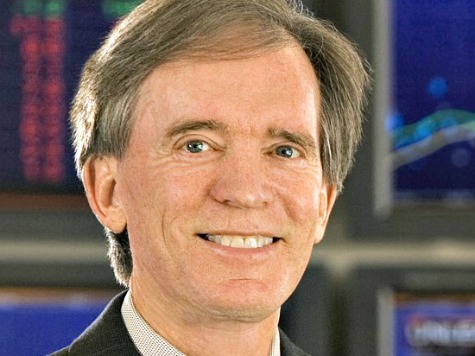

Big bucks Wall Street traders were flabbergasted that, after a year of lousy performance, huge internal battles at Pacific Investment Management (PIMCO) that led to demands to fire Bill Gross, Barry Ritholtz of the View reported Gross had pocketed an epic bonus:

According to documents provided to Bloomberg View by someone with knowledge of Pimco’s bonus policies, the numbers break down like this: Gross earned $290 million as his year-end bonus for 2013. Mohamed El-Erian, Pimco’s former chief executive officer and one-time heir apparent to Gross, received $230 million (El-Erian is a fellow Bloomberg View contributor).

PIMCO was quick to deny the report, but the damage was done. Bonuses in 2013 for top Wall Street performers were up 15% to $163,530, according to New York State Controller Thomas P. DiNapoli. But life in Newport Beach, CA was obviously much sweeter, and the very secretive PIMCO was forced to put out a public statement that PIMCO bonuses are about company profits and not at all connected to customer profits:

While PIMCO does not comment on compensation, the figures provided to Bloomberg are not correct. For more than three decades, PIMCO’s managing directors have maintained a substantial interest in the firm, currently 30% of profits, and this provides an important means to attract and retain the best investment talent to serve our clients.

Gross managed the $1.6 trillion Total Return Fund. According to Morningstar, that rates and compares mutual fund performance, Total Return has under-performed for the last two years. The fund is rated as “Bronze”, which is sort of a booby prize.

Investors through August, the last full month Gross was at PIMCO, had been abandoning Gross by withdrawing money from the fund for 16 straight months. Even more ominous, Total Return was on track to show a loss for the third quarter ending September 30th. This would surly cause huge defections, given that all but the worst performers in Total Return’s category of bond investors were about to book profits.

Facing a palace coup at PIMCO to quietly fire Gross, he left in September for a competitor and vindictively went public with his own resignation letter in Shakespearian prose: “The immense wealth I helped to create for my colleagues, partners and clients over all that time meant nothing, once Machiavelli’s stratagems were put into play.”

About 2% of assets left PIMCO in the next few weeks. But with interest rates falling, along with oil prices, the firm stabilized at about $1.47 trillion in assets under Daniel Ivascyn. Bill Gross has traded down to managing Janus Funds’ Unconstrained Bond Fund, with about $442.9 million in assets.

The Ritholtz’s is standing by his sources, and his report states PIMCO’s bonus pool for 2013 was $1.5 billion and Ivascyn only “took home a $70 million bonus” in 2013. Given Gross’ resignation would have canceled his 2014 bonus, PIMCO stands to save a quarter of a billion dollars by saying goodbye to an under-performing manager.

Chriss Street suggests that if you are interested in business and politics, please click on President Obama Goes around Senate on Climate Change

COMMENTS

Please let us know if you're having issues with commenting.