In one of its first legislative acts of the 114th Congress, the House overwhelming passed a reauthorization of the federal terrorism insurance program on Wednesday. The program, first passed in the wake of the 9/11 attacks, expired at the end of 2014. The Senate passed the bill 93 to 4, and President Barack Obama is expected to sign it into law.

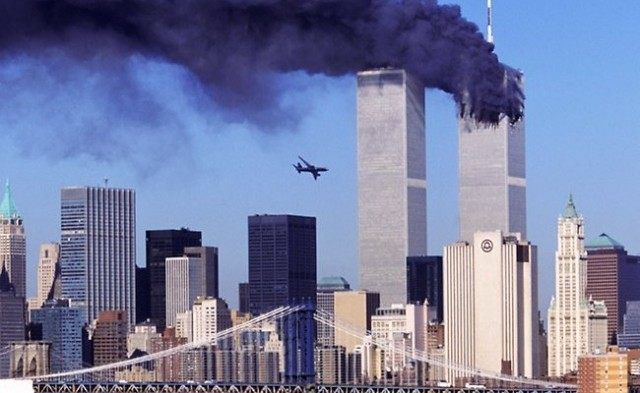

After the attacks on the World Trade Center and Pentagon, many banks and investors required the purchase of terrorism insurance as a condition for capital to finance construction or renovations of buildings deemed “soft targets” for terrorism. Because of the uncertainty in the aftermath of the attacks, Congress created a terrorism insurance program to cap insurers’ risk exposure. The new program put taxpayers on the hook for losses above $100 million from any attack, requiring an eventual repayment of these damages to the feds.

The impetus for the creation of the law was understandable in the wake of the catastrophic attacks. There has been sufficient time, however, for insurers to better assess their risks and allow a private market to develop for this type of coverage. Limiting insurance company’s exposure disincentivizes them from demanding better security or building design.

Rep. Jeb Hensarling, chair of the House Financial Services Committee, has long championed reform and moving to a market-based approach. His policy goal is to lift the “backstop” threshold, limiting taxpayer exposure, and push for the creation of a private market in terrorism insurance.

His bill, which passed the House overwhelmingly, would raise the threshold at which the federal government covers losses to $200 million, rising to $500 million in a few years. It would also increase the amount that had to be repaid to the federal government if the “back-stop” is triggered by an attack.

Hensarling’s bill, of course, preserves the program, which isn’t the ideal free-market policy, but is probably the most practical and realistic choice. A move to a completely market-based system probably ought to be phased in, rather than implement in the wake of the law’s expiration. Sound policy ought to minimize uncertainty, not exacerbate it. Without a renewal, the law’s expiration at the end of the last year would have been a shock for the property and casualty insurance market.

Renewal of the program at first got sidetracked by a number of side provisions which angered some Democrats. Given the attacks in Paris this week and the continued threat of radical groups like ISIS, it is fitting that this would be the first law passed by the Republican Congress.

COMMENTS

Please let us know if you're having issues with commenting.