By PAMELA SAMPSON

AP Business Writer

BANGKOK

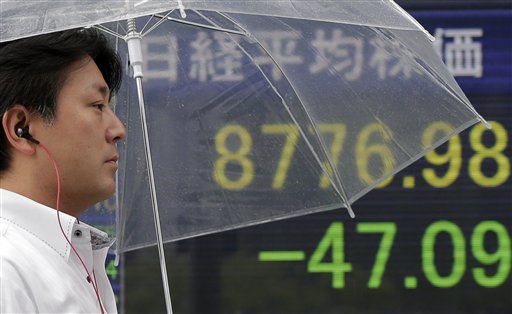

Asian stock markets fell Friday as gloomy economic reports from the world’s two biggest economies piled up, heightening fears of a sharper global downturn.

The U.S. Labor Department reported Thursday that the four-week average of applications for unemployment benefits jumped to the highest level in nine months. Meanwhile, sales of previously owned homes fell 1.5 percent in May.

A further sign of weakness in the world’s No. 1 economy came from the Philadelphia branch of the Federal Reserve, which issued a report showing that manufacturing in the northeast had experienced a sharp decrease due to a steep fall in company orders.

Appetite for financial assets such as stocks was also dented by the results of a monthly HSBC survey, which showed that manufacturing in China has continued to contract. China’s growth has been a pillar of the global economy in recent years, so its slowdown has been of particular concern to investors.

Meanwhile, infighting over Europe’s heavy debt burden continued to brew, leading IMF head Christine Lagarde to warn that the euro is under “acute stress” and to urge leaders of the 17 countries that use the currency to consider steps such as jointly issuing debt.

Japan’s Nikkei 225 index fell 0.2 percent to 8,802.54 and South Korea’s Kospi slid 2.1 percent to 1,848.57. Hong Kong’s Hang Seng Index lost 1 percent to 19,067.51 and Australia’s S&P/ASX 200 was down 1 percent at 4,046.70.

Benchmarks in Singapore, Taiwan, Thailand and Indonesia fell while the Philippines rose. Markets in mainland China were closed for a public holiday.

Sentiment was also shaken after Moody’s Investors Service lowered the credit ratings of 15 major banks, including Bank of America, JPMorgan Chase and Goldman Sachs, saying their long-term prospects for profitability and growth are shrinking.

Downgrades generally make it more costly for banks to raise money by selling debt because investors demand higher interest in return for taking on riskier debt.

Asian financial shares sputtered after the ratings slap. South Korea’s Shinhan Financial Group Co. tumbled 4 percent while Australia & New Zealand Banking Group lost 1.7 percent. Hong Kong-listed Industrial & Commercial Bank of China, the world’s biggest bank by market value, fell 1.2 percent.

Falling commodities prices hurt mining and raw materials shares in Australia. BHP Billiton, the world’s largest mining company, fell 2.6 percent. Newcrest Mining Ltd. dropped 3.3 percent. Hong Kong-listed Jiangxi Copper Co. fell 1.7 percent.

On Thursday, the Dow Jones industrial average plunged 251 points, its second-worst loss of the year. The Dow lost 2 percent to close at 12,573.57. The Standard & Poor’s 500 index lost 2.2 percent to 1,325.51 and the Nasdaq composite fell 2.4 percent to 2,859.09. All three indexes lost their gains for the week.

Benchmark oil for August delivery was up 64 cents to $78.85 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell $3.25, or 4 percent, to settle at $78.20 per barrel in New York on Thursday.

In currency trading, the euro fell slightly to $1.2553 from $1.2558 late Thursday in New York. The dollar rose to 80.34 yen from 80.29 yen.

___

Follow Pamela Sampson on Twitter at http://twitter.com/pamelasampson

COMMENTS

Please let us know if you're having issues with commenting.