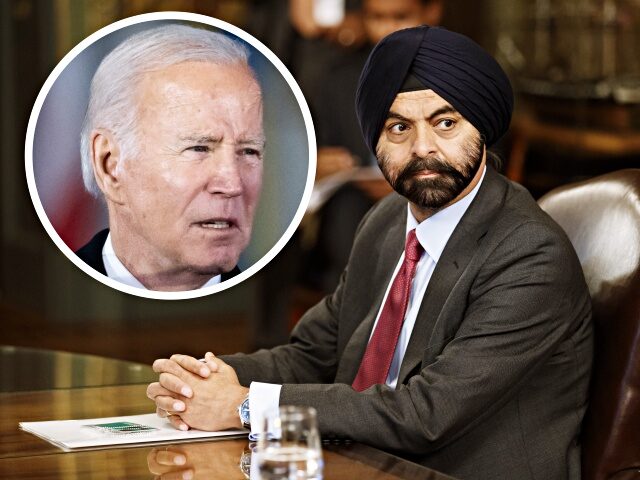

President Joe Biden has nominated former Mastercard CEO Ajay Banga to lead the World Bank — the first time a credit card executive has been chosen for the spot. The nomination comes as Biden pitches himself as a defender of American consumers and an enemy of the banking industry.

“Ajay is uniquely equipped to lead the World Bank at this critical moment in history,” Biden said in a statement on Thursday. “… he also has critical experience mobilizing public-private resources to tackle the most urgent challenges of our time, including climate change.”

Banga’s nomination comes less than a month after Biden pitched himself to the American public as an economic populist defending consumers against the often-predatory banking industry in his State of the Union address.

“We’ve reduced exorbitant bank overdraft fees, saving consumers more than $1 billion a year. We’re cutting credit card late fees by 75 percent, from $30 to $8,” Biden said:

Junk fees may not matter to the very wealthy, but they matter to most folks in homes like the one I grew up in. They add up to hundreds of dollars a month. They make it harder for you to pay the bills or afford that family trip. [Emphasis added]

I know how unfair it feels when a company overcharges you and gets away with it. Not anymore. We’ve written a bill to stop all that. It’s called the Junk Fee Prevention Act. [Emphasis added]

Firms like the Consumer Bankers Association, which lobbies lawmakers on behalf of Mastercard, have tried to pour cold water on the Consumer Financial Protection Bureau’s rule that would cap late fees at $8.

“This announcement is just the latest example of the Bureau seeking to advance a political agenda that will harm, rather than help, the very people they are responsible for serving,” an executive with the Consumer Bankers Association said following the proposed rule.

Credit card companies like Mastercard and Visa are estimated to charge Americans more than $30 million every day in late fees. Annually, these companies rake in $12 billion from late fees alone.

While Banga was head of Mastercard, the federal government concluded that the company had made a number of “preventable failures” where customers were unable to use their prepaid debit cards to make payments on bills or get their paychecks. Mastercard, along with UniRush, was ordered to pay $10 million in restitution and fined $3 million.

Biden’s rebrand as an enemy of the banking industry comes as he has been accused for decades of doing the bidding of the nation’s biggest credit card companies who often served as major donors to his political campaigns.

In August 2019, Breitbart News reported how Biden sided with MBNA, a top donor and later acquired by Bank of America, to pass legislation that tightened financial regulations making bankruptcy more difficult. The legislation, eventually signed into law, is widely seen to have benefited credit card companies at the expense of consumers.

MBNA, at the time, was the nation’s largest issuer of credit cards and became Biden’s biggest donor throughout his nearly 40-year political career. From 1996 to 2006, MBNA employees donated more than $212,000.

Sen. Elizabeth Warren (D-MA), long considered one of the Senate’s leading consumer advocates, blasted Biden in early 2019 for his relationship with credit card companies.

“At a time when the biggest financial institutions in this country were trying to put the squeeze on millions of hardworking families,” Warren said of the 2005 bankruptcy legislation. “Joe Biden was on the side of the credit card companies.”

Biden’s son, Hunter Biden, was being paid at least half a million dollars by MBNA as a consultant at the time the then-Delaware Senator was promoting the bankruptcy legislation that had MBNA’s backing.

Hunter Biden worked at MBNA as an executive but left the company in 2001, which is when his sweetheart consultant gig with the firm began. After the bankruptcy legislation was signed into law in 2005, Hunter Biden’s contract with MBNA ended.

John Binder is a reporter for Breitbart News. Email him at jbinder@breitbart.com. Follow him on Twitter here.

COMMENTS

Please let us know if you're having issues with commenting.