(AFP) – Treasury and currency markets were roiled Tuesday by signs that US and European central banks may be closer to monetary tightening measures than previously thought.

Yields on US treasuries rose sharply following comments from two Federal Reserve regional presidents who support an imminent interest-rate hike.

Yields on government bonds in Europe engineered a similar move higher after Bloomberg News reported that the European Central Bank would probably taper its bond purchases before it ends its quantitative easing stimulus.

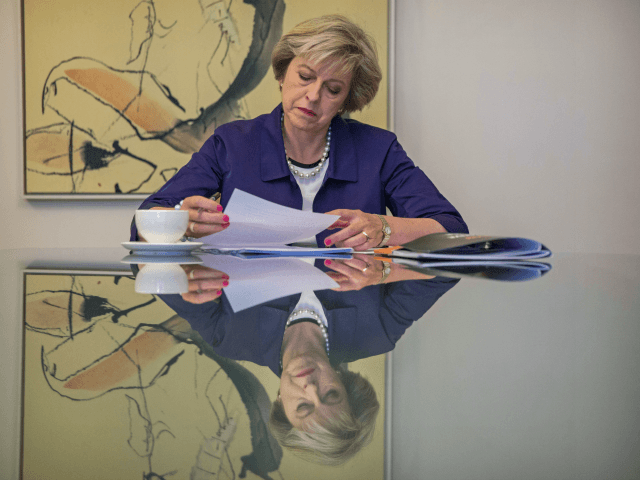

The US and eurozone currencies rose sharply on the British pound, which hit a 31-year low against the dollar after British Prime Minister Theresa May set a timeframe for the British exit from European Union.

“The euro had a big move higher at the end of the morning after a Bloomberg story about the ECB,” said Vassili Serebriakov, a forex analyst at Credit Agricole.

“The dollar certainly popped a bit,” said Art Hogan, chief market strategist at Wunderlich Securities.

US stocks finished lower, with the S&P 500 falling 0.5 percent behind weakness in commodities-linked stocks.

The stronger dollar weighed heavily on dollar-linked commodities, including oil, copper and gold, which fell below $1,300 an ounce for the first time since June.

Dow members ExxonMobil and Chevron both lost about one percent, while Barrick Gold and Newmont Mining plunged 11.2 percent and 10.1 percent, respectively.

Earlier equity markets in London, Paris and Frankfurt all gained at least one percent, while bourses in Tokyo and Hong Kong rose by more modest margins.

In the bond market, the yield on the 10-year US Treasury rose to 1.687 percent from 1.625 percent Monday night.

The moves followed remarks from Cleveland Fed president Loretta Mester, who said she expects a strong case for a rate hike in November. They were followed by similar comments from Richmond Fed president Jeffrey Lacker.

Yields on the French government’s 10-year bond rose to 0.266 percent from 0.227 percent, while Spain’s rose to 0.977 percent from 0.936 percent. In Germany, the yield on the 10-year was -0.054 percent compared with -0.093 percent.

That came after Bloomberg, citing unnamed ECB officials, reported that there was an “informal consensus” that the ECB should gradually scale back its bond-buying program in steps of 10 billion euros.

– Key figures around 2100 GMT –

New York – DOW: DOWN 0.5 percent at 18,168.45 (close)

New York – S&P: DOWN 0.5 percent at 2,150.49 (close)

New York – Nasdaq: DOWN 0.2 percent at 5,289.66 (close)

London – FTSE 100: UP 1.3 percent at 7,074.34 (close)

Frankfurt – DAX 30: UP 1.0 percent at 10,619.61 (close)

Paris – CAC 40: UP 1.1 percent at 4,503.09 (close)

EURO STOXX 50: UP 1.2 percent at 3,034.53 (close)

Tokyo – Nikkei 225: UP 0.8 percent at 16,735.65 (close)

Hong Kong – Hang Seng: UP 0.5 percent at 23,689.44 (close)

Shanghai – Composite: Closed for holiday

Pound/dollar: DOWN at $1.2724 from $1.2841 Monday

Euro/pound: UP at 88.05 pence from 87.30 pence

Euro/dollar: DOWN at $1.1203 from $1.1211

Dollar/yen: UP at 102.88 yen from 101.63 yen

Oil – Brent North Sea (December delivery): DOWN 2 cents at $50.87/barrel

Oil – West Texas Intermediate (November): DOWN 12 cents at $48.69/barrel

COMMENTS

Please let us know if you're having issues with commenting.