As Jack Kemp famously said, “”It is not enough to be against something; you have to tell people what you are for.”

Last week I wrote a long analysis on Zero Hedge asking a simple question: Is the Housing Sector a Drag on the US Economy? The reason the answer is “yes” is that a disturbing number of Americans are still living in homes that are worth less than the mortgage debt they carry. This situation is a not-so-hidden time bomb lurking inside the chest cavity of the US economy. If you’ve seen the movie “Aliens?” then you get the idea.

The key question I want the readers of Breitbart to consider is whether we have seen the peak in home prices and how this fact, added to the other acts of idiocy in Washington, are combining to drag down our collective fortunes. Despite what the economists that the Fed want you to believe, the low interest rate experiment of Ben Bernanke and now Chairman Janet Yellen has not had much effect on the structural problems in the housing sector and American consumers. The chief beneficiaries of low interest rates have been big banks, private debtors and the US Treasury.

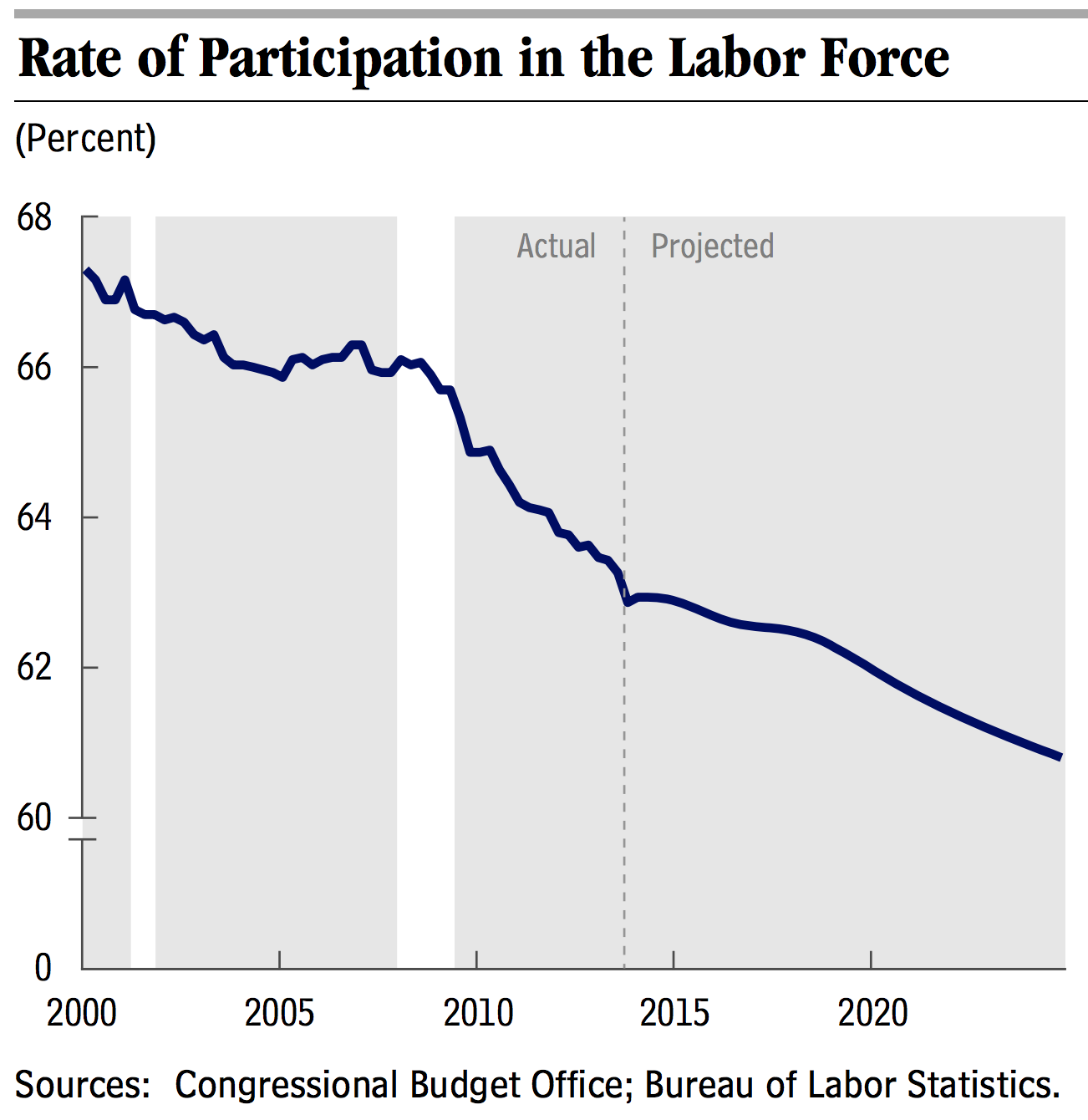

Add to problems in housing the regulatory nightmares called Dodd-Frank and the Affordable Care Act and you have a perfect storm bearing down on the US economy that ought to hit about the time of the mid-term elections. The Congressional Budget Office on Tuesday said that the Affordable Care Act will contribute to the equivalent of 2 million workers out of the labor market by 2017, as employees work fewer hours or decide to drop out of the labor force entirely, Business Insider Reports.

Keep in mind that the only reason that we have seen an improvement in the unemployment rate since the start of the subprime financial implosion is that millions of Americans have left the workforce. Incredibly, After the CBO review came out, White House Press Secretary Jay Carney published a statement in which he declared, remarkably, that it’s a good thing that millions of Americans may drop out of the work force:

Over the longer run, CBO finds that because of this law, individuals will be empowered to make choices about their own lives and livelihoods, like retiring on time rather than working into their elderly years or choosing to spend more time with their families. At the beginning of this year, we noted that as part of this new day in health care, Americans would no longer be trapped in a job just to provide coverage for their families, and would have the opportunity to pursue their dreams.

With the Democrats celebrating a shrinking economy, and with it lower consumer activity and even GDP, you would think that conservatives are poised to regain control over the levels of power in Washington. But here’s the big question: Are the Republicans and conservatives more generally smart enough to take advantage of this opportunity to win back control of the US Senate and eventually the White House? Maybe.

