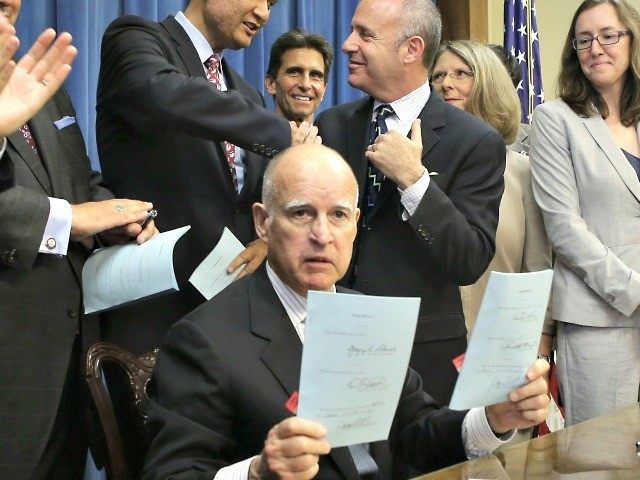

Both houses of the California legislature have agreed to a budget deal to forward to Governor Jerry Brown by the June 15 deadline.

Forced by Proposition 98 to pump more cash into education, Sacramento politicians have been working overtime inflating revenue expectations to justify passing new health and child care entitlements that mostly benefit illegal immigrants. The ball is now Governor Brown’s court to use his line-item-veto to decide how much he wants to protect taxpayers from irresponsible spending.

Since the April 7 non-partisan Legislative Analyst’s Office confirmed that “state revenues appear to be surging” due to higher sales and capital gains taxes, the Democrat-controlled legislature has been trying to “game” how to limit Proposition 58 requirements that the annual state budget to be balanced and a percentage of any surplus revenue at year end be deposited into “rainy-day-fund.

After a decades of the legislature “short-checking” schools to spend taxpayer cash on political constituencies, California voters in 1988 passed Proposition 98 as a constitutional amendment that sets a “minimum guarantee” for funding schools and community colleges. That forced 50 to 60 percent of any “surplus” to go first to paying down any accrued deficits to schools, before the legislature could spend surpluses.

But since the 2012-13 fiscal year, the state has administered the formula to require virtually all new revenue go toward Proposition 98. Last year, virtually 100 percent of the budget surplus went to schools, and this year the remaining $723 million will go to schools.

This year, the legislature will get to spend any surplus over the school pay-off and a $534 million rain-day-fund deposit. With the governor’s office estimating the surplus at about $3 billion, the legislature can spend $1.3 billion in surplus. But if the legislature estimates the surplus is $6 billion, it can more than triple spending to $4.3 billion.

The legislature and the Governor agree that California tax collection through April was up $10 billion, mostly due to capital gains taxes that jumped from $4.7 billion in 2010 to 11.9 billion last year, and that could hit $15 billion by the end of June. But the legislature believes in “rainbows, butterflies and unicorns” guaranteeing the hot stock market capital gains will pour, while Gov. Brown is concerned another market crash could send capital gains back to the $2.3 billion collected in 2009.

“The governor is focused on ensuring ongoing balance of the state budget and avoiding the boom-and-bust cycle that has plagued the state over the past decade,” H.D. Palmer, a spokesman for the state Department of Finance, told the Contra Costa Times.

Brown’s May Revised Budget sets a $115.3 billion spending plan for next year that is $7.3 billion larger than last year’s July to June budget, and predicts revenue that is $6.7 billion higher than the budget proposal he announced in January.

The California legislature’s Senate and Assembly Democrats decided to unite before the June 15 deadline to have more time to lobby the Governor on new entitlements. To help their unionizing friends at AFSCME, the Legislature wants to start spending another $325 million next year to raise reimbursements and create 27,000 new child care and preschool slots. They want to spend another $130 million to offer Medi-Cal to immigrant children who are living in the state illegally–an idea Brown has so far been unwilling to support because of the high, ongoing cost. Legislators also want Medi-Cal and Denti-Cal doctors’ reimbursement rates for low-income/illegal alien patients to increase by 5 percent.

In addition, the legislature wants to yank $70 million from middle–class scholarships and give the money to the California State University to add 10,000 students. The University of California will receive $25 million more to enroll 5,000 more California students, if it stops selling undergraduate slots to out-of-state students that pay three times the tuition.

From the time the budget proposal finally hits his desk, Governor Brown will have until June 30 to strike most spending items not under Proposition 98.

Gov. Brown and the legislature have already agreed to have California taxpayers give away $380 million a year to about 825,000 California families in a new Earned Income Tax Credit. As he weighs the competing demands that remain, Brown may likely “split the baby in half” by adopting more of the legislature’s spending proposals.

COMMENTS

Please let us know if you're having issues with commenting.