After plunging to an all-time-low in June, Twitter’s rise to $19 per share on rumors of a buy-out picked up credibility this week when its co-founder said the wilting social network company must ponder options, such as a buy-out.

Twitter jumped 4.5 percent after co-founder Ev Williams told Bloomberg TV on Wednesday that the company has to consider all of its options, especially when it is in a “strong position.” Williams was asked on Bloomberg TV whether Twitter was a takeover target.

At first Williams tried to avoid the topic, but then went on to acknowledge that the company must ponder alternatives, which would include a merger or acquisition.

“We are in a strong position right now,” Williams said. “As a board member, we have to consider the right options.”

Breitbart News reported in June 2015 that the termination of Twitter CEO Dick Costolo, who won high praise for not knuckling under to Leftists’ social networking “thought police,” would be a disaster, especially with the company on the verge of profitability.

But then Obama campaign cash bundler Chris Sacca led a Board of Directors coup d’état to fire Costolo, who “proudly worked on President Barack Obama’s campaign as a Telecommunications, Media, and Technology advisor, a speaking surrogate, a field office volunteer, and as Co-Chair of Finance and a Trustee of the Presidential Inaugural Committee.”

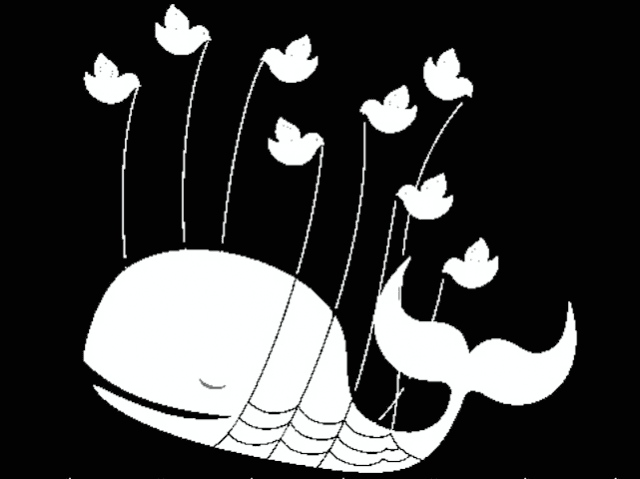

Twitter began a purge of conservatives that muzzled free speech. Despite enjoying a lift from Republican Donald Trump, who has been using the social media platform as his political firehouse, Twitter monthly average user growth died. Over the last 14 months Twitter’s social media user rank dropped from number three to number nine.

The San Francisco-based Twitter could be a good acquisition for a company that wants 300 million sets of eyeballs. Michael Tchong, founder of Las Vegas-based “Ubercool Innovation,” which tracks tech trends, told SiliconValley.com blog: “Twitter is a very high-profile leader in the thought community … Ideally, they get bought by somebody who needs the audience reach but has the money.”

Twitter has continued to lose money and burn cash since Costolo was booted. From June 2015 to June 2016, Twitter lost a jaw-dropping $408.9 million on revenue of $2.48 billion.

“Twitter doesn’t improve their interface enough, they have languished behind Facebook in that regard,” Tchong added. He thinks that any buyer would have to be someone that “understands that frequent improvements in the user interface and the site’s features are absolutely essential.”

Twitter’s stock peaked at about $69 a share in 2014 during its first year being public. But the stock imploded after Costolo was shown the door. Without the rumor value for buy-out, the share could trade in the single digits, according to many Wall Street analysts.

COMMENTS

Please let us know if you're having issues with commenting.