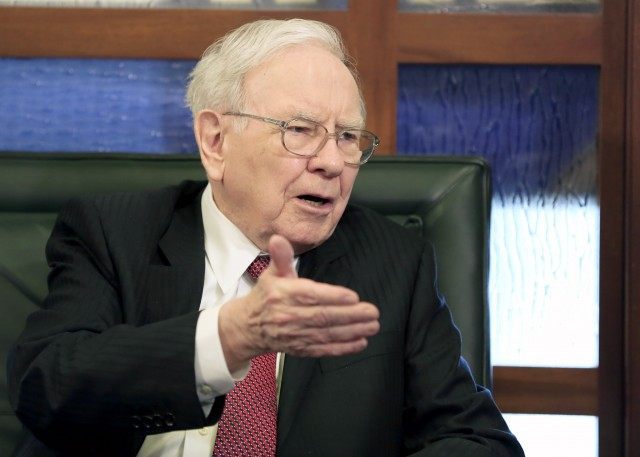

OMAHA, Neb. (AP) — Warren Buffett’s Berkshire Hathaway reported a 37 percent drop in its second-quarter profit as the paper value of its investments fell and its insurance companies reported an underwriting loss.

Berkshire Hathaway’s net income fell to $4.01 billion, or $2,442 per Class A share. That’s down from last year’s $6.4 billion, or $3,889 per share. Those results were helped by a $1.1 billion paper gain on a stock exchange deal.

Revenue grew 3 percent to $51.4 billion.

The four analysts surveyed by FactSet expected Berkshire to report operating earnings per Class A share of $2,997.14. By that measure Berkshire reported per share profit of $2,367, down from $2,634.

Buffett recommends investors pay more attention to Berkshire’s quarterly operating earnings because they exclude the swings in the value of investments and derivatives, which can vary greatly from quarter to quarter.

Berkshire’s investments and derivatives added $123 million this quarter, compared to last year’s $2.06 billion. A year ago, Berkshire traded most of its Graham Holdings stock for Miami-based television station WPLG, some Berkshire stock and cash.

Berkshire officials do not typically comment on their quarterly earnings reports, and they did not immediately respond to an interview request on Friday.

Berkshire’s latest major deal that created the Kraft Heinz Food Co. closed just after the second quarter ended, so it’s not reflected in these results. But Berkshire said it expects to record a $7 billion gain on the Kraft deal in the third quarter.

Berkshire teamed up with the Brazilian investment firm 3G Capital to acquire Kraft through their ketchup maker H.J. Heinz. The deal created one of the world’s largest food companies with annual revenue of about $28 billion. Berkshire owns 27 percent of the new Kraft Heinz.

Andy Kilpatrick, who wrote “Of Permanent Value: The Story of Warren Buffett,” said the Kraft deal will make up for the rough second-quarter results.

“That’s the real positive of the year, and that will come in the third quarter,” Kilpatrick said.

Berkshire’s insurance companies, which include Geico and General Reinsurance, reported a $38 million underwriting loss compared to last year’s $411 million gain. The negative swing was driven by higher claims at Geico and $115 million in storm losses in Australia that Berkshire insured.

Berkshire said Geico customers may see rate increases as a result of the increase in claims.

Berkshire’s BNSF railroad generated $963 million net income, up from $916 a year ago, despite relatively flat volume and weaker demand for coal and crude oil shipments.

The company’s utility subsidiary, Berkshire Hathaway Energy, generated $502 million net income, up from $375 million last year. The utility unit was helped by last year’s acquisition of Canadian power transmission company Altalink and by higher electricity rates in Iowa.

Besides insurance and railroad companies, Berkshire owns utility, clothing, furniture, brick, carpet, jewelry and pilot training firms. It also has major investments in such companies as Coca-Cola, IBM and Wells Fargo & Co.

COMMENTS

Please let us know if you're having issues with commenting.