When Fed officials meet this week to discuss the state of the economy and monetary policy, the tone of their discussions may be a strong indicator of what lies ahead.

Before each meeting of the Federal Open Market Committee, the staff of the Federal Reserve Board of Governors prepares projections about how the economy will fare in the future. These projections are laid out in quantitative point forecasts—such as a prediction that GDP will grow at a 4 percent rate this year—accompanied by a narrative in what is known as the Greenbook.

It turns out that the tone of that narrative can be used to predict whether the economy will do better or worse than what is forecast by the panel of 50 top private sector analysts that are collected by the Blue Chip Survey of Economic Indicators, a study by Fed researchers Steven A Sharpe and Nitish Shinha and University of Michigan economics PhD student Christopher Hollrah shows.

The researchers analyzed what they call the “tonality” of the narratives and found that it can be used to predict changes in economic growth, unemployment, interest rates, and even the performance of the stock market. When the tone of the narrative is positive, GDP growth over the next six months and 12 months is often higher than what is forecast and unemployment lower. When it is more negative, GDP growth tends to be sluggish and unemployment higher than expected.

The tonality of the Greenbook has predictive power for even when the Greenbook’s own quantitative point forecasts will be revised upward or downward. In some sense, that’s not unusual because the official quantitative projections are extremely correlated with the Blue Chip forecasts. If narrative tone can predict errors in the Blue Chip forecast, it should also predict errors in the Greenbook forecast.

On the other hand, this is quite odd. How could the narrative tone predict errors in the analysis of the very researchers writing the narrative? The researchers suspect that the Greenbook forecasts reflect what researchers think is the most likely outcome but not necessarily the risks to that outcome. So if the Fed researchers worried that the chance of a recession was rising but still believed the most likely outcome was continued growth, the numerical forecast might be unchanged but the narrative could note the increased uncertainty. The tone picks up on nuance that the numbers obscure.

Because tonality has predictive power over the economy, it also has predictive power about monetary policy. A more optimistic tone presages a higher than anticipated Fed funds rate up to 12-months ahead.

Perhaps more strikingly, tonality also has “substantial power” for predicting excess returns on stocks over three-month, six-month, and 12-month holding periods. So the narrative contains information that even the stock market has not yet figured out.

Unfortunately, the usefulness to the public of this narrative predicting power is stymied because the Greenbook is not released for five years after the relevant FOMC meeting.

But the researchers find that the minutes of the meeting, which include summaries of the meetings, also have predictive tonality. That’s because there is a strong correlation between the tone of the Greenbook narrative and the tone of the minutes. If the Greenbook narrative is pessimistic, the minutes that follow the meeting will be also, and vice versa.

Ironically, the tone of the Fed’s official statement released after each two-day meeting—one closely parsed by Wall Street analysts and financial pundits—has no predictive power at all.

The researchers did not analyze the tone of the press conferences that now follow every FOMC meeting. But it is easy to imagine that the Fed chair’s tone would also reflect the Greenbook narrative.

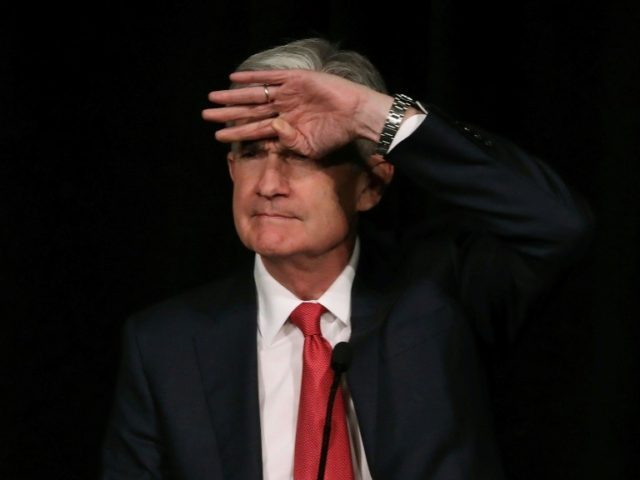

If that’s the case, investors and analysts should pay close attention to whether Fed chair Jerome Powell sounds upbeat or worried on Wednesday.

COMMENTS

Please let us know if you're having issues with commenting.