London (AFP) – Financial markets steadied Tuesday as traders tracked the latest developments surrounding global trade, including a significant deal signed between the EU and Japan.

Around 1045 GMT, European stock markets were fairly stable, as were oil prices and the dollar.

Stock markets however mostly slid across Asia, led by share price falls for the energy sector one day after oil prices plunged on excess supply concerns.

Brent crude hit another three-month low Tuesday, at $71.35 per barrel, before recovering.

“Investors have… remained focused on the possibility of a trade war and the upcoming earnings season,” said Craig Erlam, senior market analyst at Oanda trading group.

The EU and Japan signed a sweeping free trade deal Tuesday that officials called a “clear message” against protectionism, as Washington imposes controversial tariffs and threatens a trade war.

The huge deal was signed as US President Donald Trump unsettles allies and provokes rivals with his aggressive “America First” trade policy.

Both the EU and Japan have been hit with new US tariffs despite their longstanding alliances with Washington.

Fears about a China-US trade war meanwhile continue to nag investors, with both sides filing counter-complaints at the World Trade Organization after recently imposing and threatening further tariffs on billions of dollars worth of goods.

On Monday, the International Monetary Fund warned about the effects of a stand-off between the world’s two economic superpowers.

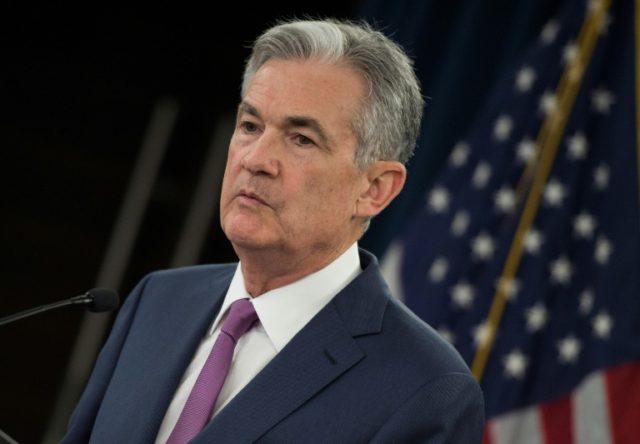

Markets’ attention is also on the start of the corporate earnings season, with hopes that strong results will deflect from the trade war, while Federal Reserve chief Jerome Powell is to give two days of congressional testimony from Tuesday.

“Today’s start for European equities has been relatively mixed, as investors look ahead to the latest comments from… Powell,” said Michael Hewson, chief market analyst at CMC Markets UK.

Looking ahead to the Wall Street open, he added:

“US stocks, particularly in the tech sector could well find themselves under pressure early on after last night’s miss from Netflix, which saw the company undershoot subscriber growth.”

Goldman Sachs could meanwhile announce the promotion of President David Solomon to chief executive on Tuesday, a person familiar with the matter said.

The move, which would also set a departure time-table for current chief executive Lloyd Blankfein, could come in conjunction with the release of second-quarter earnings from the big US investment bank, the person added.

– Key figures at 1045 GMT –

London – FTSE 100: DOWN 0.1 percent at 7,591.34 points

Frankfurt – DAX 30: DOWN 0.1 percent at 12,544.14

Paris – CAC 40: DOWN 0.2 percent at 5,397.52

EURO STOXX 50: DOWN 0.3 percent at 3,438.05

Tokyo – Nikkei 225: UP 0.4 percent at 22,697.36 (close)

Hong Kong – Hang Seng: DOWN 1.3 percent at 28,181.68 (close)

Shanghai – Composite: DOWN 0.6 percent at 2,798.31 (close)

New York – Dow: UP 0.2 percent at 24,064.36 (close)

Euro/dollar: UP at $1.1723 from $1.1712 at 2100 GMT

Pound/dollar: UP at $1.3242 from $1.3237

Dollar/yen: UP at 112.42 yen from 112.27 yen at 2100 GMT

Oil – Brent Crude: DOWN 18 cents at $71.66 per barrel

Oil – West Texas Intermediate: DOWN 16 cents at $67.90 per barrel

burs-bcp

COMMENTS

Please let us know if you're having issues with commenting.