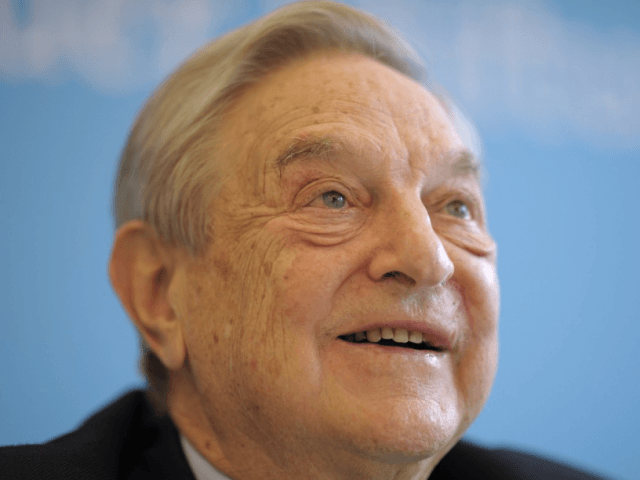

George Soros is often called the “Godfather of the Left” for supporting a worldwide network of progressive causes with over $550 million in donations. But the world’s 27th wealthiest person–according to Forbes–with a net worth of about $30 billion has allegedly used tax deferral to prevent paying any taxes on $13.3 billion profit. Now, according to an Irish regulatory filing by Soros, he will soon be enjoying the shared sacrifice of paying a 50 percent tax that will wipeout a quarter of his net worth.

Congress closed a lucrative loophole in 2008 used by U.S. hedge fund managers to avoid paying income taxes for fees and profits. Congress gave these corporate elites until 2017 to pay accumulated taxes on all pre-2009 deferred income.

Warren Buffett in August 2011 called on the U.S. government to “stop coddling the super-rich.” Buffett pointed out he pays less of his income in taxes than his secretary does. He added that the rich should pay higher taxes for the sake of “shared sacrifice,” and suggested that most of his wealthy friends “wouldn’t mind being told to pay more.”

When the liberal website Salon launched the Patriotic Billionaire Challenge to ask the 400 richest Americans if they approved of “The Buffett Rule” to raise taxes, only Georges Soros and 6 of the other uber-wealthy responded positively.

George Soros has always had sterling liberal credentials as the founder and chairman of Open Society—a network of foundations, partners, and projects in more than 100 countries that he states has a “commitment to the idea of open society—where rights are respected, government is accountable, and no one has the monopoly on the truth.”

But just before Congress had closed the “hedge fund loophole” in 2008, Soros transferred assets to Ireland—a country that was seen as a refuge from paying taxes under the new U.S. law. The recent Irish regulatory filings, according to Bloomberg show for the first time the “extent Soros’s almost $30 billion fortune—he ranks 23rd on the Bloomberg Billionaires Index—came from finding ways to delay taxes and reinvesting the money in his fund.”

As a New York-based money manager, Soros would be subject to a federal rate of 39.6 percent; combined state and city levies totaling 12 percent; and an additional 3.8 percent tax on investment income to pay for Obamacare, according to Andrew Needham, a tax partner at the law firm of Cravath, Swaine & Moore.

Applying those combined tax rates to Soros’s $13.3 billion in deferred income would create a 54 percent tax rate that will cost the avid supporter of “The Buffett Rule” over $6.7 billion in taxes. Bloomberg reported that the “calculation is based on publicly available information such as the Irish regulatory filings, which provide only a partial glimpse into Soros’s finances.” (The calculation is only an estimate.)

Bloomberg calculated what George Soros’ net worth would be as a hedge fund manager that started with $12 million 40 years ago, but was able to defer all taxes and reinvested profits. If that was the case, his fortune would have grown to $15.9 billion, versus just $2.4 billion if he participated in the “shared sacrifice” of paying tax each year.

“No person has a constitutional obligation to pay any more taxes than he is required to pay,” James Sitrick, a tax attorney who represented Soros for decades told Bloomberg. If Soros “couldn’t legally do it, he wouldn’t do it,” says Sitrick, who has also worked on international tax policy for the U.S. Department of the Treasury.

Soros through his spokesman Michael Vachon, declined to comment.

COMMENTS

Please let us know if you're having issues with commenting.