The chairman of a top wealth management firm has said in 10-15 years’ time Britain leaving the European Union will be seen as a “positive turning point in our political and economic history” for both the United Kingdom and the continental power bloc, calling the difficult process of leaving: “Short-term pain for long-term gain.”

In remarks sent to clients before the new year, banking heir and one of Britain’s richest men Jamie Hambro said he was optimistic about 2018 and the Brexit process, noting that while the European Union is presently playing hard-ball with Britain over a trade deal, it was the continent which had the greater incentive to make sure one was signed, as “a no-deal outcome would be possibly more disastrous for the EU than for GB”.

Full, clean Brexit… Bring it on! https://t.co/KBqJK4YKpg

— Breitbart London (@BreitbartLondon) November 26, 2017

Stating that “our departure will force long overdue reforms on mainland Europe and here too, which in the long run will be to both sides’ benefit”, Hambro pointed out that the UK imports £82 billion more than it exports to Europe each year. In his opinion, collectively the EU had more to lose from a trade no-deal — comments which strengthen the case for Britain threatening to walk away from talks if they do not improve.

A significant part of the EU’s budget comes from the UK’s contributions, but the departure of the UK would not just cause financial problems — it could also upset the balance of power in the bloc.

No wonder they want to extract a massive Brexit bill… https://t.co/3RWsTHTsv4

— Breitbart London (@BreitbartLondon) November 23, 2017

Hambro wrote: “Many sensible people in Europe are very concerned about the balance of power after the UK’s departure. The UK is the fifth-largest economy in the world and the second-largest in the EU. Many in Europe see Britain as a stabilising force between France and Germany. They worry about what will happen if Britain no longer has a seat at the table.”

Regardless, Hambro called himself optimistic. “When we look back in 10 or 15 years’ time, I believe we will see it as a positive turning point in our political and economic history. Short-term pain for long-term gain,” said the wealth manager.

Brexit Boom: British Manufacturing at 30-Year High While German Business Confidence Falls https://t.co/JZ02jfic1D

— Breitbart London (@BreitbartLondon) December 19, 2017

Hambro’s predictions come amidst an avalanche of economic good news for Brexit Britain. On Friday, London was revealed to be the top city in Europe for technology investment in 2017. The rate of growth for technology companies in British companies was so pronounced, the amount of investment cash pouring in was higher than the next seven cities combined — including Berlin and Paris.

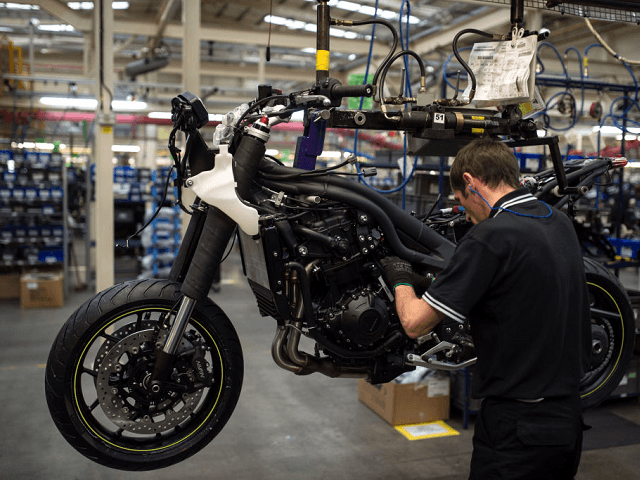

In December, British manufacturing hit a new 30-year high, with 14 out of 17 industrial sectors reporting orders were higher than average.

COMMENTS

Please let us know if you're having issues with commenting.