There is a specter haunting GOP efforts of tax reform: the ghost of GOP efforts to repeal Obamacare.

Few on Capitol Hill know the details of the legislation being drafted behind closed doors to put flesh on the skeletal tax overhaul framework released by Republican leaders last month. Many lawmakers are hesitant to endorse the efforts because they know so few details about what will actually be in the tax bill.

Even President Donald Trump appears to be largely in the dark about the bill. If the president’s vagueness about the tax overhaul in speeches intended to promote it led to suspicions that he did not have the details ready at hand, his rejection of a plan under consideration by GOP tax writers to cap contributions to 401(k) retirement plans confirmed them. If the president had been fully briefed on the issue, surely it would have been killed quietly instead of requiring a public tweet by the president to shoot it down.

This pattern of secrecy, leaked details of major changes to popular programs, and public criticism from the president is all too familiar to Republic lawmakers. It is exactly what happened as the GOP moved–and failed–to repeal and replace Obamacare.

The irony is that repealing and replacing Obamacare was supposed to be a layup for the GOP that would make tax reform easier. Instead, it appears to have created a template for legislative failure that the GOP keeps trying. If madness is doing the same thing time and again while expecting a different result, the GOP leadership on Capitol Hill is a Mad Hatter’s Tea Party.

Also familiar from the Obamacare debacle are the divisions among Republicans. Deficit hawks worry that tax cuts on businesses will not be “paid for” by tax hikes elsewhere, Blue State GOP lawmakers object to plans to end deductions for state and local taxes, anti-tax libertarian types worry that closing some loopholes and deductions might raise some tax bills, and populists worry that the Republican tax bill will shift more of the tax burden to the American middle class.

The child tax credit is one issue where GOP lawmakers depart. Some lawmakers are pushing back on expanding the child tax credit, saying it would expand the deficit without contributing to economic expansion, according to people familiar with the matter. But without an expanded childcare tax credit, the GOP bill might end up raising taxes on many middle-class families.

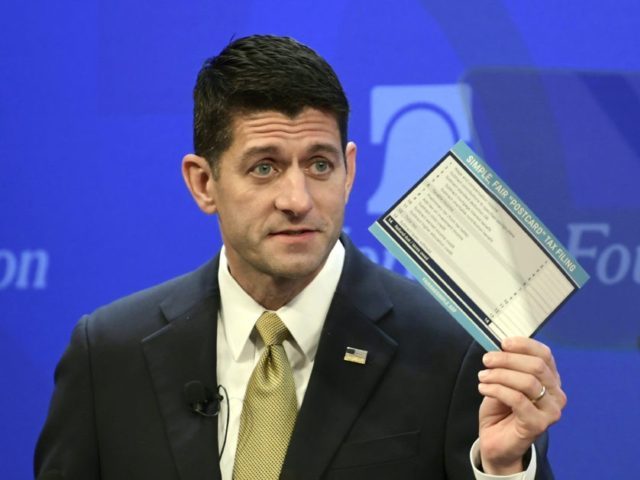

House Ways and Means Chairman Kevin Brady has said his goal is to release the tax legislation on November 1. House Speaker Paul Ryan has vowed to get the bill through the House by Thanksgiving. But even if both those timetable goals are accomplished, that would make it challenging to get a deal done with the Senate before the holidays and year’s end.

COMMENTS

Please let us know if you're having issues with commenting.