The oil market is a ticking financial time bomb that can send prices skyrocketing higher with just a small 2 percent reduction in supply.

The idea that these low prices can continue for any extended period of time is a false belief. The marginal cost of production for the majority of the world’s producers is not being met, and in so doing, endangering a large percentage of future supply.

No one is in business to lose money. Today’s low prices are not only bankrupting companies and causing nations to plunge into turmoil (see Venezuela), they are also likely setting the world up for a nasty price reversal that most economies are not prepared for.

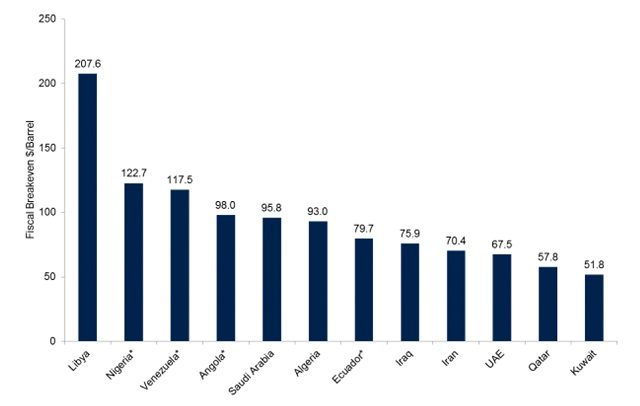

Today oil prices are below $40. The lowest cost OPEC producer, Kuwait, needs prices to be in the $50’s given their government’s current budget. Saudi Arabia, the largest OPEC producer, needs prices in the $90’s range to pay their obligations. Even the most efficient domestic producers, operating in the very best areas, need prices in the high $40’s in order to survive over the long-term. The simple fact is that the majority of the world’s producers are hemorrhaging incredible amounts of money in this environment at rates that cannot be sustained.

