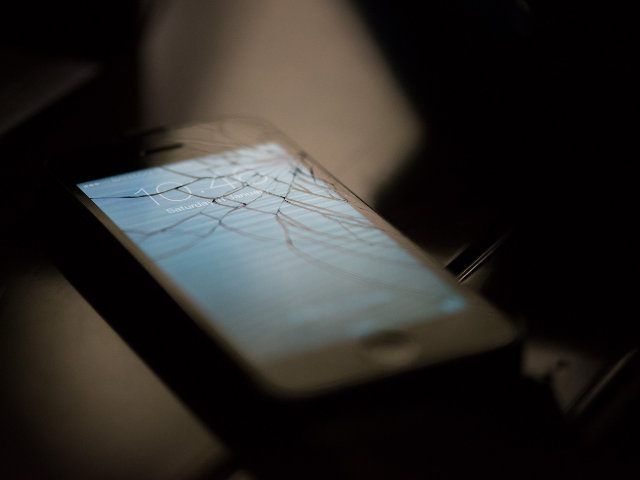

To compound Wall Street’s angst that the Apple faces a diminished future, the company refused to comment overnight about the infuriating new bug in their Safari web browser on iPhones and Mac that causes a screen crash and sends users back to the iOS home page every time users try to launch a new tab in the mobile web browser or try typing into the address bar.

In perhaps the best indication that the iPhone craze has peaked, Reuters reported that in the last month, the number of stores with employees dressed up in imitation Apple Inc. uniforms selling counterfeit iPhones along a street of gadget outlets in the southern China city of Shenzhen has shrunk by a third. The Apple displays have been mostly replaced by stores selling locally-branded phones from Huawei, Xiaomi, Meizu and Oppo.

Breitbart News warned on January 6 that Wall Street traders were shorting Apple at around $105 a share, claiming the company’s stock appeared to be carving out a very dangerous “head and shoulders trading pattern.”

With iPhone sales having peaked, traders are looking for the stock to continue to fall $120 billion in value, to $75 a share.

COMMENTS

Please let us know if you're having issues with commenting.