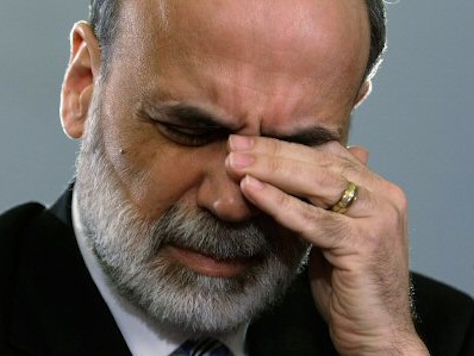

In a dramatic sign that the American economy is being largely propelled by Federal Reserve pumping of the dollar, the Dow Jones Industrial Average sold off 206 points on indications by Fed Chair Ben Bernanke that by the end of 2013, the Fed could begin reining in quantitative easing. While Bernanke maintained that interest rate hikes were “far in the future,” he did indicate that the Fed’s continuous and massive bond-buying spree could taper off if the economy improves.

In a less-noticed development, Bernanke also said that the Fed would continue buying mortage-backed securities – the same type of securities whose precipitously dropping value drove the economy off a cliff in 2008. Now, the taxpayers will subsidize those mortgages again, creating a real estate bubble. “While participants continue to think that in the long run the Federal Reserve portfolio should consist predominantly of Treasury securities, a strong majority now expects that the committee will not sell agency mortgage-backed securities during the process of normalizing monetary policy,” said Bernanke.

Should the Fed rein in its bond-buying spree, interest rates will likely rise, since the easy money policies of the Fed enable banks to lend at lower rates. But the Fed also indicated that while it might slow down its buying of bonds to spur lending, the government should continue to spend lots of money, lest so-called austerity measures lead to “restraining economic growth.” If the Fed does not power that spending through buying of government bonds and continued inflation of the currency, more taxation or borrowing from foreign countries would be necessary.

The Fed now controls America’s fiscal destiny. And it has apparently run out of tricks in its bag.

Ben Shapiro is Editor-At-Large of Breitbart News and author of the New York Times bestseller “Bullies: How the Left’s Culture of Fear and Intimidation Silences America” (Threshold Editions, January 8, 2013).

COMMENTS

Please let us know if you're having issues with commenting.