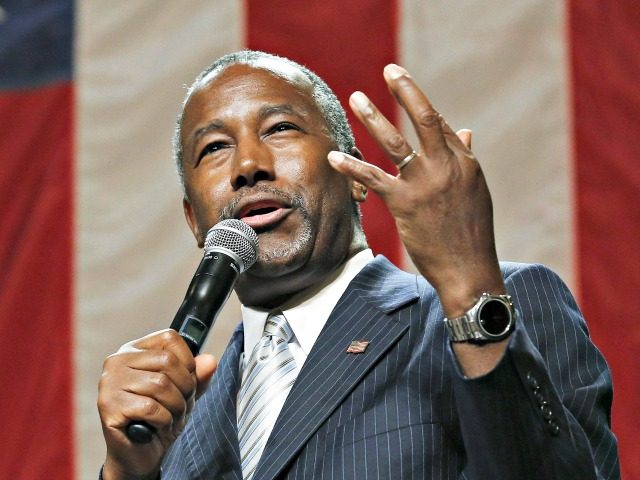

The Senate Committee on Banking, Housing, and Urban Affairs will meet in executive session Tuesday morning “to vote on the nomination of Dr. Benjamin Carson, Secretary-Designate, U.S. Department of Housing and Urban Development.”

It has been eleven days since Carson sailed through his confirmation hearings before the committee on January 12.

Republicans outnumber Democrats on the committee twelve to eleven. Several of the Democrats on the committee are likely to vote to confirm Carson, while others, most notably Sen. Elizabeth Warren (D-MA), used Carson’s confirmation hearings as an opportunity to grandstand against President Trump.

Both Sen. Jon Tester (D-MT) and Sen. Heidi Heitkamp (D-ND) questioned Carson in a friendly manner at the hearing. Tester and Heitkamp are among a number of Democrat senators up for re-election in 2018 in states won by President Trump in the 2016 general election.

“There’s a lot of people who scratch their head when you were nominated. What does he know about housing?” Heitkamp told Carson at his committee hearing, adding that “I thought about you as a neurosurgeon. You know, you just might be the right guy if you focus on why people are in poverty.”

“You talked about a holistic view, which I agree with,” Tester told him.

On the day of the hearing, CNN’s Jake Tapper tweeted “@SenatorTester says he plans on supporting @RealBenCarson for HUD Secy.”

In the event the Senate Committee on Banking, Housing and Urban Affairs votes to confirm Dr. Carson as Secretary of Housing and Urban Development on Tuesday, which appears likely, the full Senate is likely to confirm him with ease.

Meanwhile, one of President Trump’s first executive orders signed within hours of his swearing in on Friday rescinded a small reduction in mortgage insurance premium rates that was announced on January 9 by former HUD Secretary Julian Castro as he was headed out the door. The reduction was scheduled to become effective on January 27.

The last minute timing of the reduction announced by former Secretary of HUD Castro on January 9 was “surprising,” Dr. Carson told the Senate Committee on Banking, Housing, and Urban Development at his confirmation hearing on January 12.

The mortgage industry press was also caught off guard by the rate reduction, and reported on the political difficulties created by its last minute nature.

“Within minutes of the Federal Housing Administration’s announcement [on January 9] that it was cutting annual mortgage insurance premiums, observers were already wondering whether the incoming Trump administration would put a stop to the plan,” The National Mortgage News reported when Castro announced the reduction:

The FHA said it would cut the premium by 25 basis points, down to 60 basis points, starting on Jan. 27, a week after President-elect Donald Trump is scheduled to take office. That gives Trump and his team a limited window to delay or scrap the cut.

Observers said it will likely be a close call, but there are reasons why Trump may want to allow the premium cut to go through.

As it turns out, those observers were wrong. One reason for Trump’s decision was the failure of outgoing Secretary Castro to discuss the proposed cut with his proposed successor, Dr. Carson.

