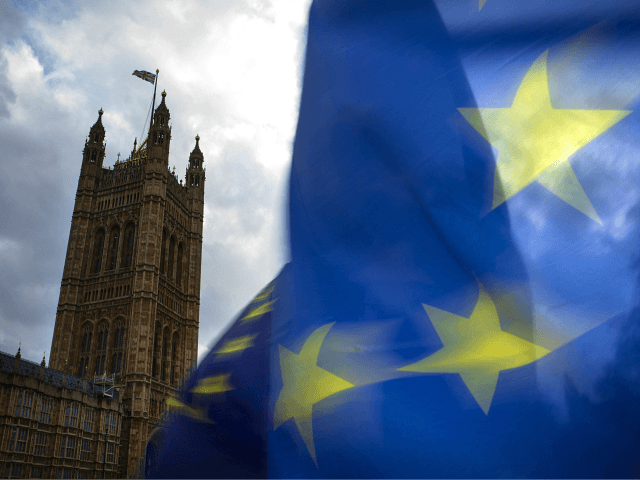

Brussels is reportedly planning on threatening to block the City of London, the nation’s finance capital, from European markets unless the UK agrees to remain aligned to EU regulations post-Brexit.

EU negotiators are set to insist the UK retain close alignment with Brussels’ regulations for financial services and data flows when they sit down for internal talks in two weeks’ time, according to restricted documents reported by The Times.

The EU is keenly aware of London being a financial hub and the importance of retaining unrestricted access to EU markets, and will use this as a stick to beat the UK should the country wish to diverge after the end of the transition period in December 2020. If EU standards are not maintained, Brussels could limit or pull completely the UK’s access to the bloc’s financial markets.

“These are both big levers for the EU,” a senior European diplomatic source told the newspaper of record. “Data adequacy and equivalence [for financial services] are decisions under our direct control, decisions that can be reversed at any time and that will be linked to progress in the wider negotiations.”

The tactic will be employed to force the UK to remain in “level playing field” territory. European countries have remained insistent that the EU must retain its regional monopoly with France’s Europe minister Amélie de Montchalin saying in October that she did not want to have “a tax haven at the gates of Europe”. German Chancellor Angela Merkel expressed the same anxiety later that month that Brexit Britain could become a “potential competitor” to the bloc on the same level as the United States or China.

Barnier Promises to Prioritise Trade Deal, But Says UK Can’t Ignore EU Regulations https://t.co/beKicZsRA3

— Breitbart London (@BreitbartLondon) November 28, 2019

–European Commission and City of London doubt Johnson can keep his promise on not delaying Brexit–

Prime Minister Boris Johnson has pledged that he will not extend the transition period — the time during which the UK negotiate a new trade deal with the EU — beyond December 31st, 2020, even including a clause in his Brexit bill making any further delay illegal.

Both Mr Johnson and his Brexit secretary Michael Gove have pledged a deal before 2021 and even Germany has said that a basic trade deal can be completed in that timeframe. However, the majority of City firms do not believe this is possible and think that the prime minister could break his promise and seek an extension to the transition period.

Research by accountancy firm EY published in The Telegraph found that firms believe issues of equivalency and market access will hold up the UK’s exit by as much as an additional year.

In an interview with French newspaper Les Echos, the president of the European Commission Ursula von der Leyen doubted that negotiations could be completed in 11 months, saying: “I think it would be reasonable to take stock mid-year and, if necessary, agree on an extension of the transition period.”

The chief of the bloc’s powerful executive arm added that she believed the UK must maintain the “principle of parity” of standards to have continued access to EU markets. Mrs von der Leyen said: “If we want to benefit from the prosperity of the Single Market, to access it without barriers or customs duties, we must all accept its common principles and values. Otherwise, the two parties must agree on the barriers to be put in place.”

Maintaining close alignment with the EU could hamper the UK’s abilities to strike trade deals with other, larger economies outside of Europe.

Merkel Fears Brexit Britain Becoming ‘Economic Competitor’ on EU’s Doorstep https://t.co/I4yZv3edPS

— Breitbart London (@BreitbartLondon) September 12, 2019

–Financial sector ready for No Deal 2.0–

There have been conflicting reports of whether the EU’s chief Brexit negotiator Michel Barnier believes that a deal can be struck within the transition period; however, he has maintained that the price of a trade deal will be maintaining regulatory alignment and has not ruled out a No Deal 2.0 at the end of the transition period, where the UK deals with the bloc on World Trade Organization (WTO) rules.

In fact, Remainer Tony Blair admitted two months before Boris Johnson’s landslide victory in December’s general election that a no deal was the most “likely outcome” because ministers have said they want Britain “to compete around tax and regulation, to become an off-shore competitor with the European Union”.

Should the EU make good on its threats, and the prime minister stand by his word, the financial sector is ready for the UK to leave the EU without a deal and operate as a third country. EY partner John Liver said in comments reported by The Telegraph: “The sector had prepared for a no-deal scenario in October this year, so there is confidence that it will be ready to weather a ‘no extension’ scenario if ultimately required.”

Blair Fears Next Negotiations Will End in No Deal, EU Doesn’t Want UK as ‘Off-Shore Competitor’ https://t.co/6KFpt7lIjd

— Breitbart London (@BreitbartLondon) October 28, 2019

COMMENTS

Please let us know if you're having issues with commenting.