The Federal Reserve now agrees with President Donald Trump on interest rates.

The Fed held its interest rate target steady Wednesday and added new language to its statement signaling that further rate hikes are on hold.

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes,” the Fed said in a statement issued after its two-day meeting concluded Wednesday.

The Fed has dramatically changed its stance when it comes to future rate hikes. Instead of forecasting that it would continue to hike rates as a “gradual pace,” as its earlier language put it, the Fed now says it will not hike rates without evidence that the economy requires a tighter monetary policy.

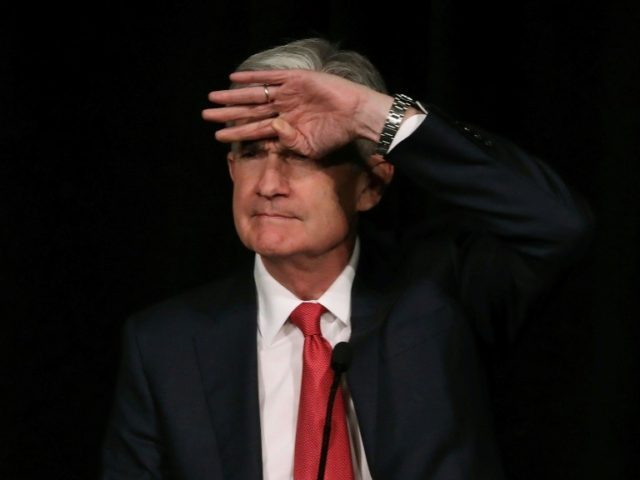

“I would want to see a need for further rate increases, and for me a big part of that would be inflation,” Fed chair Jerome Powell said in a press conference that followed the Fed meeting.

Despite backing away from its earlier predictions that it would raise rates several times in 2019, the Fed remains upbeat about the economy.

“The committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2% objective as the most likely outcomes,” the statement said.

The Fed described job gains as “strong” and said household spending has “continued to grow strongly.”

Business fixed investment has continued to grow but has “moderated from its rapid pace earlier last year.”

President Donald Trump criticized the Fed several times last year, saying he disagreed with its interest rate hikes. The Fed persisted in hiking rates throughout the year, raising its target by a quarter of a percentage point four times. This gave rise to the fear that the Fed could overshoot, raising rates too high too quickly, snuffing out the economic expansion.

In recent weeks, however, the Fed has sought to reassure markets that it would not recklessly hike rates.

COMMENTS

Please let us know if you're having issues with commenting.