Tesla stock plunged in after-hours trading Wednesday as the all-electric car maker dropped by over 5 percent following revelations that it spent $622.4 million in the last 90 days in an all-out effort to launch its Model 3 sedan.

Despite a Yahoo Business March 30 average quarterly earnings estimate of a loss of $0.82, or $133 million, by the 17 Wall Street analysts that cover the Silicon Valley icon, Tesla booked a stunning loss of $330.3 million, or $2.04-per-share. That was better than the $283 million, or $2.13-per-share, loss for the same quarter last year, but the company’s shares were trading a third lower at the time.

Breitbart News noted that Tesla, Inc. (TSLA:NASDAQ) became the most valuable U.S. car company in early April with a $52 billion stock market capitalization, after passing both GM and Ford last month on an upgrade from Piper Jaffray brokerage analyst Alexander Potter, who issued a “buy” recommendation on April 10 with price target of $368.

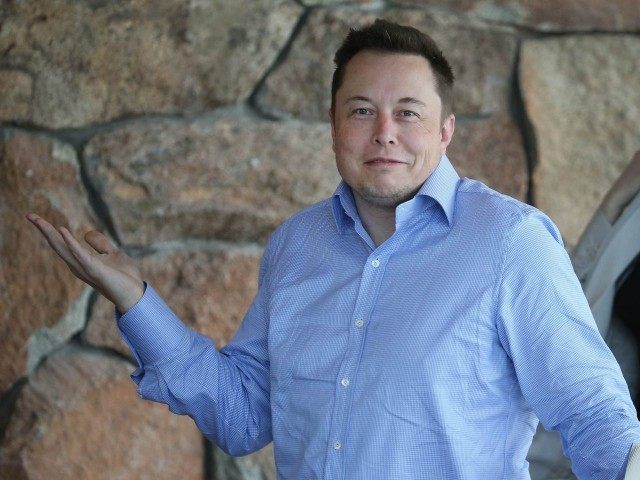

Potter slashed his 2017 annual earnings-per-share estimate from a profit of $0.42 to a loss of $4.83, based on his belief that Tesla had the financial capacity, and CEO Elon Musk had the guts, to go all-in to pay for the tooling and production ramp-up to begin shipping hundreds of thousands of middle-class-friendly Model 3 sedans.

Tesla’s mission statement is “to accelerate the world’s transition to sustainable energy.” The company’s quarterly revenue doubled to $2.7 billion and was slightly better than the $2.61 billion analysts had forecast. The company set a new delivery record of 25,051, up 64 percent from the prior year.

CEO Elon Musk commented that the company had $4 billion in cash in the bank as of March 31. He expects 2017 capital expenditures to be about $2 billion by the time it launches the Model 3 production in the fourth quarter. But analysts had been expecting $2.5 billion in the bank.

With Tesla devouring about $7 million day per, the company’s balance sheet would have been grim by March 31. But in what has to be extraordinary timing, China’s Tencent Holdings Limited bought 5 percent of Tesla stock for $1.7 billion on March 28.

COMMENTS

Please let us know if you're having issues with commenting.