Caracas (AFP) – Venezuela has arrested the president of Banesco, the country’s leading private bank, along with 10 top executives on suspicion of “attacks” on the local currency, the country’s top prosecutor said Thursday.

Banesco CEO Oscar Doval was arrested after testifying before Venezuela’s Military Counterintelligence directorate, where he had been summoned for questioning along with other top bank officials.

Also arrested were four of Banesco’s vice presidents, a legal consultant, a director, two managers and two other officials, chief prosecutor Tarek William Saab said.

The bankers are suspected of facilitating or covering up “attacks” on Venezuela’s currency, the bolivar, through the movement of currency abroad and dollar speculation on the black market.

Banesco has operations in the United States, Spain, Panama and the Dominican Republic.

“The end game was to destroy the Venezuelan currency,” Saab said, indicating that an investigation had found widespread evidence of “omissions in the prevention and monitoring of money laundering.”

The arrests are part of a sweeping operation against alleged criminal mafias trying to undermine Venezuela’s rapidly depreciating currency.

Saab said the aim was to “dismantle an entire parallel financial system” with links to Colombia and Panama, but insisted the arrests would not affect anyone who had savings in the bank.

Since the operation began in mid-April, police have arrested 134 people and frozen 1,380 accounts — 1,000 of them at Banesco. Operations of three online currency exchange sites have also been halted.

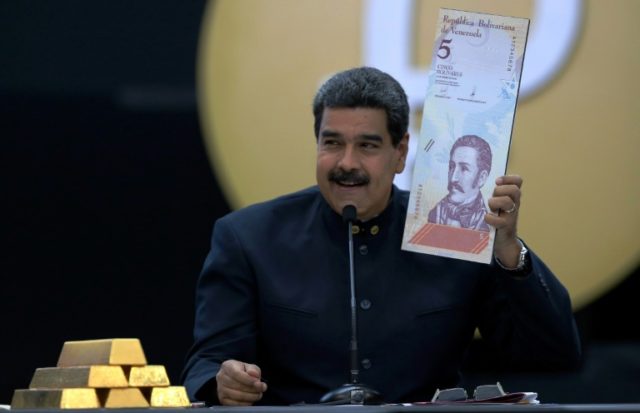

The government of embattled President Nicolas Maduro has blamed alleged criminal networks for the meltdown of the bolivar through fixing the rate of the “black dollar” which trades 12 times higher than the central bank’s rate, but which is not accessible to Venezuelans citizens or companies.

The parallel market has flourished as the government has maintained a tight grip on currency exchange rates.

Before the recent slump on oil prices the government had practically halted the transfer of foreign exchange to the private sector, which has been forced to rely on the black market for hard currency to pay for imports raw materials, in turn raising the cost of living.

The bolivar’s plummeting value has sent inflation soaring. Last month the IMF said that massive hyperinflation was likely to see prices soaring 13,000 percent this year.

COMMENTS

Please let us know if you're having issues with commenting.