With a little over two more years left in office, California Governor Jerry Brown agreed to a $122.5 billion budget for the 2016-17 fiscal year that adds $2.7 billion of mostly unfunded new spending for welfare, schools and prisons.

Despite a warning by Moody’s Global Credit Research last month that their fiscal stress-test of the largest states in America found California the least prepared to weather the next recession, Gov. Brown, with just 14 days before the start of the state’s new fiscal year, negotiated a spending agreement with the top two Democrat legislative leaders, Assembly Speaker Anthony Rendon (D-Paramount) and Senate President Pro Tem Kevin de Leon (D-Los Angeles).

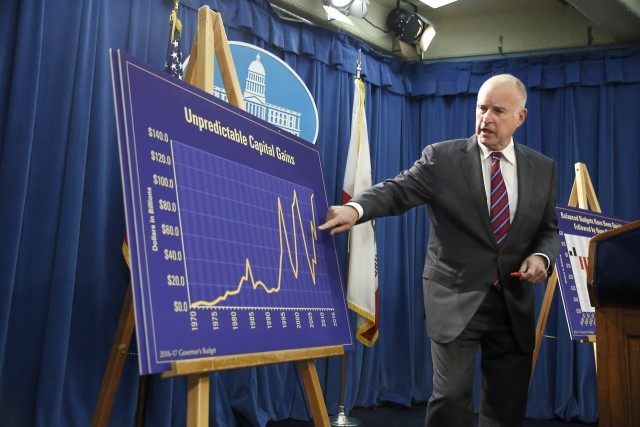

Brown knows that with almost $500 billion in unfunded pension liabilities and an economy highly leveraged on about $15 billion in variable capital gains, California is on the verge of a financial crisis.

That is why he negotiated a deal with the state legislature that promises billions in increases this year and bills in the future after he leaves office.

The new $2,050,700,000 budget increase for the 2016-2017 fiscal year includes:

- $1.3 billion more for K-12 schools and community colleges, as required by Proposition 98

- $270 million for jail construction, including $20 million earmarked for the Napa County jail that was severely damaged in a 2014 earthquake;

- $148.3 million increase for California State University;

- $125.4 million increase for University of California;

- $107 million to fund the cost of repealing of CalWorks (welfare) maximum family cash grant; and

- $100 million increase for subsidized child care.

But the budget deal also includes a list of so-called “baked in” spending increases for future years that are estimated at $664 million, and can automatically expand if more people seek state benefits including:

- Another $400 million more in for subsidized child care over the next four years;

- Another $233 million the following year to repeal the maximum family grant in CalWORKs, the state welfare program;

- Another $18.5 million if UC schools enroll more California residents; and

- Another $12.5 million if CSU schools enroll 5,194 additional California residents.

All of this new spending is founded on the state’s budget update in January, which estimated California would have a $3.6 billion surplus from the higher collection of personal income tax revenues in the current year.

But according to the non-partisan Legislative Analyst Office’s May Budget Revision report, “The tax revenue forecast has been reduced by $1.9 billion, reflecting poor April income tax receipts and more sluggish sales tax receipts than expected.”

The LAO also expects that although it will only cost $39 million next year, “[t]he passage of legislation that made California the first state in the nation to raise the statewide minimum wage to $15 per hour will eventually raise General Fund costs by an estimated $3.4 billion.”

Governor Brown has managed balanced budgets over the last three years, but the LAO warns, “Balanced Budgets Have Been Quickly Followed by Huge Deficits.” It highlights that California has had a budget deficit in 10 of the last 16 years and “the sum of all the deficits during this period is seven times greater than the sum of all the surpluses.”

Photo: file

COMMENTS

Please let us know if you're having issues with commenting.