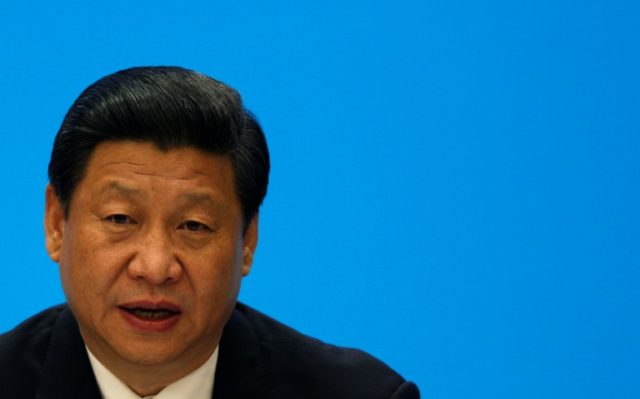

Hong Kong (AFP) – Asian markets rallied Tuesday after Chinese President Xi Jinping eased worries over a simmering US trade conflict by promising new measures to open his country’s massive economy “wider and wider”.

In a closely watched speech at the Boao Forum — dubbed the Asian Davos — he pledged a “new phase of opening up”, adding that Beijing “does not seek a trade surplus” and wants to boost imports.

After starting the day cautiously, dealers pounced on the comments as a sign that a possible trade war between the world’s top two powers can be averted.

Markets have been roiled in recent weeks as the White House has announced a series of tariffs mostly on Chinese goods as part of his “America First” protectionist agenda, fuelling fears of potentially devastating tit-for-tat measures that could hammer the global economy.

China’s massive surplus with the US is a key complaint of Trump’s who accuses the country of unfair trade practices that hurt American jobs.

His latest measures on Friday battered US stocks, though hopes the issue can be resolved saw Asia post gains on at the start of this week.

But on Tuesday Xi said he would move to liberalise automobile investment, significantly reduce tariffs on cars this year and protect intellectual property — all areas that have been high on the list of demands by Washington.

The measures have been high on Trump’s list of grievances against China.

“Xi’s speech sends a positive signal to the market since he backs globalisation and the opening up of China market,” Linus Yip, a strategist at First Shanghai Securities, told Bloomberg News.

“Investors were very worried about trade disputes, while his speech calms the nerves a lot. The concern about trade disputes in near-term are still here however, since what Xi pictures is a very long-term picture.”

– Fresh Trump probe woe –

Shanghai climbed 1.7 percent and Hong Kong jumped 1.9 percent.

Tokyo added 0.5 percent, Sydney — where a number of firms are listed that rely on China trade — rose 0.8 percent, Singapore put on 0.6 percent and Seoul added 0.3 percent.

There were also healthy gains in Wellington, Taipei, Manila and Indonesia.

Chinese carmarkers were hit by Xi’s speech, which will allow for greater foreign access to their home market. Hong Kong-listed BAIC fell 10 percent, while Dongfeng lost one percent and Brilliance China was off more than four percent. However in Tokyo, Toyota jumped 1.4 percent and Honda added 2.6 percent.

After last week’s plunge, all three main indexes on Wall Street ended in positive territory Monday but eased from earlier highs after it emerged the FBI had raided the offices of Trump’s long-time personal lawyer.

Michael Cohen has admitted to paying porn actress Stephanie Clifford $130,000. Clifford, who goes by Stormy Daniels, claims she received the money to cover up a sexual encounter with Trump more than a decade ago.

The move is the latest volley in special counsel Robert Mueller’s probe into possible Russia collusion with Trump’s presidential campaign.

It adds to the sense of turmoil on Pennsylvania Avenue and Trump slammed the raid as “disgraceful”, a “witch-hunt” and “an attack on our country”.

Adding to uncertainty for traders are geopolitical worries after an alleged toxic gas attack that killed dozens in a rebel-held Syrian town, which prompted Trump to indicate a decision could be taken imminently on military action.

Russia, which backs the Syrian regime, has warned against such a move, saying it could have “grave repercussions”.

Tensions in the Middle East have buoyed oil prices, which extended Monday’s rally, with gains also helped by speculation the US will tear up the Iran nuclear deal.

On currency markets the dollar was boosted by easing trade worries, while it also extended gains against the ruble after after Trump slapped sanctions against Russian oligarchs close to Vladimir Putin following the diplomatic crisis sparked by the poisoning of former spy Sergei Skripal.

The US move also hammered Hong Kong-listed aluminium giant Rusal, which lost more than 50 percent Monday and fell a further five percent Tuesday.

In early European trade London rose 0.6 percent, Paris added 0.7 percent and Frankfurt piled on more than one percent.

– Key figures around 0720 GMT –

Tokyo – Nikkei 225: UP 0.5 percent at 21,794.32 (close)

Hong Kong – Hang Seng: UP 1.9 percent at 30,800.00

Shanghai – Composite: UP 1.7 percent at 3,190.32 (close)

London – FTSE 100: UP 0.6 percent at 7,238.38

Euro/dollar: DOWN at $1.2311 from $1.2318 at 2100 GMT

Dollar/yen: UP at 107.20 yen from 106.75

Pound/dollar: DOWN at $1.4123 from $1.4127

Oil – West Texas Intermediate: DOWN 15 cents at $63.27 per barrel

Oil – Brent North Sea: DOWN 13 at $68.52 per barrel

New York – Dow: UP 0.2 percent at 23,979.10 (close)

COMMENTS

Please let us know if you're having issues with commenting.