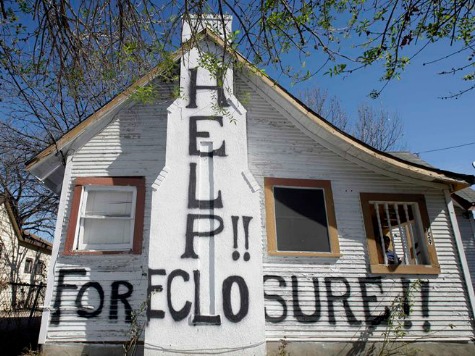

As the cost of living soars, jobs are lost, retirement is put off until later ages, and elder Americans lose their expected retirement benefits, they are increasingly turning to expense sharing with friends or taking in borders and roommates to make ends meet.

A report by CNBC reports that middle-class seniors are finding their golden years laden with considerably less gold than they thought as costs rise and investments decline.

“Middle-class seniors and the growing wave of baby boomers behind them want to stay in their homes and communities as they grow old,” CNBC noted on May 20, “but escalating costs of everything from food to medication to property taxes; battered retirement portfolios; and dwindling savings have today’s older Americans looking to become ad hoc landlords or tenants, even if the practice sometimes is forbidden by zoning restrictions.”

Robert Stein, president and CEO of the American Society on Aging, told the cable business network that sharing expenses with a roommate or border is one answer for struggling middle-class senior. However, he feels that local city ordinances need to catch up to this new economic necessity.

“With high costs of living today, and diminished resources of seniors, renting and sharing excess space in one’s dwelling will certainly call into question the relevance of current law,” Stein said.

One issue is that older Americans are carrying larger mortgages later into their lives than ever.

CNBC also notes that the Consumer Financial Protection Bureau recently reported that Americans are over extended even as they age. “A home can be a place of security for older Americans in their retirement years–a roof over their heads as well as a valuable asset. But as more seniors carry significant mortgages into retirement, they put themselves at risk of losing their nest eggs and their homes,” the bureau said in a recent report.

More senior homeowners with mortgages: Older consumers are carrying more mortgage debt into their retirement years than in previous decades. For homeowners age 65 and older, the percentage carrying mortgage debt increased from 22 percent to 30 percent from 2001 to 2011. Among those aged 75 and older, the rate more than doubled during that same time period, from 8.4 percent to 21.2 percent.

“Median mortgage debt for seniors increased by 82 percent,” the bureau said. But another problem is less affordable housing.

Follow Warner Todd Huston on Twitter @warnerthuston or email the author at igcolonel@hotmail.com

COMMENTS

Please let us know if you're having issues with commenting.