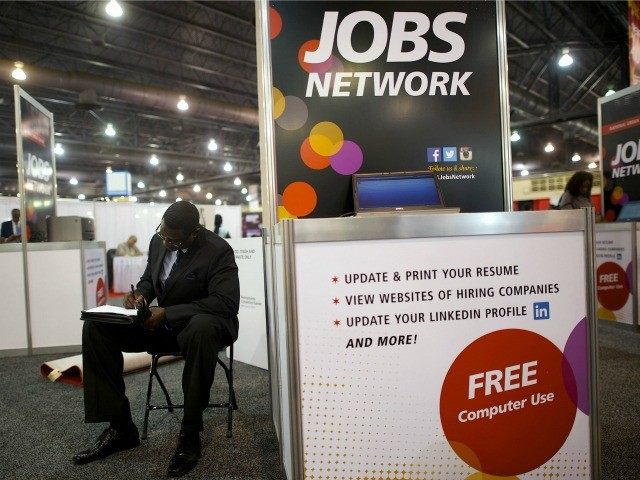

When you lose over a million manufacturing jobs, but replace them with waiter/bartender jobs what do you get? Answer: Politicians trying to claim we are in a recovery.

When higher paying jobs are replaced with transient, low paying ones would it surprise you to see anemic same-store sales?

But don’t forget this is a recovery. More than 260,000 Americans have dropped out of the labor force this past month, an increase of 1.8 million in the past year, and 14.9 million since Depression 2.0 began back in December 2007. Remember, these 14.9 million people are no longer counted when the government determines the official unemployment rate.

Don’t worry though, only 82.5 percent of the workforce is NOT keeping up with inflation. That means 17.5 percent are at least keeping their heads above water. They can be counted on to carry the rest of the economy forward.

Hopefully those among us who are falling behind can roll those existing debts into lower and lower interest rate payments, which have been falling for over three decades masking the shrinking paycheck of the average American.

What would happen if those rates ever rose to where they were before the economy broke down in 2008? How many houses would sell if mortgage rates ever returned to 5 percent or 7 percent levels? How would that federal deficit look now that it has grown to more than $18.3 trillion?

What happens to those who can’t refinance? How have they been doing through this recovery?

Well they can always join the millions on Food Stamps, whose numbers are almost equal to the entire population of Spain. How is their “recovery” working out?

Until these numbers drop down to where we were back in 2008 (adjusted for population growth) any optimistic rhetoric from the administration is worthless.

Much of the recovery rests on convincing the public that things are getting better. Only for a small minority of the population, however, has this has been true.

The dilemma is that not everyone has had a stock or real estate portfolio to make up for stagnant wage growth. When your house goes up by thousands of dollars each year, it can make up for over a decade without a pay raise. The problem is that this has been built on a policy of continuously falling interest rates that have very little margin for further decline.

COMMENTS

Please let us know if you're having issues with commenting.