It’s official. The Federal Reserve has looked at the economic data and flipped out. Whatever rhetoric the Obama campaign is peddling about the economy improving isn’t being bought by the Fed governors in charge of America’s monetary policy. Their prescription? They want us to borrow and spend more and, perhaps, save a lot less. Their moves will help the balance sheets of Wall Street banks and investment houses, but do little to arrest the problems in the economy.

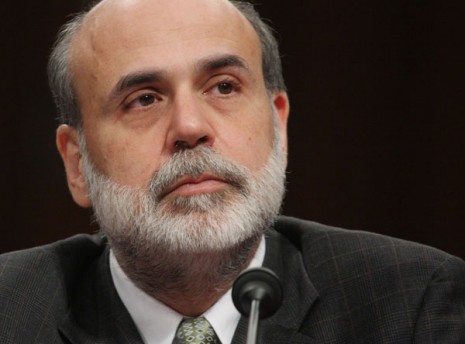

Yesterday, Fed Chairman Ben Bernanke announced the long-anticipated next round of monetary stimulus. Dubbed QE3 (it’s the third round of “quantitative easing” in three years), the Fed committed itself to a zero-interest rate target through at least 2015 and announced that it would spend around $40 billion a month buying up assets, chiefly mortgage-backed securities.

The move is clearly targeted at bringing down long-term interest rates, which are already at historic lows. It is also designed to lower mortgage interest rates, presumably to spur a spike in home buying. Mortgage rates are already under 4%, so it’s unlikely a further drop at the margin will spark more demand for houses. It may, however, support a new round of mortgage refinancing, which the Fed hopes consumers use to increase their spending. The Fed’s big bet is that consumers and businesses will borrow more money and spend it, fueling a hiring spree that will bring down unemployment.

Unsurprisingly, the stock market surged on the Fed announcement. The site, BusinessInsider, which is the chief stock market-cheerleader, had heart palpitations. Even stocks which had previously announced bad earnings guidance rose. Never has the tune between the stock market and the actual real market been more discordant. Stocks will do well because there is almost literally no where else to go to get any kind of real return on your money.

The Fed move will be a big win for Wall Street banks, who will get to unload $40 billion a month in risky assets. They will also get access to essentially free money from the Fed for another three years. The Fed obviously hopes that they will use this windfall to lend out more money. But the banks have enjoyed free money for about three years already. And, we’ve already had two rounds of “quantitative easing” with very little effect.

Here’s the thing. Corporations are sitting on huge piles of cash. Even banks have over $1 trillion in “excess reserves” parked at the Fed. They have plenty of money to make loans. And, corporations also have plenty of money. There isn’t a lack of capital to make investments. There is a lack of will to make investments. There is simply no demand for more debt. And, that is directly attributable to the confused signals coming out of the Obama Administration.

Obama is promising tax hikes if he is reelected. He is also promising a lot more government spending. He is promising a full implementation of ObamaCare, whose true costs are unknown. He is promising a greater level of regulation. This uncertainty has spooked investors and entrepreneurs who are sitting on cash, uncertain of how to invest.

The Fed’s move will boost the stock market and pad the bottom-lines of Wall Street banks. But, it won’t trickle down to Main Street. Americans, facing bleak, long-term economic insecurity, aren’t going to jack up debt to fuel more spending. Businesses aren’t going to ramp up investment until they have a handle on their future costs. The dollar will go down, gold, energy and commodity prices will move up.

But, what the Fed move really tells us is that Obama’s economic policies aren’t working. In fact, they are the opposite of not working. They are working against economic recovery. The Fed is trying to counter-balance that, but it won’t work. The only thing that will work is a change in leadership come November. That is in your hands.

COMMENTS

Please let us know if you're having issues with commenting.