From the Financial Times:

Those campaigning for Britain to leave the EU are not bigoted little Englanders. The accusations made by the Remain camp about commerce and inward-looking Brexit campaigners are questionable. Too often, their arguments are based on financial and economic assumptions that make liberal use of the word “could”. Their dire predictions about what would happen to the City of London after Brexit are close to hyperbole.

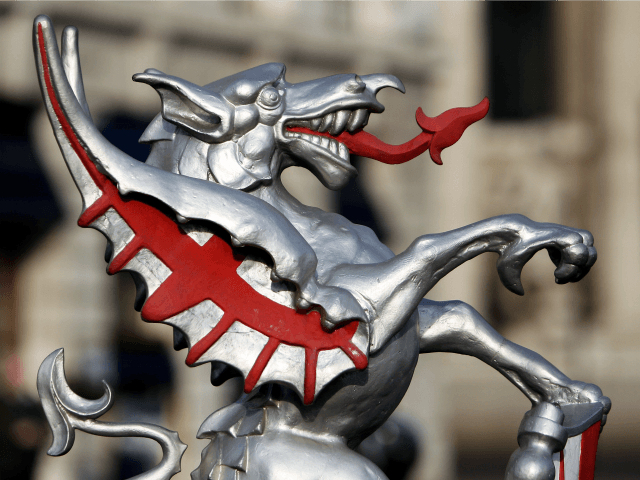

It is ridiculous to claim that this country and the City of London, in particular, would be ostracised were the British to vote to leave. Freed from the Brussels straitjacket, I believe the British economy would be stronger and deliver benefits to the City, the rest of the country — and our partners abroad…

…Despite claims that Britain is at the heart of Europe, the reality is that for decades it has been on the periphery. If this had not been the case, our recent negotiations could have been meaningful and not, as alleged, dictated at a late-night dinner on a “take-it or-leave-it” basis. The main “concession” — that Britain will not be dragged into bailing out the euro — is likely to prove empty; the reality is that we would be pulled in the next time there is a banking crisis in Europe.

By leaving the EU, the UK will move into a position of strength because Europe needs Britain far more than Britain needs Europe. There is no doubt Brussels will need to be accommodating in post-Brexit negotiations. The reality is that the City is the greatest financial centre in Europe, if not the world. Its unrivalled pool of talent, concentration of firms and markets in almost every conceivable product, as well as its welcoming tax, regulatory and legal environment, make it pivotal for every European financial services company. Then there are assets we can never lose, such as the English language and our timezone.

The EU will therefore do everything necessary to ensure it retains unfettered access to London and nothing will be done to harm British financial services in Europe. On trade, Britain will do just fine because we import £68bn more goods from Europe each year than we sell there. Nobody would seek to put up trade barriers to harm their own exporters. Voting to leave will also free us of the threat of hostile regulation from Brussels which would marginalise our competitive advantages by “harmonising” legal systems in areas such as insolvency, property and company law.

One current scare story is to blame the falling pound on the referendum. But sterling has been weakening since October 2014. It is falling because of fundamental issues with the economy: the financial markets have lost confidence in the British government’s ability to stop the national debt doubling while running large trade and current account deficits.

Read the rest of the piece by Michael Geoghegan, a former chief executive of HSBC Group, here.

COMMENTS

Please let us know if you're having issues with commenting.