China laid out the welcome mat on Friday for foreign investors looking to buy stakes in its financial sector, announcing that it would relax restrictions on foreign ownership of its banking and securities businesses.

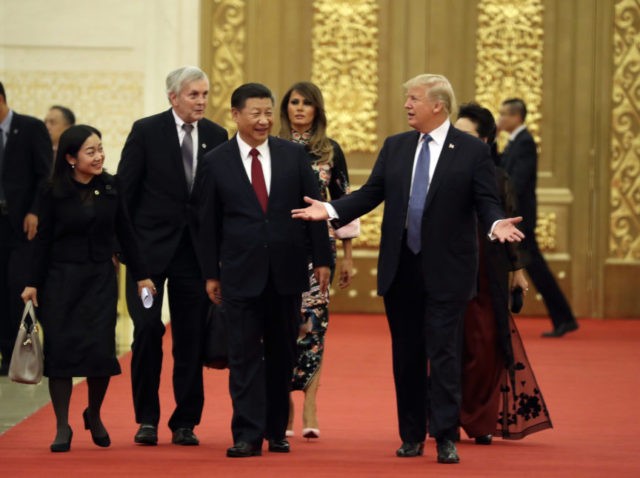

Just hours after Donald Trump concluded his trip to China, the government announced that it would raise the caps on foreign ownership with the eventual goal of eliminating all restrictions for insurers, brokerages, and fund managers.

While it is traditional to quote fifth century B.C. Chinese strategist Sun Tzu in articles about major changes in China, a more apt maxim might actually come from common law jurisprudence: caveat emptor. That is, buyer beware.

American investors have been clambering to get into the Chinese financial sector for a long time. Decades ago, it was seen as unclaimed and untamed territory by U.S. banks. Unlike Europe or Japan, China had no mature, native financial sector. U.S. companies like Goldman Sachs and banks like J.P. Morgan Chase saw it as the new promised land.

That was then, this is now. China now has a huge financial sector that is seriously troubled. Profitability has fallen dramatically. Average return on assets has fallen from six percent in 2011 to just 0.9 percent, according to the Wall Street Journal. Falling profitability is often a sign of deteriorating credit quality, signaling a willingness to make risky and underpriced loans.

It’s not surprising, then, that many outside observers believe the Chinese economy is trapped in a huge credit bubble. The International Monetary Fund warned in August that debt levels had become “dangerous” and risks a “disruptive adjustment.”

In an effort to bolster their capital cushions, the Chinese have been selling bonds and equity at a breakneck pace. Chinese banks have issued $200 billion of new debt this year, a 40 percent increase over the previous year, according to the Wall Street Journal. Equity issuance is up 57 percent. But despite all this, their capital cushions are still very thin and much of this may be simply keeping up with mounting loan losses.

Faced with this capital shortage, it’s not surprising that China’s government would seek to lure outside investors into its financial sector. Indeed, last June China’s long-serving central bank chief announced that opening the financial sector up to foreign investment was part of the government’s strategy to avert a crisis.

“If we want to avoid a financial crisis, we must ensure the health of our financial institutions and we should not tolerate high leverage, insufficient capital or high non-performing loans,” Zhou said in June at an annual gathering of regulators and bankers in Shanghai.

In other words, China wants foreign capital to bail out its financial sector.

The Chinese financial sector is largely an extension of its government. Its largest banks are majority state-owned and every financial firm in the country has ties to the Chinese government or the Communist Party. So investors will be able to supply capital to these firms but not control them.

That has not stopped bailed-out U.S. financial companies from applauding the Chinese opening. On Friday, J.P. Morgan Chase and Morgan Stanley issued statements reaffirming their commitments to China.

COMMENTS

Please let us know if you're having issues with commenting.