Republicans have found healthcare reform to be a difficult task – and have put replacing Obamacare on the back burner – but the President and the GOP-controlled Congress must demonstrate to the American people that they can turn campaign promises into legislation. What gives me confidence they will meet this challenge is the desire of American voters to overturn many of President Barack Obama’s failed policies and resilient Republican leadership at both ends of Pennsylvania Avenue.

Maybe the best chance Republicans have to enact meaningful legislation is to focus on issues that unite the Party. Since the Reagan Revolution, one area that has consistently united Republicans is a commitment to liberate the American people from the burden of hefty taxation and a desire to allow free markets – not tax policy – to drive the American economy.

While much of the focus on tax reform has been on the corporate side, another problematic area has that has gotten far less attention is the use of tax incentives to support the “green” energy business. In my opinion, there are no worse examples of tax policy then these incentives because they adulterate the free market and often direct massive profits to the wealthy and politically connected.

One tax policy that is ripe for fixing is the Solar Investment Tax Credit (ITC). The ITC currently allows homeowners and businesses to deduct a portion of the cost of installation of solar panels until 2021. In 2015, Congress approved this tax cut in a deal with the Obama White House. What bothers me is that the implementation of the ITC means that Americans who do not choose to put solar panels on their rooftops have to subsidize those that do. Also, it turns out that taxpayers are also subsidizing some of the wealthiest people on the planet.

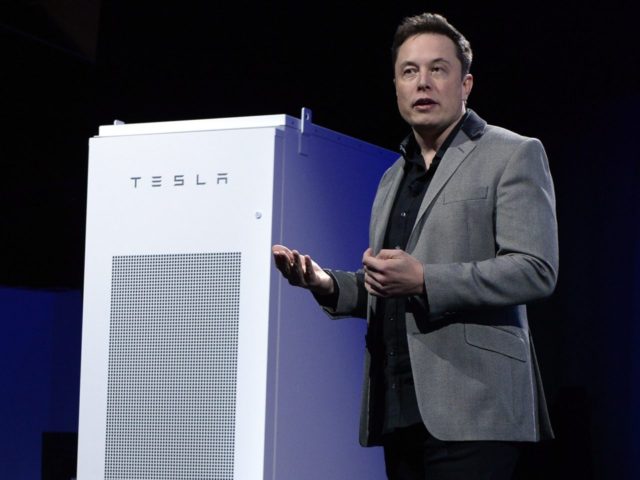

Consider Elon Musk, the owner of SolarCity – which recently merged into his other company, Tesla – is the largest provider of residential solar panels in the nation. Musk is the 87th richest man in the world and someone worth admiring for his financial successes that have created thousands of jobs. However, I am not supportive of tax policies like the ITC that put more money in the pockets of billionaires.

Another government incentive that Elon Musk benefits from is the Zero Emissions Vehicle (ZEV) tax credit. This policy allows people who purchase electronic/plug in vehicles to deduct $7,500 from their federal taxes. This credit phases out after any manufacturer sells 20,000 qualified vehicles. The only automaker even coming close to this 20,000 threshold is Tesla and Elon Musk.

Now, Musk has publicly said he does not support the ZEV, stating on a recent earnings call: “the reality actually is that, if electric vehicle incentives went away tomorrow, Tesla’s competitive position would improve.” If Musk can’t have the tax credit much longer, he doesn’t want his competitors to have it either. So Musk uses the tax credit to get a leg up and then wants to eliminate it to punish his competitors when he can’t get it anymore? Oddly enough, the only profitable quarter Tesla has seen in a long time was selling $139 million in pollution tax credits to other automakers.

To me, the lesson of Elon Musk – who, according to a report by the Los Angeles Times in May of 2015, has been the beneficiary of almost $5 billion dollars in government subsidies – is that these green tax credits allow businesses to subvert the free-market to their own advantage. I don’t blame Musk, nor is this piece meant to be a critique of him. The business world is a tough place, and competitors need to seek out any advantage they can get. I just don’t think the American tax code should be a tool used by corporate titans to gain leverage or advantage over each other. Success should be determined by the quality and price of their products and services in the free market.

More importantly, if Congress eliminates these “green” energy tax credits, we pay down the debt and put badly needed funds into education, infrastructure, and other important priorities that help to improve the lives of regular people and allow them to pursue the American dream. Elon Musk has said multiple times in recent months that he doesn’t want government subsidies. The Trump Administration and the Congress should give him his wish in the upcoming tax reform debate.

Steele served as Lieutenant Governor of Maryland from 2003 – 2007, and as the Chairman of the Republican National Committee from 2009 – 2011

COMMENTS

Please let us know if you're having issues with commenting.