I have long complained that the status of thermodynamics as the keystone of energy policy has been that of a missing person. Well, maybe the Department of Energy (DOE) has finally woken up after an eight-year slumber, and is going to let science dictate support for projects that make sense to get America back on the track of meaningful and advanced energy policy.

On December 21, 2016 the DOE announced a conditional commitment of funding for the Lake Charles Methanol Project. The project, which will be located in Lake Charles, Louisiana, is a petroleum-coke-to-methanol project that will transform the dirtiest of solid fuels into methanol, hydrogen, and captured carbon dioxide.

The carbon dioxide, rather than an economic burden, will be sold for profit by the project for use by the oil industry to produce additional oil from depleted fields. As part of the processing of the petroleum coke with oxygen and steam, additional products such as sulfuric acid, argon, krypton, and xenon will also be produced and sold under commercial agreements. The argon, krypton and xenon come from the air used to generate the oxygen. The sulfur for the sulfuric acid comes from the coke that is heavily laden with the sixteenth element of the periodic table. The same technology can be used with coal to transform it into clean energy.

Petroleum coke is a waste product of oil refining and is a disposal nightmare. It is so laden with hazardous elements that regulators won’t even permit its storage where contents could leech into groundwater. Today, it is primarily exported to underdeveloped countries where it is simply burned in power stations or cement kilns. These uses create substantial air pollution — acid gases of nitrogen and sulfur, plus lots of carbon dioxide (CO2).

The technology to refine petroleum coke in a gasifier with oxygen and steam has been around for a century. This technology minimizes the air pollution and facilitates economic use of the CO2. The technology to synthesize methanol from gasifier gas (essentially hydrogen and carbon monoxide) is broadly demonstrated. The capture and transformation of sulfur into sulfuric acid is also a well-established process. What is new to the Lake Charles project versus dozens of solid feedstock methanol plants in China and elsewhere is the economic use of the captured CO2 for tertiary oil recovery by injecting it into depleted oil fields. The Lake Charles plant is near existing Gulf Coast CO2 pipeline infrastructure that will transport it to depleted oil wells to stimulate an additional 4.5 million barrels per year of domestic oil production.

With the Lake Charles Methanol plant, DOE finally has a project that is founded on market principles, commercial contracts and private sector risk taking. In the current political climate, it is a happy coincidence that this project will create up to 1,000 construction jobs for 4 years, and 150 permanent technology based jobs with average pay of $100,000 a year.

Lake Charles sounds elegant, so why can’t it be done with private market financing; why does the DOE have to be involved? First of all, nearly half the financing is from the private capital markets – $1.8 billion of equity that takes most of the risk. As for the government’s role in the debt, look no further than Dodd-Frank to understand the impediments to placing commercial debt for a project of this scale.

After the government reduced competition by forcing bank consolidation post 2009, there is simply less commercial lending capacity to finance large capital projects like Lake Charles, particularly one that involves an innovative business model that does three things at once — disposal of petroleum coke, production of methanol and other industrial products, and domestic oil production from CO2.

Some unfair critics may call this another Kemper project. I have opined that Kemper is a disaster that the Southern Company and the DOE foisted on poor ratepayers in Mississippi. The Lake Charles is a different beast. The gasification technology is fully proven and very old. And ratepayers are not the revenue source or at risk from cost overruns. Rather, the contractor will take the risk of cost overruns, plant productivity, and schedule delays. And the project has commercial, market-driven contracts with industrial and energy companies that will purchase the methanol, hydrogen, argon, xenon, krypton and CO2 for market value.

The closer one looks at this deal, the clearer it becomes that there isn’t any subsidy here at all. The project is not looking for grants. It has to raise nearly half the cost in private equity. And it has to pay Uncle Sam for the “credit subsidy” that marks up the price of government debt to private debt. (Note to Congress: fix Dodd-Frank and you can get the government out of the lending business.)

Of course I want the newly invigorated department of energy to be part of the effort to make America Great Again and I do not want any more Fiskers, A 123s, Solyndras, or Bloom Energy Bloomdoggles. (The IRS gave Bloom and its clients over $600 million in tax credits for dirty, unreliable, and exorbitantly expensive electrons.) I believe the DOE should make the loan guarantee for Lake Charles Methanol and make sure that the terms of the loan place appropriate risk of the project on private parties. I am not concerned about the technical risk of the project. The Chinese do this sort of thing day in and day out except they are not as fortunate as we are to have the place to profitably turn CO2 into oil by sequestering it in depleted oil fields.

Any way I look at it, Lake Charles Methanol makes a lot of sense: the thermodynamics, the economics, the boon to U.S. jobs and energy production.

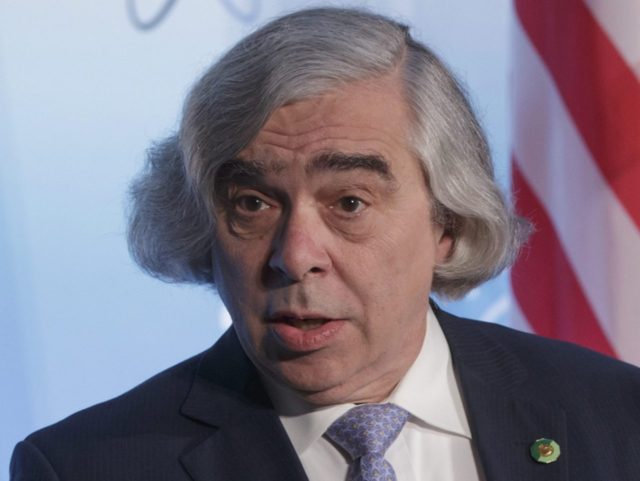

Outgoing DOE Secretary Ernest Moniz may have finally found a worthy energy project based on solid science to fund in the waning moments of the Obama administration.

This will be a welcome change from Solyndra, Fisker, KIOR, Range Fuels, A 123, Ivanpah, Kemper, Ineos Bio, Poet DSM, Enerkem, American Process, Mascoma, Amyris, Gevo, and myriad other thermodynamic hypes we have witnessed the DOE fund, only to watch them underperform or fail over the past decade.

The Trump Administration’s Department of Energy would do well to fast-track this project. It may just make up for all the past failures in the DOE green tech portfolio.

COMMENTS

Please let us know if you're having issues with commenting.