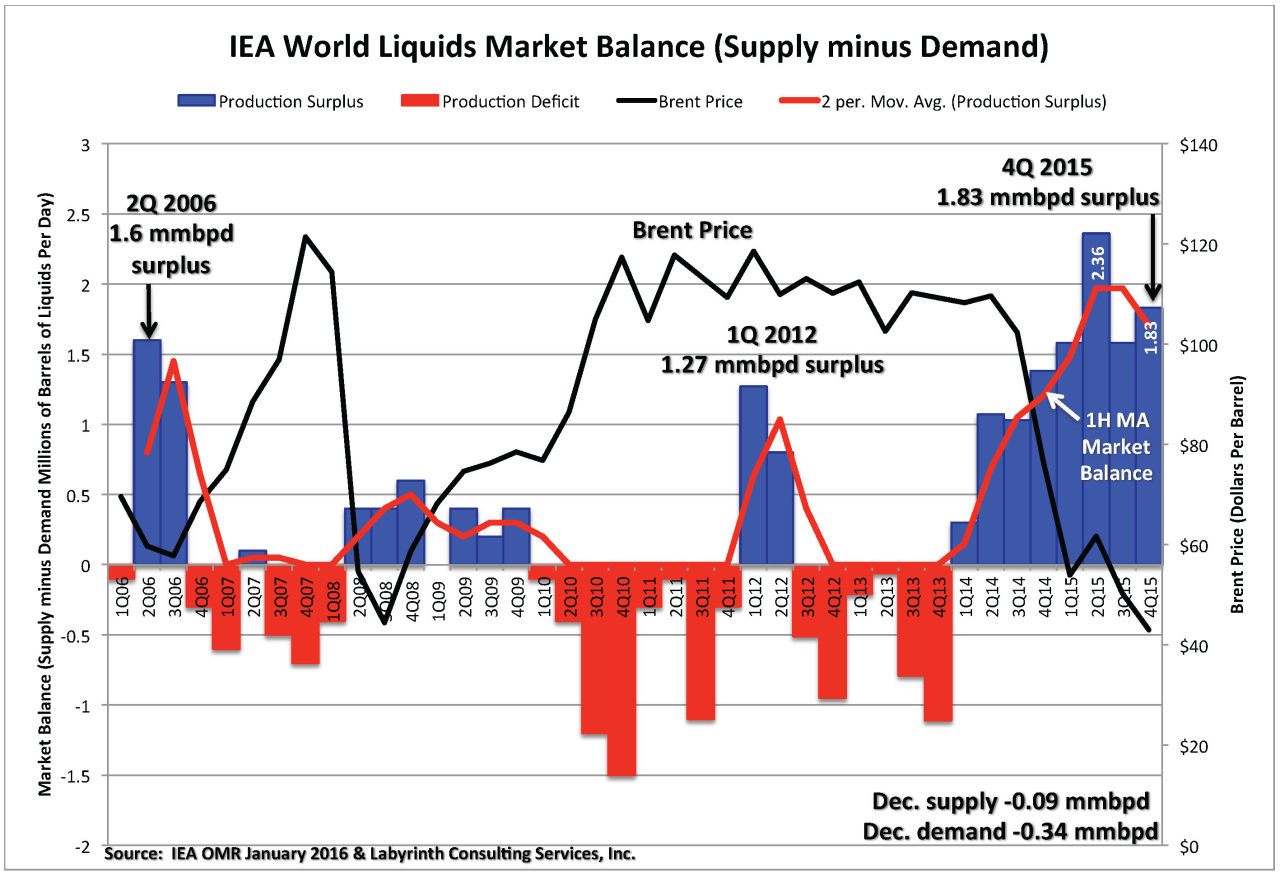

Contrary to what you may have been led to believe, the world is not oversupplied by 15, 10, or even 5 percent. The oversupply is less than 2 percent, or less than 2 million barrels in a 96 million barrel per day market. Future supplies are likely to begin an extended decline by the fall of this year and accelerate rapidly if prices don’t significantly appreciate before then.

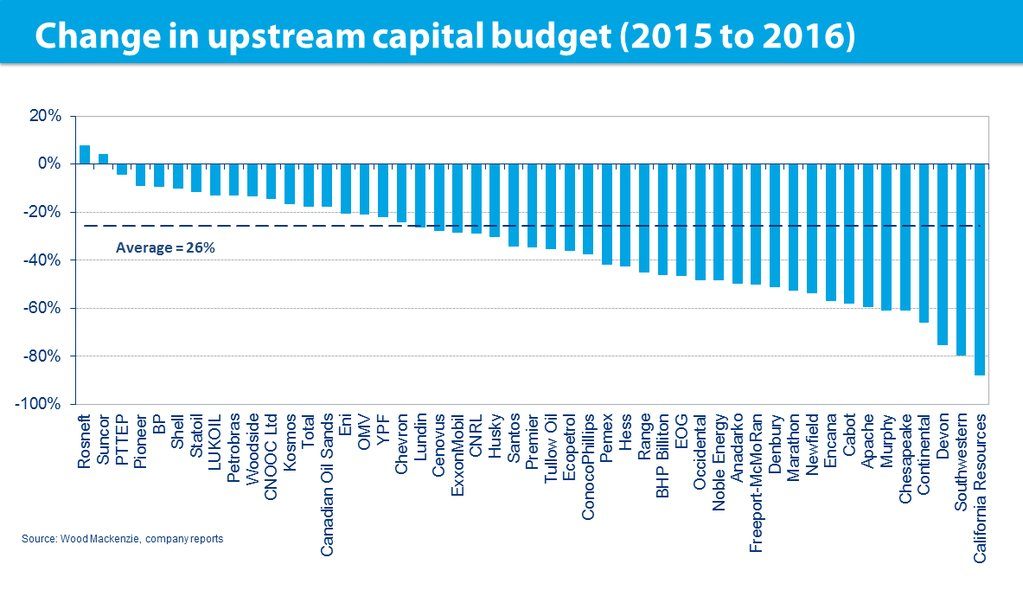

The drastic reduction in capex spending is going to lead to significant future supply problems. To maintain the status quo, the oil industry must spend approximately $300 billion annually. Companies, in order to survive, have delayed and cancelled development for needed new supplies. These capex cuts are historical in both depth and breadth. The chart below demonstrates the degree to which capex spending has collapsed since 2015.

