It’s remarkable how much effort left-wingers put into avoiding the high taxes they advocate for everyone else.

When asked how she planned to pay for all the “free” goodies she’s been promising her constituents — a detail curiously left off her “fact sheets” — Hillary Clinton’s campaign mumbled something about “revenue enhancements.”

There are few moments when men and women should be more on their guard than when high-rolling politicians employ crafty euphemisms for tax increases. At least Democrats finally have some vague sense that they can’t just keep racking up trillions in debt to finance their vote-buying schemes. That’s progress, sort of.

So we’re back to tax-and-spend liberalism, instead of Obama’s tax-and-send-the-bill-to-your-kids version of deficit-fueled lunacy. It’s still not an honest game, and not just because getting Democrats to use the words “tax increase” requires effort akin to performing an exorcism.

They love to pretend only super-rich people will be forced to pay for everything, no matter how often people who understand math point out that a relatively small group of wealthy individuals don’t have the cash to finance plans on the scale Democrats envision, not even if their money is confiscated outright. All the class-warfare demagoguery in the world won’t change the fact that taxation is a hideously inefficient means of diverting resources, and spending commitments won’t go away, even when the tax hikes inevitably fail to generate the promised revenue.

Have you ever noticed how tax hikes never produce anything close to the promised revenue? That’s because rich and clever people, very much including Hillary Rodham Clinton and her family, always find ways to avoid paying the taxes. Many of their methods are impractical for lower-income brackets, so the burden of paying for Big Government spending always rolls downhill, in a process familiar to every homeowner in the Rockies.

Of course, liberals are monstrous hypocrites when it comes to tax avoidance. They love to describe it as a crime, deliberately confusing it with illegal tax evasion schemes, when other people do it. Clinton is brimming with ideas for punishing companies that use “tricks” to avoid high taxes.

She sneered that those who use maneuvers like corporate inversion to “game the system and leave everybody else holding the bag are just offensive to me” in a typical rant this week, throwing in questions about their “patriotism” for good measure. (But don’t you dare ever question the patriotism of any Democrat, or any of their constituents, no matter what country they’re actually citizens of!)

“You should pay what you owe, just like everybody else,” Clinton demanded.

Corporate inversions are an easy target, because they involve companies shifting financial assets out of the country to avoid high U.S. tax rates. Bloomberg News quotes Donald Trump calling inversion “disgusting” and shameful in the same article that related Clinton’s remarks. (One month ago, on the other hand, Trump was saying the very same inverting company, Pfizer, should not be blamed for undertaking a move out of the country because the American corporate tax system is so bad, and he intends to fix it.)

There are many other ways to avoid high taxes besides inversion, and most of them involve a net loss to America’s overall wealth, because the money would be used more productively, if investors and business managers weren’t protecting it from ravenous Big Government. Also, the cost of devising and implementing avoidance strategies is immense, effectively siphoning billions away from investment and commerce, into accounting pursuits that have zero productive value.

This is, again, a hugely inefficient way of allocating national wealth. Sure, the accountant who helps a company save $100 million on taxes is probably going to buy himself a few nice things with his commission, but from an overall national standpoint, there is nothing worse than an industry dedicated to keeping the government from looting the private sector.

One of the biggest shell games politicians play is advocating high nominal tax rates, but providing their cronies with exemptions that make their actual tax rate far lower. Voters drunk on class-warfare rhetoric celebrate their conquering socialist heroes for really socking it to those rich fat cats with soaring tax rates… which most of the fat cats don’t actually pay, especially when they’re generous donors to the socialists.

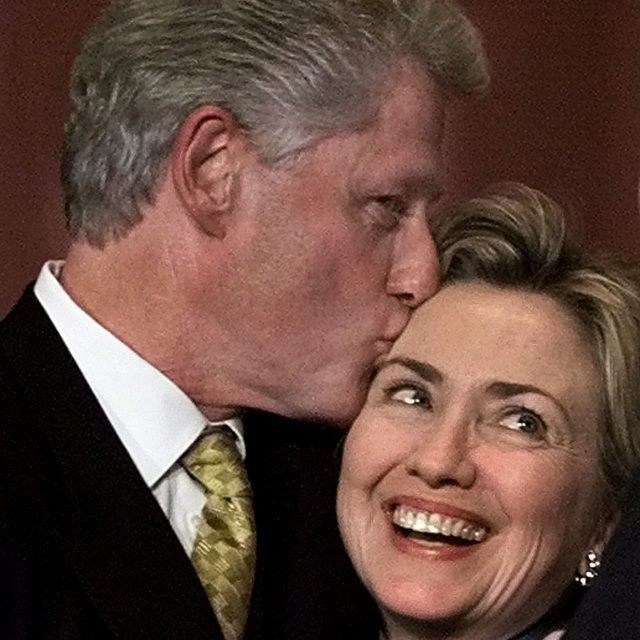

Hillary Clinton herself is a champion at shielding her income from taxation. She’s curiously reluctant to pay those “patriotic” high taxes she demands for others. For example, she loves to demand high estate taxes, but she uses classic One Percenter financial tactics to create trusts and avoid those very same taxes.

There is nothing illegal about these tactics – any good financial planner would recommend them for the “dead broke” Clintons, whose net worth is well over $50 million – but the Clintons don’t have to use them. They could take a patriotic stand, send their accountants packing, and piously insist on paying the huge tax bill they demand for others. Instead, as the New York Post put it, Bill and Hillary “have apparently grown quite attached to their money.”

This is an especially glaring hypocrisy in light of the media’s bizarre effort to slam one of Clinton’s 2016 rivals, Senator Marco Rubio, for having ObamaCare insurance even though he wants to repeal the Affordable Care Act. There is nothing even slightly hypocritical about obeying a law – enforced vigorously by the IRS – that one ultimately hopes to change. Rubio’s access to ObamaCare amounts to a very, very tiny fraction of the wealthy Hillary Clinton shields from the collectivist State she insists everyone else must feed with enthusiasm.

Furthermore, Rubio and other ObamaCare opponents are working within the legislative system to change a law. Clinton and other tax hypocrites are trying to shame people who obey the law, accusing them of unwritten meta-crimes for refusing to voluntarily pay more taxes than they are legally required to. They’re trying to work up political support by painting law-abiding individuals and companies as enemies of The People.

When that’s your game, voluntarily refusing to take advantage of the “loopholes” you rail against is a necessary act of moral leadership. Taxation shouldn’t be a moral crusade anyway, because treating such an important topic emotionally sets the public up for all kinds of sucker plays. The Tax Foundation cites the Clinton example to argue that estate taxes “fail to collect significant revenue and mainly serve to support a cottage industry of tax planning – resources that could better be used in the productive economy.”

Nevertheless, Democrat voters would be unlikely to accept getting rid of such taxes, because that would be a totally unacceptable sop to the Evil Rich… even as they vote for a very rich candidate who goes to great lengths to avoid paying those taxes. They won’t support tax cuts that would create jobs and increase income for the middle class, if they think the rich will benefit as well. They’ll never support tax reforms that would radically simplify the system and make everyone’s taxes fit on a postcard, even though no tax form longer than a postcard will ever be devoid of nooks and crannies that only Big Money can exploit.

These Democratic voters never demand the financial clarity from government that they demand from even the smallest private operation. That’s a knockout victory for emotion over reason.

COMMENTS

Please let us know if you're having issues with commenting.