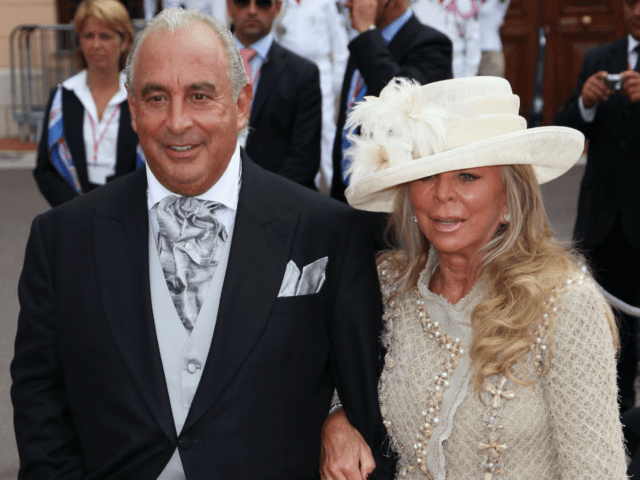

LONDON (Reuters) – British lawmakers have asked retail billionaire Philip Green and his wife Tina to appear before them within the next few weeks to help with inquiries into the failure of department store chain BHS and its pension liabilities.

BHS went into administration on Monday, with a 571 million pound deficit in its employee pension fund, barely a year after Green sold it for one pound to a group of little known investors called Retail Acquisitions.

Green bought BHS for 200 million pounds in 2000, and when it was profitable it paid out several hundreds of millions of pounds of dividends to his family.

“The spine of our inquiry is looking at how and where money went out of the company, to whom it went, and how this may have disadvantaged the pensioners,” Labour Party lawmaker Frank Field said on Sunday. Field chairs parliament’s cross-party Work and Pensions Committee.

The inquiry will also ask the trustees of BHS’s pension fund and Retail Acquisitions investor Dominic Chappell to appear.

The committee launched an investigation into the impact of BHS’s failure on the industry-funded Pension Protection Fund (PPF) on Tuesday.

The day before, Britain’s Pensions Regulator said it was investigating the BHS pension scheme to determine whether the retailer’s previous owners sought to avoid their obligations and should be pursued for contributions.

One Labour lawmaker, John Mann, has said Green should be stripped of the knighthood he was awarded in 2006 if he does not repay the dividends he took out of BHS.

COMMENTS

Please let us know if you're having issues with commenting.