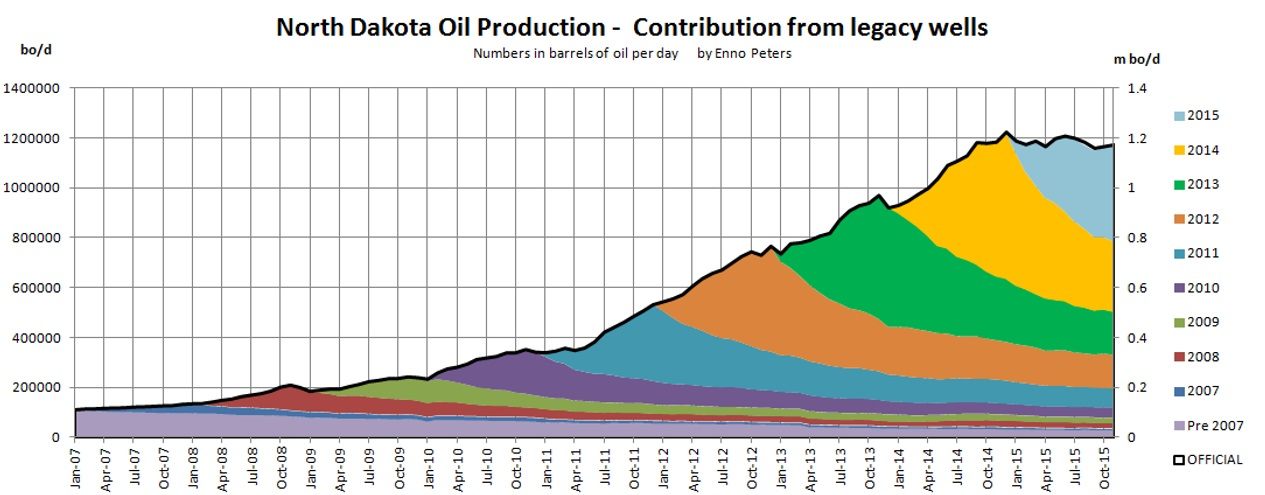

Below is a graph of North Dakota’s oil production showing legacy well decline. Production numbers from 2010 reflect the surge in fracking well output. Fracking well production has a decline rate much faster and steeper than traditional (conventional) wells. Since the majority of the world’s new supply of oil has come primarily from North American frackers over these last five years, the unsustainability of current production levels should be obvious. Fracking well production is now beginning to reverse all of those previous years’ strong gains putting the world back into an oil deficit.

Declines in production are not limited to only fracking wells. Conventional wells, which represent over 90 percent of the world’s supply, decline on average 6.2 percent per year if they are passed their peak. The harsh reality is that the world needs to find around four-to-five million barrels per year just to stand still. Major oil companies were only able to replace 75 percent of their reserves last year. ExxonMobil’s replacement rate was only 67 percent, which is the first time this number has gone below 100 percent in 22 years.

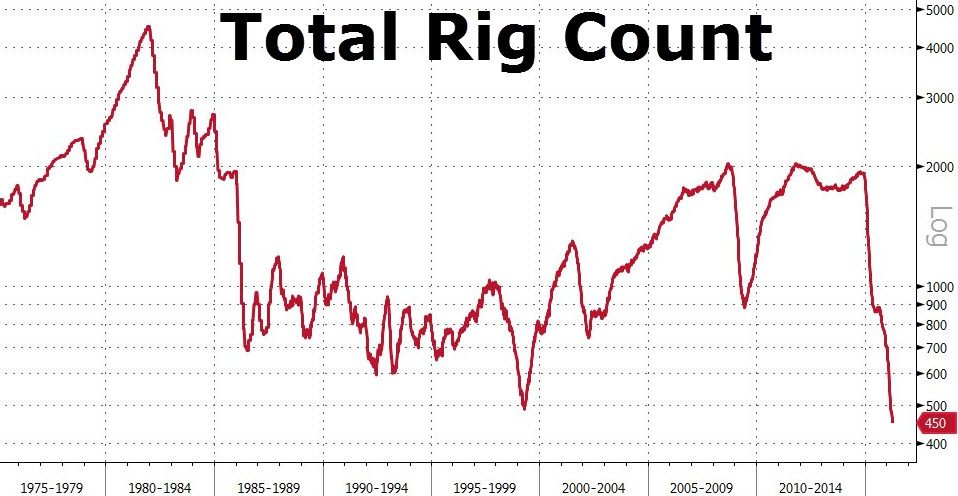

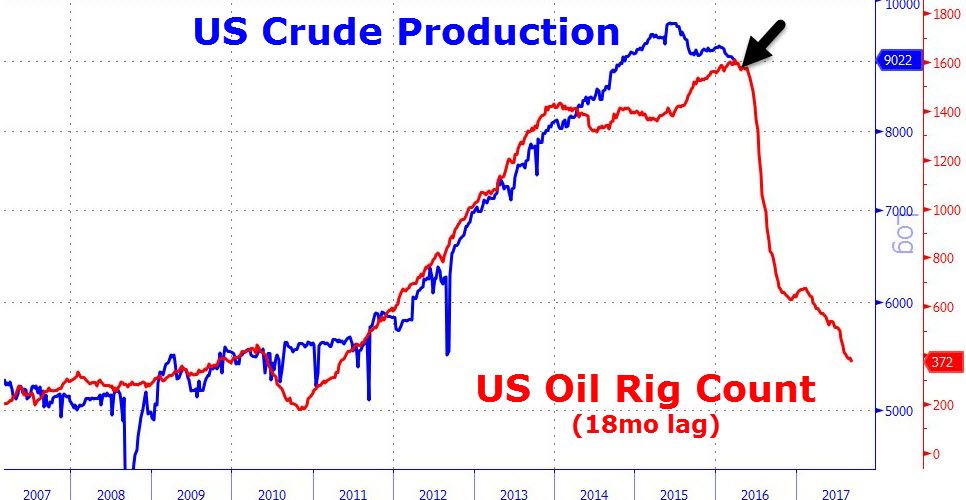

The industry as a whole has been trying to coast their way to recovery, but these decisions to curb investment only rob from future supply. Take note of the two charts below. The one on the left shows how total rig count is at 41-year lows. The right chart shows how overlaying current U.S. crude production with an 18-month rig count lag, could mean that we are facing a dramatic drop in domestic production in the months ahead.

