Since he first took office in 2008, President Barack Obama has been relentless in his cry for all Americans to pay their “fair share” of taxes, without ever once giving the specifics of a tax plan that would truly create a “fair share” tax system.

Here’s a novel idea: let’s take the President at his word. Let’s demand taxation fairness. And nothing will better insure that everyone is paying his or her “fair share” than a flat tax.

The concept of the flat tax is simple – one tax rate is applied to all income levels. If you make more – you pay more. If you make less – you pay less.

Our solution should not be to punish job creators, but to simplify the tax law with fairness that has everyone paying the same tax rate: 15 percent across the board. My proposal leaves two deductions: (1) charitable contributions since true charities do a better job of getting help directly to those who truly need it, and (2) a mortgage interest deduction for one residential homestead.

The President says he wants Warren Buffet to pay the same tax rate as his secretary. The President’s proposal will not accomplish that goal. A flat tax will do it by making the income tax, the capital gains tax, the gift tax, and the estate tax, all a simple 15 percent across the board tax rate.

Not only will it be fairer, but the economy will explode upward in a dramatic expansion and there will be even more revenue coming into the federal treasury. The historical facts show when you lower the tax rates, you create more growth, more businesses, more jobs and a much more robust economy – but it will be even better when everyone pays the same low tax rate – no wiggle room for the very wealthy.

History shows that when federal, state, or local governments raise tax rates on the ultra rich, the governments bring in less revenue because the super rich can live wherever they’d like. They move. In Great Britain, for example, after taxes were raised in 2009 to 50 percent on people making a million pounds or more each year, the number of millionaires living there immediately went from 16,000 to 6,000. Not only did revenues not increase; they decreased by raising those taxes in a class warfare play.

It is the poor and the middle class taxpayer who are wedded to their location. They cannot move their factory location, or mechanic shop, or store where they work or sell or clerk. They have to be at that location to keep their job.

Just as Vice-President Biden pointed out, the middle class “has been buried for the last four years” under the Obama administration. The President wants to paint conservatives as the defenders the of the rich, yet the dirty little secret is that Wall Street executives and their immediate families donate consistently about four times more to Democrats than they do to Republicans. It is the ultra rich who continue to make increasingly more than the lower classes under this President’s policies, which have widened the gulf between the ultra rich and the middle class.

It is time to truly level the playing field. We are continuing to play on the current un-level playing field every time we entertain “increasing revenue” through tax hikes. This is not the time to be defensive. It is the time to be bold; it is time to go on offense with a truly “FAIR” idea – a flat tax across the board. It’s time to articulate principles that don’t defend the rich, but actually create and defend a system that allows everyone the opportunity to get rich.

Let’s not forget the more important point. Not only will raising taxes in a recession bring in less revenue right now, but it will result in less individual freedom and will completely fail to addresses the biggest cause of our debt: out of control spending. America is at its greatest with less government interference and more individual freedom. Raising taxes will hurt the economy, stymie job creation, while prolonging and deepening the Obama recession, as the President himself once publicly noted.

We can compromise on the numbers; but, when it comes to principle, we should never concede. If we lose the battle for principle, the fight for true fairness and freedom, we lose everything that has made this country the greatest in the history of mankind.

This is a tenuous time – a time for bold, strong leadership. Now is the time to stand up and be counted.

This is the American Spirit. We’ve been blessed with the wealth of brilliant minds, hardworking attitudes, and the greatest energy resources in the world. It is high time to create the system, once again, where everybody can become rich. This will pave the way to the new economic renaissance this nation so desperately needs and so closely has within its grasp.

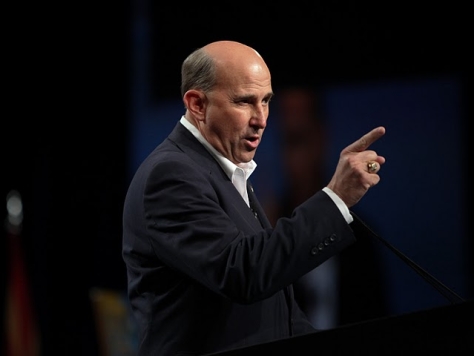

Congressman Louie Gohmert is the Vice Chair of the Judiciary Subcommittee on Crime, Terrorism and Homeland Security. Prior to being elected to serve in Congress, Louie was elected to three terms as District Judge in Smith County, Texas and also served as Chief Justice of Texas’12th Court of Appeals.

COMMENTS

Please let us know if you're having issues with commenting.