“Carson was not consulted about HUD’s decision until it was made public on Monday morning because Castro said the move was “market sensitive,” the National Mortgage News reported:

Jaret Seiberg, an analyst with Cowen Washington Research Group, said stopping the premium cut could be a political liability for the new president.

“The Trump administration would be accused on day one of raising mortgage costs for average Americans if it reverses the FHA move,” he wrote to clients. “In addition, Trump’s career has been real estate. It would seem out of character for him to be aggressively negative on real estate in his first week in office.”

Trump’s executive order was seen by some in the mortgage and real estate industry as a needed step to safeguard the fiscal stability of the Federal Housing Administration’s Mutual Mortgage Insurance Fund, despite the perceived short term “political liability” created by the last minute move by Castro.

“If they stop a fee that hasn’t been implemented, then it’s no-harm, no-foul,” David Stevens, who now heads the Mortgage Bankers Association and is a former Obama administration official in the Federal Housing Administration, told the Los Angeles Times.

“Today was really the last day to do it in order not to disrupt a whole lot of mortgage closings,” Stevens added.

“The order will affect millions of homeowners with an FHA-backed mortgage. FHA backs about 16% of the country’s new mortgages. FHA loans offer easier credit requirements, lower down payments and smaller closing costs, attractive perks for lower-income home buyers,” the Times reported.

In November, more than two months before former Secretary of HUD Castro announced his decision to reduce mortgage insurance premiums, Housing Wire reported that “Ed Golding, the Department of Housing and Urban Development’s principal deputy assistant secretary for housing . . . [said] that the FHA is not considering cutting its mortgage insurance premiums, despite the FHA’s flagship fund showing growth for the fourth year in a row.”

But in November the Mortgage Business Association’s Stevens opposed the cut on grounds of fiscal responsibility.

Responding to a report from the FHA released that month, the agency’s Mutual Mortgage Insurance Fund “continued its growth of the last few years,” Stevens noted, adding that “[a]n important subtext to this report is the continued volatility in the HECM book of business, which this year turned negative, dragging down the overall value of the MMIF.”

“An HECM loan is the Federal Housing Administration’s reverse mortgage program,” David Chee, a reverse mortgage specialist, writes:

An HECM reverse mortgage enables the homeowner to withdraw some of the equity in their home with limitations or to withdraw a single disbursement lump-sum payment at the time of mortgage closing. The HECM loan may also be used to purchase a primary residence.

“Today’s positive report on the state of FHA will most likely renew calls for a reduction in FHA fees. It is a worthwhile conversation, but must caution that today’s report again shows the vulnerability to the reserve fund posed by the volatility in the HECM book,” Stevens told Housing Wire at the time, adding:

Given the HECM volatility and recent concerns about liquidity in the Ginnie Mae market, these discussions should occur with an eye toward long term stability for the FHA program. We look forward to working with FHA to evaluate options that balance the need to ensure affordability for FHA borrowers, maintain actuarial soundness, and preserve stability in the Ginnie Mae mortgage backed security and mortgage servicing rights markets.

At the time of the November report, the National Association of Realtors (NAR) supported such a cut, as did the Community Home Lenders Association (CHLA).

“FHA’s actuarial report shows that the fund has indisputably found its footing,” NAR President William Brown told Housing Wire.

“The Community Home Lenders Association commends FHA for its solid financial results as demonstrated in its 2016 Actuarial Report – and renews its call made in a letter last month for a further premium cut, to improve mortgage access to credit,” the CHLA’s executive director Scott Olson told Housing Wire.

The NAR criticized Trump’s executive order last week, as did a number of Democrats.

But the CHLA left the door open for further review by Carson after his likely confirmation as Secretary of HUD.

“Based on the prior administration’s lack of communication on the FHA premium reduction, we believe the decision to review such action prior to implementation is prudent,” CHLA’s Olson told Politico.

“We are confident the review will support a premium cut,” Olson added.

COMMENTS

Please let us know if you're having issues with commenting.