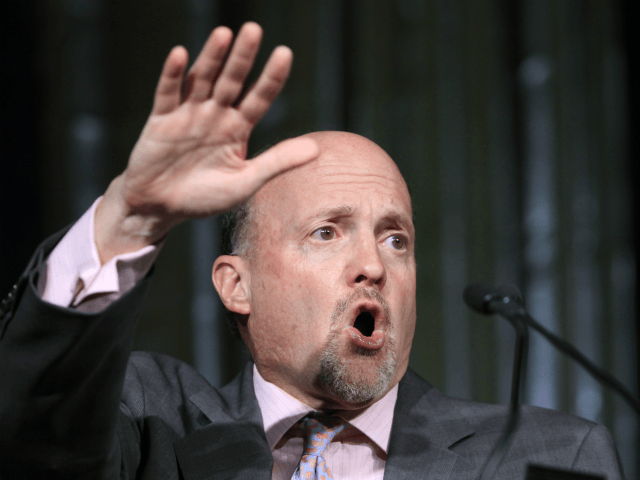

Jim Cramer has a radical plan to fight the economic toll of the coronavirus: suspend federal tax collection.

“The federal government should not be taking in any money whatsoever from any major companies, so the major companies can have the cash flow. Also with individuals, so individuals can have the cash flow,” the CNBC anchor said on Thursday morning. “There’s no need for the federal government to take any money in right now. Print the darn money.”

Cramer also called for the U.S. Treasury to issue $500 billion in 30-year Treasury bonds to create a fund to spend to support the economy and “essential industries.” Those likely include U.S. airlines whose business has sharply fallen off because of travel restrictions and public hesitation to travel amid the coronavirus pandemic.

“If we have a situation where a company is going to be very strapped and go under, that company has to be able to tap the Treasury right now. I wouldn’t be surprised if the federal government, maybe through the Federal Reserve, has to be able to buy corporate bonds,” Cramer explained.

If too many companies turn to backstop credit lines from banks, it could put a strain on the banking system, Cramer warned. Typically, companies attempt to avoid drawing on expensive revolving credit lines except in cases of dire need. It is possible that if too many companies attempt to draw down on bank credit lines at the same time, the availability of bank credit could contract.

Cramer argued that only the federal government has the wherewithal to provide the funding needed to preserve the health of U.S. businesses in light of the coronavirus and the extreme measures likely needed to stem the pandemic.

“Fortunately, the rates are so low that we can do this. We can be the strongest country on earth if we use the federal government’s balance sheet. Not necessarily the Federal Reserve but the actual federal government,” Cramer said.

Cramer famously argued months prior to the crescendo of the financial crisis that monetary policy was too tight, shouting on live television that the central bankers “know nothing.” While many mocked his “outburst” or “rant” at the time, it looked prescient after Wall Street and the U.S. economy came to the edge of collapse in late 2008 and early 2009.

The difference this time is that Cramer is advocating for fiscal policy rather than monetary policy. That reflects the difference in the economic challenges facing the country: this time we’re not facing a financial crisis but a challenge to the nonfinancial sector from diminished demand and supply due to the pandemic. It also reflects the fact that interest rates are already so low that monetary policy may not be as effective.

“Everyone owes the government at all times. Everyone in this country, individuals, corporations. That has to be suspended right now so they have more money. Are these radical actions? You bet they are. Can they be done smoothly? Absolutely,” Cramer said.

COMMENTS

Please let us know if you're having issues with commenting.