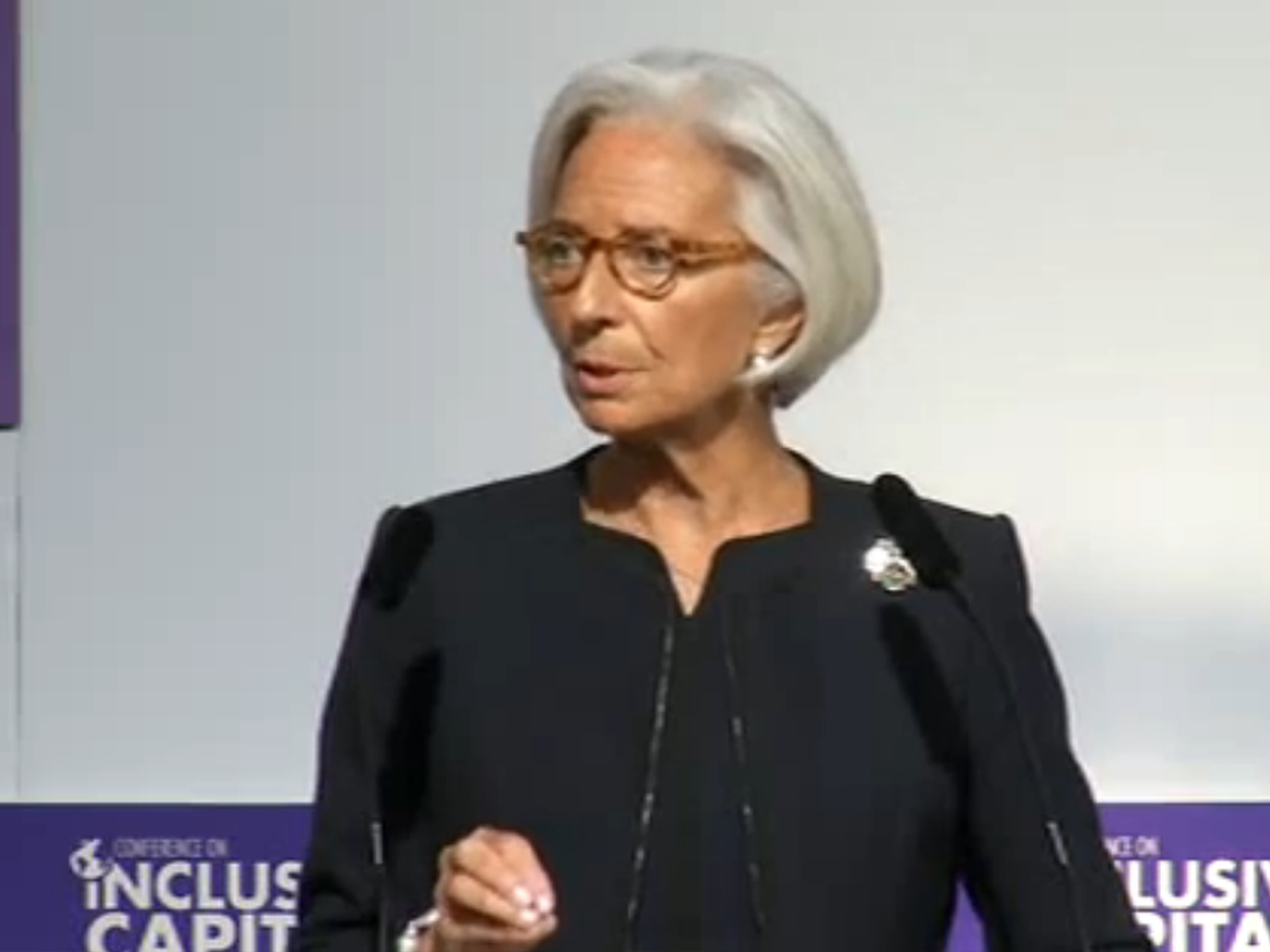

Christine Lagarde, managing director of the International Monetary Fund (IMF), told a conference in London today that progress in the reform of banking regulation was still too slow and blamed “fierce industry pushback.”

“The [global financial] crisis has prompted a major course correction, with the understanding that the true role of the financial sector is to serve, not to rule, the economy,” she said. “The good news is that the international community has made progress on the reform agenda.”

“The bad news is that progress is still too slow, and the finish line is still too far off. Some of this arises from the sheer complexity of the task at hand. Yet, we must acknowledge that it also stems from fierce industry pushback, and from the fatigue that is bound to set in at this point in a long race.”

Among other speakers at the conference on “Inclusive Capitalism” were the Prince of Wales and former US President Bill Clinton.

Lagarde said: “Some of the greatest problems, still outstanding today, lay with the so-called too-big-to-fail firms.”

“The size and complexity of the megabanks meant that, in some ways, they could hold policymakers to ransom. The implicit subsidy they derived from being too-big-too-fail came from their ability to borrow more cheaply than smaller banks–magnifying risk and undercutting competition.”

“A big gap [in reform] is that the too-big-to-fail problem has not yet been solved. A recent study by IMF staff shows that these banks are still major sources of systemic risk. Their implicit subsidy is still going strongly, amounting to about $70 billion in the US, and up to $300 billion in the euro area.”

“So clearly, ending too-big-to-fail must be a priority. That means tougher regulation and tighter supervision.”

She was confident that new capital surcharges for systemic banks can work. Increasing the capital ratio on these banks by 2.5 per cent “can reduce the systemic risk of a trillion dollar bank by a quarter. This is a big deal.”

However, “rules are only as good as their implementation…people who want to skirt the rules will always find creative ways of doing so.” The financial industry “still prizes short-term profit over long-term prudence, today’s bonus over tomorrow’s relationship.”

“Some prominent firms have even been mired in scandals that violate the most basic ethical norms –LIBOR and foreign exchange rigging, money laundering, illegal foreclosure.”

COMMENTS

Please let us know if you're having issues with commenting.