Hong Kong-registered China Concord Petroleum Company (CCPC) has become “a central player in the supply of sanctioned oil from Iran and Venezuela, even after it was blacklisted by Washington two years ago for handling Iranian crude,” according to a Reuters report Thursday.

CCPC was sanctioned by the U.S. Treasury Department in September 2019 for shipping banned Iranian oil. The major sanctions target at that time was Chinese shipping giant Cosco, which controlled up to 50 supertankers that could be affected by the Treasury blacklist. According to Reuters, CCPC became a more important player in the sanctioned oil trade over the following two years.

Former Secretary of State Mike Pompeo said in September 2019 the blacklisted Chinese companies “knowingly transported oil from Iran contrary to United Nations sanctions.”

“We’re telling China and all nations: know that we will sanction every violation of sanctionable activity,” Pompeo declared.

According to Reuters, the expansion of CCPC into the key player in China’s sanctions-busting oil trade with Iran and Venezuela has not been reported until now.

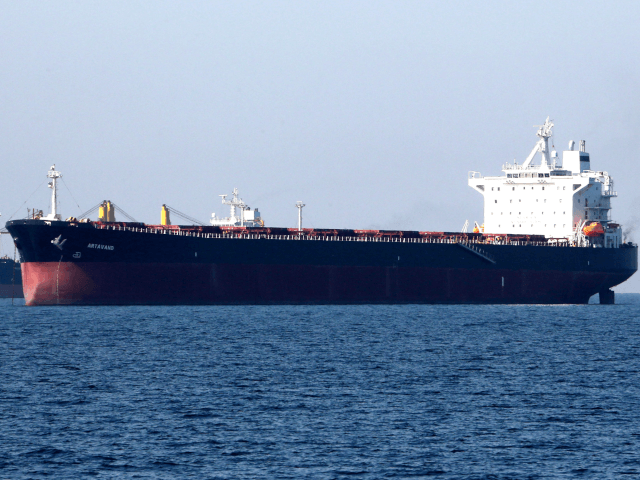

The report said CCPC has acquired “at least 14 tankers to transport oil from Iran or Venezuela to China” over the past year while making a string of deals with half a dozen small “teapot” Chinese refineries to handle the influx of Venezuelan crude. China accounts for at least 60 percent of Venezuela’s oil exports, despite American sanctions on the Venezuelan state oil company, PDVSA.

Reuters’ sources included Iranian officials who confirmed that CCPC has become the “central player in Tehran’s oil trade with China.”

China is now importing an estimated 557,000 barrels of crude oil a day from Iran, Reuters reported, and about 324,000 from Venezuela. Iran’s shipments have roughly doubled since 2020 to 600,000 barrels per day, but are still far below the 2.8 million barrels per day it exported before President Donald Trump restored sanctions in 2018.

Both the Chinese regime and the Biden administration declined to comment for the Reuters piece, aside from the Chinese Foreign Ministry insisting Beijing “maintains normal, legitimate trades with Iran and Venezuela under the framework of international law that shall deserve respect and protection.”

Trump administration officials said measures applied against CCPC and other Chinese entities were meant to slow down the sanctions-busting trade in Iranian and Venezuelan oil by making foreign businesses nervous about dealing with the targeted Chinese companies. Shipping industry analysts were concerned in 2019 that more aggressive measures could have triggered serious global economic complications, a fear that would probably have been validated by the looming Wuhan coronavirus pandemic in 2020.

Former Treasury sanctions official Julia Friedlander told Reuters on Thursday that CCPC’s brisk trade in blacklisted oil demonstrates “there are limitations as to what U.S. sanctions can do especially when you target multiple like-minded or selectively like-minded actors like oil traders.”

An analysis at global financial news site FXEmpire on Thursday alluded to the Reuters report, along with news that Iran has opened a new oil terminal in the Gulf of Oman, as evidence that Tehran has effective undermined the JCPOA nuclear deal while the Biden administration is still negotiating to rejoin it:

Possible support for Iran’s oil export expansion is already clear and in the making. China Concord Petroleum Corporation (CCPC), a Hong-Kong based oil trader, could be one of the main new clients. Since the US administration has put sanctions on the company two years ago due to oil deals with Iran and Venezuela, the Chinese party has become a major player in the Iran-Venezuela-China oil trade market. It currently plays the middle man between Iran and Venezuelan oil deals, as both are partly blocked from the international market and financial systems. US government sources are following the black-listed oil deals of CCPC.

FXEmpire suggested opening a terminal in the Gulf of Oman will make it far more difficult for the U.S. to restrict Iranian oil shipments through the Strait of Hormuz, while CCPC has developed the tanker and refinery infrastructure to handle a substantial flow of Iranian oil. Tehran has effectively achieved an export level it can live with, even if its strident demands for unilateral sanctions relief make it politically impossible for President Joe Biden to capitulate and rejoin the JCPOA. India is also thirsty for oil and might be able to secure waivers for a heavy flow of Iranian crude if the nuclear deal remains on hold.

“This is a strategic move and an important step for Iran. It will secure the continuation of our oil exports. This new crude export terminal shows the failure of Washington’s sanctions on Iran,” outgoing Iranian President Hassan Rouhani said when inaugurating the Gulf of Oman facility on Thursday.

U.S. officials told the Wall Street Journal (WSJ) on Monday that heavier sanctions are being considered to “choke off Iran’s swelling crude oil sales to China” by targeting its oil shipping networks. In light of the Reuters exclusive on Thursday, this would presumably require sterner measures against CCPC and other Chinese entities.

“There is not much left to sanction in Iran’s economy. Iran’s oil sales to China is the prize,” said one of the WSJ’s sources.

COMMENTS

Please let us know if you're having issues with commenting.