My suspicion is that things are going to need to get a lot worse in terms of home prices, employment and the economy before conservatives get angry enough to take the offensive. Speaking as a former staffer for Jack Kemp (R-NY), conservatives need to take a couple of pages from the Supply Side playbook that helped Ronald Reagan win two terms in office.

First, conservatives should focus on lower taxes and lower federal spending to help get the private sector growing faster. Second, conservatives should help Americans understand that big federal deficits and the low interest rates maintained by the Federal Open Market Committee to facilitate the US Treasury’s debt addiction are killing working people via inflation. Back in 2011, Rep Paul Ryan spoke about a pro-growth agenda and our friend Kemp:

My mentor Jack Kemp was not just another political leader or public official. His impact on the nation’s prosperity and well-being was out of all proportion to the positions he held in government and all the more astonishing for his never having attained the Presidency to which he aspired. There are two ideas in particular about which Jack was an impassioned advocate: pro-growth tax cuts, and sound and honest money.

The first idea was to establish a national fiscal policy based on a broad-based reduction in tax rates in order to create incentives for business and job creation in a slow economy. For years he was a voice in the congressional wilderness, tirelessly pitching his deep income tax cut proposal to uncomprehending colleagues. It is easy to forget that Jack’s “supply side” gospel was met with the ridicule and scorn of conventional experts who lacked his economic imagination. They could not grasp how lowering tax rates on individuals would increase incentives and boost economic activity.

In a sense Jack was prophesying to an audience of one: the comprehending, imaginative, and unconventional Ronald Reagan. The Republican candidate for President in 1980 was convinced that Kemp was right. He saw that the policy of increasing after-tax rewards for entrepreneurship and job expansion could be a key factor in reviving a stagnant economy. President Reagan first carried the case for across-the-board tax cuts to the American people in the election, and then to Congress to enact what became known simply as Kemp-Roth. The long economic expansion that began soon afterward confounded Jack’s critics and reduced opponents to stunned or sullen silence. Today supply-side fiscal policy is still considered a reasonable approach to the problems of stagnant economies.

Kemp also understood that sound and stable money was an important precondition for sustainable, long-run growth. Jack believed that since President Nixon ended the Bretton Woods international monetary arrangement which had linked the dollar to the world gold price, the Fed’s experimentation with fiat currency had resulted in periodic bouts of inflation and deflation, creating an unnecessary barrier to long term expansion of the national economy and international trade.

The path to prosperity and growth for all Americans is clear: lower taxes and sound money. Do Republicans have the courage to make that case to the American people?

COMMENTS

Please let us know if you're having issues with commenting.