Any number of problems can arise that could easily flip this surplus into shortage. Security risks (e.g., Algeria, Iraq, and Libya); political risks (e.g., Venezuela and Nigeria); technological challenges (e.g., deep water and arctic); and high development cost (e.g., remote Siberia) are all legitimate arguments for why oil should be trading at higher prices, but the real danger is the rising cost of capital.

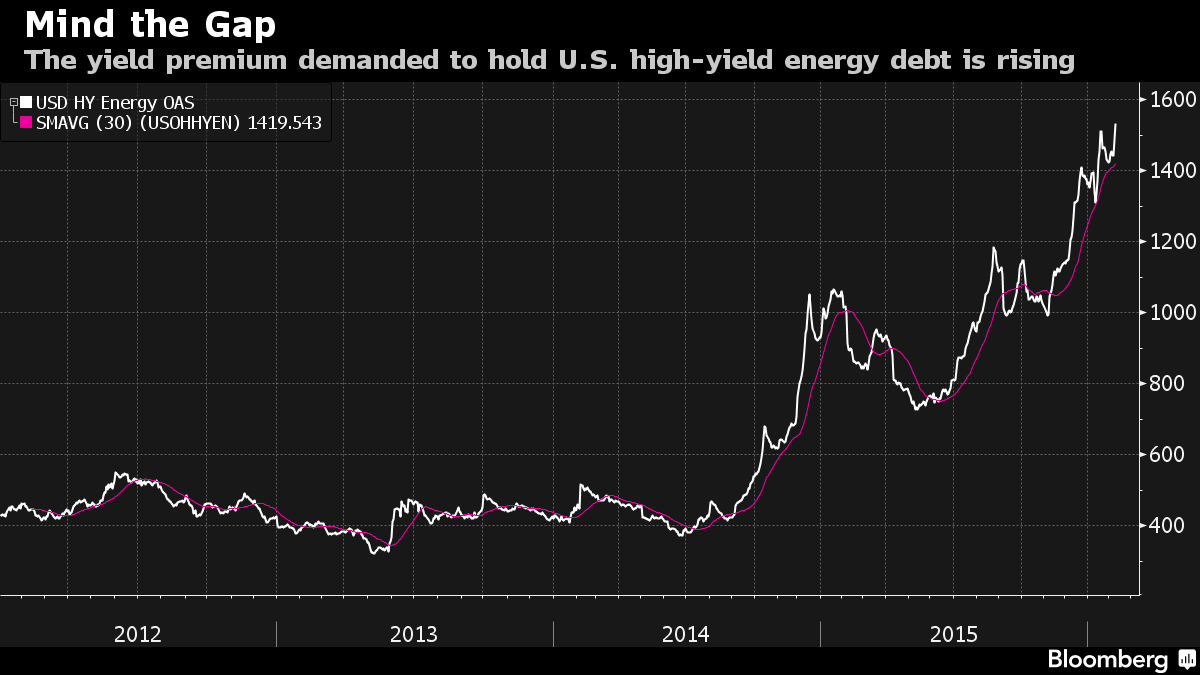

Rising capital costs will be responsible for the destruction of future production more so than any other factor given the lower prices. The oil industry runs on colossal amounts of capital, and in the past was able to borrow cheaply by selling junk bonds to income-hungry investors–those days are over.

The oil patch, that must incessantly drill, will not be able to secure favorable future financing at these low prices. It is important to note that this access to cheap capital (in direct response to the Fed’s zero interest rate policy) has been the primary accelerant to the oil boom, no different than how low rates and low lending standards creating the housing bubble.

The only thing that really matters now is the surging finance costs for energy projects. Imagine that instead of the chart above reflecting borrowing costs for energy firms, instead represented 30-year fixed mortgage rates. How many houses do you think would get built if rates rose from 4 percent to 14 percent? Now ask yourself one question: how much oil can be produced in the future with a tripling of borrowing costs?

The seeds for the reversal in oil prices have been planted and are growing by the day while prices remain depressed and borrowing costs continue to surge. Leary bankers are not going to be lending at favorable terms to an industry that is drowning in defaults and bankruptcies. It has been said that the solution to low prices are low prices, and at these historically low prices, the current oversupply will soon be gone. Both consumers and producers should always remember that the laws of supply and demand can be sometimes be delayed, but never avoided.

*Nothing in this article should be taken as a recommendation to buy or sell any security.

COMMENTS

Please let us know if you're having issues with commenting.