Millions of British taxpayers face the prospect of being artificially placed in higher tax brackets as a result of inflation and the government’s decision to place a “deep freeze” on thresholds, meaning that the state will take in £78 billion more in taxes over the next six years.

Prime Minister Rishi Sunak’s move to lock in income tax thresholds in March of 2021 while he was serving as the de facto top man at the Treasury in Boris Johnson’s government will cost taxpayers £78 billion more in tax than previously forecasted as a result, in part, of rampant inflation.

The decision by Sunak as Chancellor of the Exchequer will also likely result in four million taxpayers being moved into higher tax bands by the year 2028, according to an analysis conducted by the Centre for Economics and Business Research (CEBR), The Telegraph reports.

The process through which millions of taxpayers will be artificially placed into higher tax bands is referred to as fiscal drag, in which the thresholds are kept the same during inflationary periods, meaning that while workers receive higher wages in a literal sense, though in real terms pay remains flat or even falls, they are then categorised as higher earners and therefore are penalised by a tax system initially sold to the public as a means of taxing truly high earners.

At the time when Sunak initially pushed forward the tax band freeze in 2021, the Office for Budget Responsibility (OBR) had predicted that it would cost taxpayers an additional £1.6 billion in the 2022-23 fiscal year, and £3.7 billion in the following year. However, the OBR would later go on to revise that estimate last March as a result of rising inflation to £2.9 billion and £10.4 billion, respectively.

The CEBR said this week that it now predicts the cost will be significantly more for the public, saying that they expect the freeze to result in an additional £4.7 billion and £17.6 billion in tax bills.

Pushpin Singh of CEBR said: “This divide is reflective of the change in the macroeconomic landscape in the UK over the past year, with strong wage growth in response to inflationary pressures forming a key reason behind our elevated figure.

“More people are being pushed into higher tax bands as a result, and while this may bode well for public finances, the same cannot be said for the individuals who see their take-home pay reduced.”

UK Disposable Income to Fall at Fastest Rate in History as 'Conservatives' Push More Taxes https://t.co/BYl8UWHpXW

— Breitbart London (@BreitbartLondon) November 17, 2022

Fiscal drag is by no means a new phenomenon in Britain, with Breitbart London reporting back in 2014 that people in upper-working and lower-middle-class professions such as police officers and teachers then being taxed as if they were members of the wealthy classes.

In 2014, the number of people being classed as high earners was already a staggering 3.6 million and currently sits at around 4 million. However, due in large part to Sunak’s freeze in 2021, this figure is expected to double to eight million people by 2028, meaning that a little under one-tenth of the population will be treated as if they are the wealthy upper class.

The Head of Research for the Adam Smith Institute think tank, Daniel Pryor, said: “Few cried foul at Sunak’s stealth tax raid two years ago, but millions of Britons are now forking out tens of billions more than expected. This might please HM Treasury but it’s a hammer blow for those dragged into higher tax brackets.

“Freezing thresholds is no way to manage the nation’s finances – any tax rise should be clear, transparent and not subject to volatile shifts in inflation.”

The chief executive at the Taxpayer’s Alliance, John O’Connell, said: “Stealth taxes are eating into the higher wages that workers are understandably seeking during a time of surging inflation. Ministers claim to want people back in employment, yet the Treasury is disincentivising work by its desire to make a quick buck.

“The government should raise tax thresholds in line with inflation.”

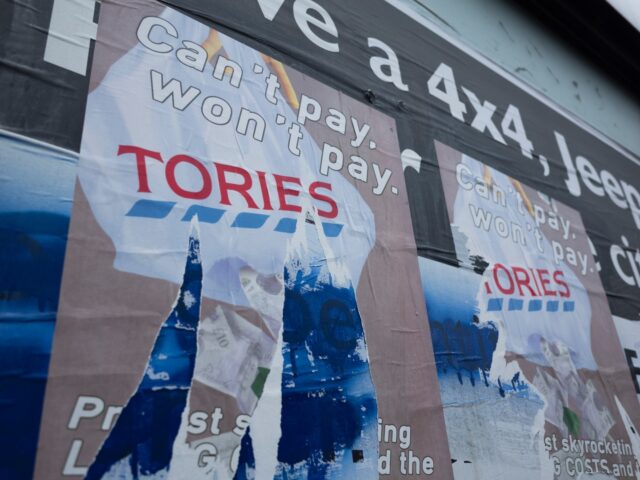

The effective spike in taxes will come as grim news for millions in the United Kingdom, which has been weighed down by the misleadingly named Conservative Party government imposing the highest level of taxation since the Second World War.

Not So Conservative: UK Saw Second Highest Tax Rises Among Top Economies in 2021 https://t.co/UkJrtvJMCG

— Breitbart London (@BreitbartLondon) December 1, 2022

Follow Kurt Zindulka on Twitter here @KurtZindulka

COMMENTS

Please let us know if you're having issues with commenting.