Capitalism is the most effective means of wealth creation and distribution yet devised by man. It is also, properly exercised, the best method of combating inequality. But we can only really enjoy the fruits of its successes when those at the top of the tree are free to experiment, invest and spend, unencumbered by punitive and envy-driven rates of income tax.

In our society the rich are constantly ridiculed, demeaned, harassed and victimised despite their disproportionate contribution to national life and the staggering sums they contribute to the Exchequer. They are battered with high taxes, and with the threat of soak-the-rich injustices, such as Labour’s proposed Mansion Tax and tightening of rules around non-dom status and inheritance tax.

Hating rich people and demanding more and more money out of them is a particularly ugly example of the politics of envy and it makes Britain a more hostile place for the wealthy to live and work. In the end, we will all suffer as the essential jobs and trickle-down wealth dry up. That’s why I think it’s time we gave the rich a break. A tax break, to be precise.

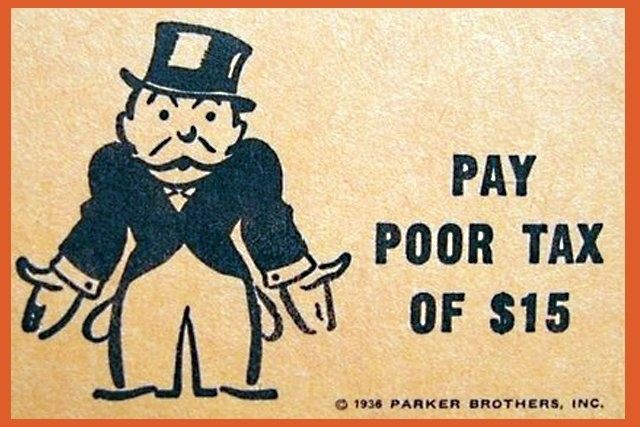

I propose a flat tax of 20 per cent to be levelled on everyone earning minimum wage, which gradually diminishes as a person succeeds in life and begins to earn more money. A doctor on £100,000 a year might pay as little as 10 per cent income tax, while anyone earning £500,000 or more would simply be taken out of tax altogether.

Why should someone who has worked hard be asked to pay a higher rate of tax? Punishing success is, in my mind, immoral and nonsensical. That is why I believe in regressive taxation: tax rates that go down the larger the amount being taxed and the easier an individual’s ability to pay.

The case for regressive tax is primarily moral: because it encourages innovation, entrepreneurship and self-improvement. I want everyone to reach their full potential, and I want the tax system to provide incentives accordingly. Why not free ourselves from the tyranny of the Laffer curve and instead base our tax policy on doing what’s right?

Some will say that regressive taxation would be unfair on the poor because it places a disproportionate burden on them. But I say: why not incentivise self-betterment? Why not make success attractive, rather than something to be ridiculed and loathed? Every child should be encouraged to work hard and earn a solid living in the hope of being rewarded with lower tax bills.

It is perhaps obvious that any regressive tax regime would go hand in hand with cuts to the state that make the current period of so-called austerity look like a festival of Julio-Claudian largesse. This, again, is a matter of ideological preference and will not be to everyone’s taste, particularly in these sentimental and indulgent times.

Entire departments, including the majority of the benefits system, would need to go given the reduction in Treasury receipts, but this would be offset by the fact that work would finally pay for those at the bottom of the pile, who would take home at least 80p in every pound they earned and be free to spend it however they wish.

The fact is that the majority of the functions the modern western state provides are outside the proper scope of government. There should be no tolerance for government spending on the arts, charities or any other luxuriant fripperies. The business of government is defence of the realm, the enforcement of private contracts and little else.

Flat sales taxes such as VAT, which are inherently regressive, can be left alone and should indeed be extended to every product currently exempted from them, for it is only when necessities are taxed regressively too that the multiplier effect of across-the-board regressive taxation is truly felt and citizens are incentivised to improve their lot.

Transparently regressive taxation with a low basic rate of tax that tapers down to zero for the very highest incomes frees everyone in society to do more or less as they please with their money, but it also incentivises success because not only does it, obviously, reward higher earners with lower income tax rates but it also offers greater agency and freedom to those who have worked hard to make a success of their lives.

Those earning modest salaries would be taxed so lightly that they could hardly with any seriousness claim they were worse-off than before, while the richest would be encouraged to spend, spend, spend, filling the Government’s coffers with sales taxes. They would also, freed from excessive demands on them from the Revenue, be able to employ more people.

I, for instance, might take on a second charwoman if my regressive tax system were properly implemented. Someday those domestic staff might, having been able to put money aside thanks to low basic rates of tax, be able to start their own cleaning company.

I believe in simplification of the way government operates. Just as we should pay MPs a decent wage, probably more like £200,000, while barring them from outside earnings while incumbent and doing away with expenses altogether, so too should we adopt a fairer, simpler and more transparent tax system that does away with the need for non-dom status, offshore bank accounts and all of the other indignities and unfairnesses we visit upon the well-off.

My proposal is simple, clear and transparent. And, when it comes down to it, rewarding success and punishing indolence is simply the morally right thing to do. Don’t you agree?

COMMENTS

Please let us know if you're having issues with commenting.